Key Highlights

- Crude oil price struggled two times to clear the $60.85 resistance against the US dollar.

- There was a break below a major bullish trend line at $58.70 on the 4-hours chart of XTI/USD.

- Canada’s CPI declined 0.2% in June 2019 (MoM), similar to the forecast.

- The US Initial Jobless Claims for the week ending July 13, 2019 might increase from 209K to 216K.

Crude Oil Price Technical Analysis

After forming a support base near $56.00, crude oil price climbed higher steadily above $58.00 against the US Dollar. The price even broke the $60.00 resistance area, but it struggled to climb above $60.85-60.90.

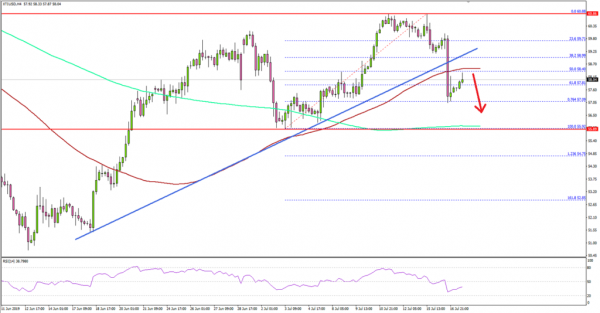

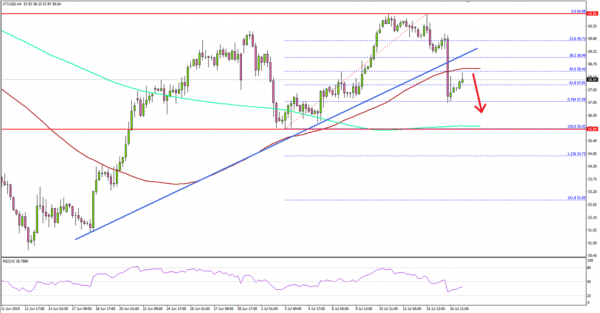

Looking at the 4-hours chart of XTI/USD, the price made two attempts to climb further above $60.85. However, the bulls struggled to gain momentum, resulting in a bearish reaction below $60.00.

The price formed a swing high $60.88 and recently declined below a major bullish trend line at $58.70 on the same chart. Later, there was a break below the $58.50 support plus the 100 (red) simple moving average (4-hours).

Moreover, the price declined below the 61.8% Fib retracement level of the upward move from the $55.92 low to $60.88 high. It seems like the price has started a downside correction and it may continue to correct lower.

The main support on the downside is near the $56.00 level and the 200 (green) simple moving average (4-hours). As long as the price is above $56.00, it could bounce back and resume its upward move. If not, there is a risk of more downsides below $55.00 and $54.00.

Fundamentally, the Canadian Consumer Price Index (CPI) for June 2019 was released by the Statistics Canada. The market was looking for a 0.2% decline in the CPI, compared with the last increase of 0.4%.

The actual result was similar to the forecast, with a decline of 0.2% in the CPI. The yearly change posted a 2.0% increase, down from the last 2.4%. Looking at the BoC’s CPI report, there was no change in the Core CPI in June 2019 (MoM), whereas the market was looking for a 0.1% increase.

The report by the Statistics Canada added:

Energy prices fell 4.1% year over year in June, following a 0.1% decrease in May. Consumers paid less for gasoline (-9.2%) and fuel oil and other fuels (-4.1%). This was due in part to falling oil prices amid rising fuel inventories in the United States and the elimination of carbon pricing in Alberta at the end of May.

Looking at major pairs, EUR/USD and GBP/USD are trading in bearish zone and they might find it difficult to correct higher in the short term.

Economic Releases to Watch Today

- UK Retail Sales for June 2019 (YoY) – Forecast +2.6%, versus +2.3% previous.

- UK Retail Sales for June 2019 (MoM) – Forecast -0.3%, versus -0.5% previous.

- US Initial Jobless Claims – Forecast 216K, versus 209K previous.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals