U.S. Highlights

- Markets had no summer vacation this week, with a new British PM, dovish message from the European Central Bank, and new U.S. GDP data to digest.

- Advanced economy central banks are all sounding dovish, with the Bank of England likely to be more cautious next week now that the risks of a disorderly Brexit have risen.

- Second quarter GDP data showed that U.S. domestic growth remained solid in Q2. But the Fed is likely more concerned with weakness in investment and exports as it prepares to cut rates next week.

Canadian Highlights

- May payrolls data was the main economic data highlight this week. It showed decent payrolls growth and a bounce-back in wages.

- Looking to next week, we expect a healthy May GDP growth report on the back of solid gains in manufacturing sales and housing activity. This would provide further confirmation of a second-quarter growth rebound.

The global economy certainly didn’t take a vacation this week. Between a new UK Prime Minister, an ECB prepared to step up the stimulus, and fresh data on U.S. growth, markets had a lot to digest. And let’s not forget the Federal Reserve is likely to cut rates for the first time in over 10 years when it meets next week. So much for the dog days of summer.

Former London mayor Boris Johnson is now Britain’s Prime Minister. Johnson faces an Oct 31st deadline to either leave the EU under the terms of the agreement negotiated by Theresa May, or face a disorderly exit without a deal. The EU had agreed that a UK election would trigger an automatic extension to this deadline, but so far the new PM says an election is off the table. How PM Johnson threads the needle on this one remains to be seen, but it is likely to be a wild ride similar to this past spring. Overall, the odds of a hard Brexit have ticked up in the last two months, and we expect the Bank of England to step back from a hiking bias at its decision next week.

The European Central Bank also hinted at easier monetary policy ahead. Further data this week pointed to a sagging European economy in the second half of the year. Consumer and business confidence have not rebounded from lows consistent with past recessions. Morever, the slump in manufacturing activity is broadening into other regions and industries. This is bad news, as it could trigger a broader pullback on spending, locking in a downward cycle.

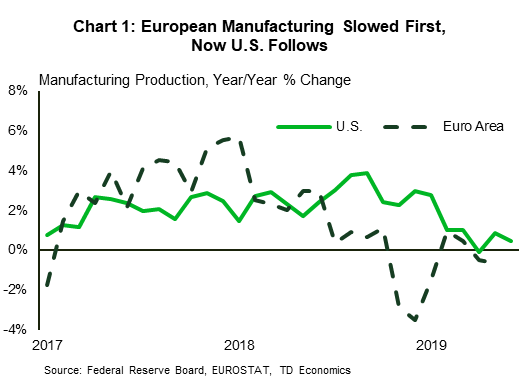

Our recent report discusses how this global chill has slowed U.S. manufacturing (Chart 1). This is a key reason why the Fed is likely to attempt to cushion the economy from further weakening by cutting rates a quarter point next week. There are real risks to the expansion, and the Fed needs to get in front of them. Research has shown that when policy rates are close to the zero lower bound, central banks need to act pre-emptively in the face of downside risks since they have less ammunition to combat them.

Today’s GDP report (Chart 2) showed that second quarter growth was supported by strong consumer spending. But, the Fed is likely most concerned about the slowdown in investment and the weakness in exports. For now, the consumer is strong enough to keep economic growth sturdy. And now the U.S. economy looks to get a helping hand from Washington. Congress recently agreed to suspend the debt ceiling until after the next election, and raised the spending caps, removing a key fiscal risk this fall. In fact, spending has been raised slightly higher than we assumed in our forecast, presenting a slight upside risk to growth in 2020.

Monetary policy is set to get a little easier both in the U.S. and abroad, and now U.S. fiscal policy is looking a little easier too. These factors should support growth heading into 2020 just as it was starting to look like the edges of the expansion were fraying. This seems to have put markets in a relaxed mood, just in time for summer vacations.

The dog days of summer are finally upon us as the blistering heat drained markets of their usual exuberance and kept the data stream somewhat dry. Oil prices started the week at $56/barrel and despite some wiggles, remained around that level at end of the week. The S&P 500 moved up by 1.3%, as news that U.S.-China trade talks are set to resume contributed to small gains.

The Canadian dollar lost some ground this week. The loonie depreciated by 1.3% against the USD as global growth concerns, news of a deal on the U.S. debt ceiling and the White House commitment to not intentionally weaken the dollar drove a rally in the greenback.

In terms of data releases, the Survey of Employment, Payrolls & Hours (SEPH) was the only top-tier release this week. The big take-away from these data was a solid bounce back up in wages, confirming the earlier signal sent by the Labour Force Survey. Indeed, both measures suggest wage growth has been picking up over recent months (Chart 1). Moreover, they are now sitting at levels well-above their long-term average.

This is a very welcome development after disappointing wage gains over most of 2018. Nevertheless, we will need to see sustained strength to know if these gains are here stay or if it will turn down again as it did last year. In the case of the former, we may be seeing the resuscitation of the Philips Curve. In other words, the tight labor market may finally be translating to stronger wage growth.

Despite the stronger wage data, the second-tier releases suggest somewhat weaker economic activity. Wholesale sales were down 1.8% in May after five straight months of increases. Six of the seven subsectors were down, with the motor vehicle industry leading the weakness. The CFIB Business Barometer also decreased, declining by nearly four percentage points in July. The largest drop in optimism was in Ontario, while it remained elevated in Atlantic Provinces. Even taking these data into account, Canadian GDP growth likely bounced back to life following a lackluster first quarter.

We will look to next week’s May GDP data to support this view. We expect growth will slow to 0.2% month-on-month from a solid showing of 0.3% in April but remain healthy (Chart 2). Earlier data suggested manufacturing and housing will buttress growth in May. On the services side (other than retail and wholesale trade), we will likely see decent growth, consistent with this week’s SEPH data.

On the whole, the data paints a picture of a relatively more vibrant Canadian economy. There is a strong chance that GDP growth for the second quarter comes in ahead of the Bank of Canada’s 2.3% forecast from earlier this month. Barring any unforeseen negative shocks, this should be enough to keep the Bank on the sidelines for the remainder of the year.

U.S. Personal Income & Spending – June

Release Date: July 30, 2019

Previous: spending: 0.4%; income: 0.5%

TD Forecast: spending: 0.4% m/m; income: 0.3%

Consensus: spending: 0.3% m/m; income: 0.4%

We anticipate personal spending to have maintained its strong pace at 0.4% m/m in June, closing the second quarter at a decent clip. We don’t discard a softer print at 0.3% if the weakness on durable goods spending is larger than we currently anticipate. In the details, we expect a 0.5% m/m advance in services spending to be the main driver behind the June gain, with a rise in spending in nondurables (+0.3%) also helping on the headline. Moreover, we forecast income to rise 0.3% m/m, a tad slower than in the prior month.

U.S. ISM Manufacturing Index – July

Release Date: August 1, 2019

Previous: 51.7

TD Forecast: 51.7

Consensus: 52.0

We look for the ISM manufacturing index to stay unchanged at 51.7, as we expect some of the major trade-related concerns to have dissipated in the short-term on the back of the US-China trade truce. This should translate into a stabilization in business sentiment and on the outlook for the sector. Indeed, the message from the ISM-adjusted regional indices was mixed, with retreats in two out of the four published surveys we track. Other data was also mixed, as recent firm growth in core durable goods orders suggest some upside, while a weak Markit PMI survey increases the odds for a downside surprise in July.

U.S. Employment – July

Release Date: August 2

Previous: 224k, unemployment rate: 3.7%,

TD Forecast: 170k, unemployment rate: 3.7%

Consensus: 166k, unemployment rate: 3.7%

We expect payrolls to trend lower to 170k in July, following the strong 224k print in the previous month. In particular, we expect job creation in the manufacturing sector to mean-revert after the five-month high 17k increase in June. Together with somewhat slower hiring in construction, this should bring employment in the goods sector back to its recent average. Likewise, we forecast employment in the services sector to moderate somewhat from its firm June print. All in, the household survey should show the unemployment rate remained steady at 3.7%, while we expect wages to rise 0.2% m/m, leaving the annual print unchanged at 3.1% in July.

Canadian Real GDP – May

Release Date: July 31, 2019

Previous: 0.3%

TD Forecast: 0.2%

Consensus: N/A

Industry-level GDP growth is projected to slow to 0.2% m/m in May after a robust performance over the last two months. Goods-producing industries will provide the main source of strength on a rebound in manufacturing output and sustained strength in construction activity, while the energy sector should make a muted contribution after leading industry-level growth for March and April. On the other end of the spectrum, lower retail and wholesale volumes point to a material drag on services while a more modest pace ofexisting home sales suggests a bit less lift from real estate activity. Industry-level GDP growth of 0.2% should be sufficient to keep Q2 GDP tracking near 3%, above estimates from the July MPR (2.3%). However, this alone is not enough to outweigh elevated global uncertainty, leaving the BoC in wait-and-see mode.

Canadian International Trade – July

Release Date: August 2, 2019

Previous: $0.76bn

TD Forecast: -$0.30bn

Consensus: N/A

TD looks for the International goods trade balance to deteriorate to a $0.30bn deficit in June on the heels of the first surplus since late 2016. The most significant driver behind the softer headline print is some giveback of the broad export gains observed in May, which included the largest increase in real non-energy exports since 2015. Motor vehicles and aerospace products should lead the pullback in a partial unwind of the (combined) 17.1% surge from May, while lower crude oil prices and a drop in preliminary US imports suggest softer nominal energy exports. Imports should see modest gains driven by strong domestic demand, although aircraft are susceptible to further declines in the absence of any Boeing deliveries to Canadian airlines.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals