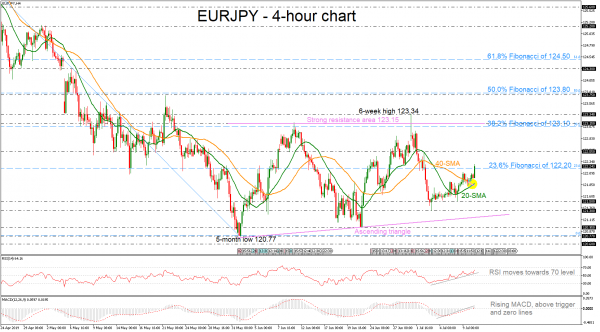

EURJPY is testing the 23.6% Fibonacci region from the high on 126.80 to the low on 120.77, around 122.20 as it seems ready to continue the very short-term upside tendency. The 20- and 40-simple moving averages (SMAs) posted a bullish crossover confirming the recent bullish run. The RSI is sloping up approaching the 70 level, while the MACD has been rising over the last week.

A successful climb above the immediate level of 23.6% Fibo would increase positive speculation towards the 122.50 minor resistance and then until the 123.10 – 123.15 area, which encapsulates the 38.2% Fibonacci of 123.10.

A possible pullback to the downside may meet support at the short-term moving averages currently at 121.90 ahead of the 121.50 barrier, taken from the latest lows.

In brief, EURJPY has been developing within an ascending triangle pattern over the last month and only a close above the significant area of 123.15 could change the long-term outlook to bullish.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals