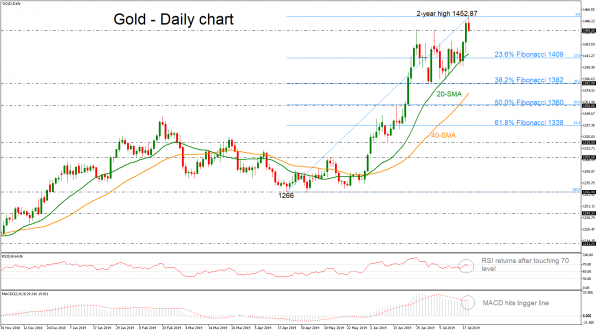

Gold advanced to a more than two-year high of 1,452.87 earlier today, but quickly reversed lower near the previous highs of 1,438. The technical indicators seem to be overstretched in the daily timeframe as the RSI is reversing lower after it touched the 70 level, while the MACD has found obstacle at the trigger line.

If the price successfully surpasses the two-year high (1,452.87), it could prove a trigger point for another bullish round towards the 1,475 mark, registered on July 2011. A stronger move could shift all the attention towards the 1,520 barrier, identified by the inside swing low on December 2011.

The 1,438 level is currently working as an immediate support to downside movements. Falling aggressively below that number, the next stop could be the 23.6% Fibonacci retracement level of the upward movement from 1,266 to 1,452.87 near 1,409 around the 20-day simple moving average (SMA).

Overall, gold is trading in the green both in the medium- and the long-term, eyeing a key resistance around the today’s peak.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals