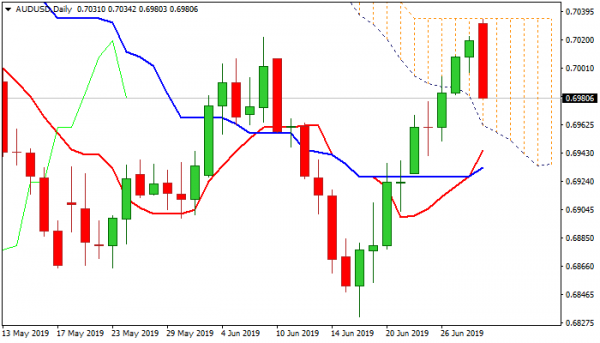

The Australian dollar pulls back after rallying in past nine days, as advance was capped by daily cloud top/100DMA (0.7035) and sentiment changes ahead of RBA rate decision, due early Tuesday. Majority of economists tip for 0.25% rate cut to a record low at 1%, with rising expectations for more cuts this year, with Australian unemployment seen as key driver. The Aussie was initially pressured by weaker than expected China’s Manufacturing data which offset positive impact from US/China agreement of not imposing new tariffs and continuation of trade talks. Overbought conditions also added to fresh pressure on Aussie dollar. The pair is on track for daily close in red, which is on track to for bearish outside day and generate initial reversal signal. Rate cut and dovish steer from the RBA would put Australian dollar under increased pressure which would generate stronger signal of reversal. Falling 55SMA (0.6975) marks initial support, with extension below 0.6956 (Fibo 38.2% of 0.6831/0.7034) needed to confirm reversal and spark stronger correction.

Res: 0.7000; 0.7035; 0.7048; 0.7062

Sup: 0.6975; 0.6956; 0.6976; 0.6936

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals