After three weeks of consecutive losses, GBPJPY is set to close in the green, though with minimal gains.

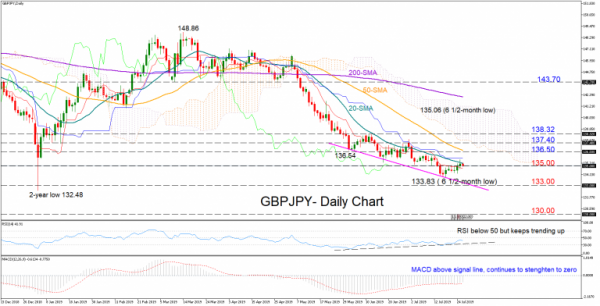

The 20-day simple moving average (SMA) remained a key resistance area, while the RSI and the MACD continue to keep the odds high for downside corrections in the short-term as long as they fluctuate in bearish area. Yet, both indicators have been correcting north and towards their neutral levels over the past two months at a time when the price was printing lower lows, suggesting that a trend reversal could be approaching.

Traders, however, would like to see an exciting bullish action above the June high of 138.32 before confirming the start of an uptrend. At an earlier stage, resistance could emerge around the 50-day SMA currently near 136.50 and then close to the 137.40 level.

Alternatively, a failure to break above the 20-day SMA could see a retest of the 6 ½-month low of 133.83 ahead of the descending line near 133.00. If there is a deeper move, the next support to watch could be the 130 number.

Turning to the medium-term picture, the sentiment is strongly bearish and only a rally above 143.70 would shift the outlook back to neutral.

All in all, GBBJPY is likely to hold bearish both in the short- and the medium-term timeframe.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals