The dollar is continuing to enjoy a post-jobs report bounce today, up around 0.2%, as Fed interest rate cuts continue to dominate investors’ mindsets.

With global economic prospects increasingly in doubt as we head into another important earnings season, the Fed is quickly becoming the only game in town as far as markets are concerned.

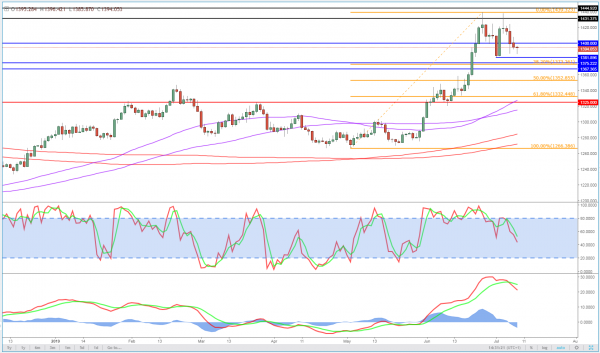

Gold Daily Chart

The belief that numerous cuts are coming has been very beneficial for gold prices, although this rally has since stalled just shy of $1,450. A break below $1,380 may signal more pain to come for the yellow metal, which would hardly be disastrous given that it was trading below $1,300 in late May. The rally that followed was very significant, rising almost 13% over the next few weeks.

Given that the last two peaks fell around the same level -around $1,438 – a double top may now be forming, with the neckline around $1,382. A break of this could be the catalyst for the next push lower, with a possible price projection – the size of the double top, projected below the neckline – of around $1,326. This roughly coincides with prior support and resistance and around the 61.8 fib level.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals