How Many Pips Should Be Targeted Per Day?

Trading with pips talking points:

- Targeting X amount of pips per day is unrealistic

- Forex traders should instead focus on diligently following a set strategy

- Trading using limited leverage should yield a positive return over time

It’s not uncommon for forex traders to approach trading with the aim of collecting ‘x’ many pips a day from the market. Some may even consider adopting a strategy that only makes X amount of pips per day. However, there are complications that arise from this approach and setting such unrealistic goals.

This article will answer the question: “how many pips per day?” and explore the best approach to using pips – considering market fluctuations which affect daily pip movements and how to capitalise on this with a solid trading strategy.

How Many Pips do Professional Traders Make?

Professional traders do not trade with a specific number of pips in mind. This is because markets do not move in a predictable manner, so a trader cannot bank on a targeted number of pips per trade.

The number of pips per day varies depending on the strategy adopted as well as the unique goals set by the individual. Certain strategies target smaller more frequent profits over multiple trades (scalping), whilst others look for large profit taking opportunities with longer time horizons (position trading).

Learn more about pips in forex trading.

Unrealistic Expectations of Setting A Daily Pip Target

Traders must accept that not all trades will yield positive returns. Therefore, trying to achieve a daily pip goal is setting up for failure. A daily pip target is ineffective because it encourages trading more at times when the strategy is not effective and trading less during times when the strategy is more effective. This is the opposite of what we should be trying to achieve.

For example, if a trader places quick trades in the morning and hits a specified “pip goal,” the trader forgoes potential additional trades that could occur during ideal market conditions. Each strategy has their ideal market conditions; thus, this trader would ultimately be limiting what the strategy could do for them.

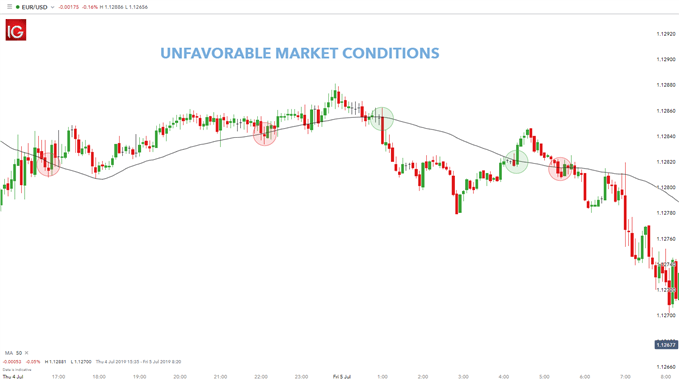

The chart below shows a typical example of forgone returns in unfavorable market conditions. The EUR/USD chart shows a trader targeting 20 pips per trade on a moving average (MA) price crossover trading strategy as highlighted by the circles which indicate entry points. When price crosses above the MA the trader looks to buy and when the price crosses below the MA line this signals a short entry. The red circles show trades that would have been unsuccessful in accordance with the strategy whilst the green circles show successful trades with 20 pip movements in the direction of the trade. This example illustrates a typical example of a trader targeting ‘x’ amount of pips in adverse conditions which often leads to revenge trading and losing trades.

Example: EUR/USD unfavorable market conditions

Focus on What is Important: A Winning Strategy

Rather than focusing on earning a specific number of pips per day, traders need to focus on what can be controlled. In trading terms this relates to following a strategy perfectly, with no emotion or hesitation. Once a strategy has been formulated, the most important step is execution of the strategy itself.

Traders need to stick to a plan by not getting overconfident when successful, and to not shy away from placing the next trade when losing. Focusing on the strategy allows traders to stay away from revenge trading. Revenge trading is a natural friend to targeting a certain number of pips each day. This is because when traders are behind on a goal, this can lead to overtrading to “make it up.” That overtrading typically leads to more and more losses. If the trader has confidence in the strategy; the winning or losing of each individual trade doesn’t matter. Traders must avoid revenge trading or adjusting trade sizes to recoup losses.

Learn more about creating a trading plan.

Pips vs Profitable Trading

Going after a certain number of pips per day sounds like a good plan when trading forex, but it is an unrealistic goal. The market conditions change frequently forcing your strategy in and out of its ideal state without notice. What is needed are goals for factors that can be controlled, like following a strategy and executing it flawlessly. It is recommended starting with a risk-free demo account that has real-time pricing data.

Interested in our analyst’s best views on major markets? Download our Free Trading Guides.

Further reading to trade forex like a professional

- If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide.

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to give yourself an edge in the markets.

- Traders often look to retail client sentiment when trading popular FX markets. DailyFX provides such data, based on IG client sentiment.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals