Manufacturing and job data released the US are pretty solid. But dollar shrugs off and stays soft. Though, Euro is even weaker on rumor that ECB is considering to revamp their inflation target, which could give policymakers rooms to pursue monetary stimulus for longer. Canadian Dollar is also among the worst performing ones as oil price extends this week’s pull back. On the other hand, Sterling is shot higher on way better than expected retail sales data. Australian Dollar is also among the strongest.

Technically, EUR/GBP retreats sharply today and focus is back on 0.8594 support. Break will be an early indication of near term bearish reversal. GBP/USD rebounds strongly after drawing support from 1.2391 low. Break of 1.2579 will indicate short term bottoming too. USD/JPY recovers after dipping to 107.61 earlier today. But further decline is still in favor for the near term.

In Europe, currently, FTSE is down -0.45%. DAX is down -0.64%. CAC is down -0.07%. German 10-year yield is down -0.13 at -0.302. Earlier in Asia, Nikkei dropped -1.97%. Hong Kong HSI dropped -0.46%. China Shanghai SSE dropped -1.04%. Singapore Strait Times dropped -0.11%. Japan 10-year JGB yield dropped -0.011 to -0.136.

Philadelphia Fed manufacturing index rose sharply to 21.8, jobless claims rose to 216k

In the Philadelphia Fed manufacturing business outlook survey, the diffusion index for current general activity jumped sharply to 21.8 in July, up from 0.3 and beat expectation of 5.0. Current shipment index rose 8 points while new orders index rose 11 pts.

Overall, the responses to the survey suggest “an improvement in regional manufacturing conditions compared with last month. The new orders index, which reflects demand for manufactured goods, showed improvement this month, and more firms added to their payrolls. The survey’s future indexes indicate that respondents continue to expect growth over the next six months.”

US initial jobless claims rose 8k to 216k in the week ending July 13, matched expectations. Four-week moving average of initial claims dropped -0.25k to 218.75k. Continuing claims dropped -42k to 1.686m in the week ending July 6. Four-week moving average of continuing claims rose 5k to 1.701m.

UK retail sales rose 1% in June, way over expectations

UK retail sales in June came in much better than expected. Sales including auto and fuel rose 1.0% mom, 3.8% yoy, versus expectation of -0.3% mom, 2.6% yoy. Sales excluding auto and fuel rose 0.9% mom, 3.6% yoy, versus expectation of -0.2% mom, 2.6% yoy.

Over the month, all four main sectors contributed positively the growth, including fuel, non-store retailing, non-food stores and food stores. Non-food stores provided the largest contribution to the month-on-month growth, with both the amount spent and quantity bought at 0.7 percentage points.

Also released in European session, Swiss trade surplus widened to CHF 4.1B in June, above expectation of CHF 3.21B.

EU Barnier: Current Brexit agreement the only way to leave in an orderly manner

In a BBC interview, EU chief negotiator Michel Barnier insisted that the current, thrice defeated Withdrawal Agree is the “only way to leave the EU in an orderly manner”. And, UK will “have to face the consequences” of no-deal Brexit if it’s the chosen path. Additionally, he said EU has “never been impressed” by a no-deal Brexit threat.

In another interview, European Commission First Vice President Frans Timmermans complained the UK ministers “haven’t got a plan” in Brexit negotiations. “We thought they are so brilliant,” he added. “that in some vault somewhere in Westminster there will be a Harry Potter-like book with all the tricks and all the things in it to do.”

Conservative Party leadership contender Jeremy Hunt said the fact the EU “never believed that no deal was a credible threat” was “one of our mistakes in the last two years”.

Australian employment grew 0.5k, unemployment rate unchanged at 5.2%

Australia employment grew just 0.5k in June, below expectation of 9.1k. Full-time jobs increased 21.1k while part-time jobs decreased -20.6k. Unemployment rate was unchanged at 5.2% with participation rate steady at 66.0%.

ABS Chief Economist Bruce Hockman said, “Australia’s participation rate was at 66 per cent in June 2019, which means nearly two of every three people are currently participating in the labour market. The participation rate for 15 to 64 year olds was even higher and closer to four out of every five people.”

Australian NAB quarterly business confidence improved, but likely short-lived

Australia NAB quarterly Business Confidence index rose from 0 to 6 in Q2. Current Business Conditions index dropped from 4 to 1. Next 12 months Business Conditions index rose from 22 to 23. Next 12 months Capex Plans rose from 22 to 24.

Alan Oster, NAB Group Chief Economist said the down tend in conditions continued. And, the quarterly survey has now show a below average reading, for the first time since 2014. The decline in conditions suggests “business sector has lost significant momentum over the past year”, and “we are unlikely to see a substantial pickup in growth in the Q2 national accounts”.

On the other hand, “the strong lift in confidence appears to be related to the outcome of the Federal election, with the bulk of the survey conducted post election day and also around the time of firming expectations of rate cuts”. But such lift should be short-lived as already shown in the June monthly business survey.

Japan’s export dropped for the seventh straight month

In non seasonally adjusted terms, Japan exports dropped -6.7% yoy to JPY 6.585T in June. That’s the seventh straight month of decline. Imports dropped -5.2% yoy to JPY 5.995T. Trade surplus came in at JPY 0.589T.

Looking at some details, exports to China dropped -10.1 yoy and imports dropped -5.3% yoy. That’s the fourth straight month of decline in exports to China. Exports to US rose 4.8% yoy while imports dropped -2.5% yoy. That’s the ninth straight month of increase in exports to US.

In seasonally adjusted terms, exports rose 4.8% mom to JPY 6.554T in June. Imports dropped -4.4% mom to JPY 6.568T. Trade deficit came in at JPY -0.014T.

EUR/USD Mid-Day Outlook

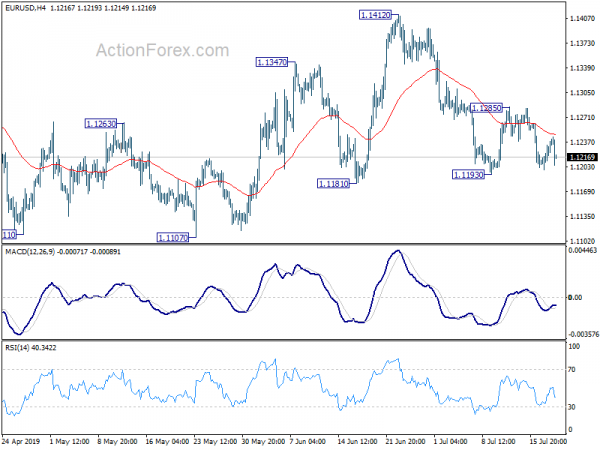

Daily Pivots: (S1) 1.1205; (P) 1.1220; (R1) 1.1239; More…

EUR/USD’s recovery was rejected by falling 4 hour 55 EMA again but stays above 1.1193 support. Intraday bias remains neutral for the moment first. On the downside, break of 1.1193 will resume the fall from 1.1412 to retest 1.1107 low. On the upside, above 1.1285 resistance will turn bias back to the upside for 1.1412 resistance.

In the bigger picture, bullish convergence condition in daily and weekly MACD suggests that 1.1107 is a medium term bottom. However, rejection by 55 EMA retains medium term bearish. Outlook will be neutral for now. On the downside, break of 1.1107 will resume the down trend from 1.2555 (2018 high) to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Meanwhile, break of 1.1412 will resume the rebound to 38.2% retracement of 1.2555 to 1.1107 at 1.1660.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jun | -0.01T | -0.14T | -0.61T | -0.62T |

| 01:30 | AUD | Employment Change Jun | 0.5K | 9.1K | 42.3K | 45.3K |

| 01:30 | AUD | Unemployment Rate Jun | 5.20% | 5.20% | 5.20% | |

| 01:30 | AUD | NAB Business Confidence Q2 | 6 | -1 | ||

| 06:00 | CHF | Trade Balance (CHF) Jun | 4.10B | 3.21B | 3.41B | 3.40B |

| 08:30 | GBP | Retail Sales Inc Auto Fuel M/M Jun | 1.00% | -0.30% | -0.50% | -0.60% |

| 08:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Jun | 3.80% | 2.60% | 2.30% | 2.20% |

| 08:30 | GBP | Retail Sales Ex Auto Fuel M/M Jun | 0.90% | -0.20% | -0.30% | -0.40% |

| 08:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Jun | 3.60% | 2.60% | 2.20% | 2.00% |

| 12:30 | CAD | ADP Payroll Jun | 30.4K | -16.0K | ||

| 12:30 | USD | Philadelphia Fed Business Outlook Jul | 21.8 | 5 | 0.3 | |

| 12:30 | USD | Initial Jobless Claims (JUL 13) | 216K | 216K | 209K | 208K |

| 14:00 | USD | Leading Index Jun | 0.10% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 72B | 81B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals