Trading on sentiment data can help traders identify hidden trends in the market that may not be obvious to novice traders.DailyFX provides client sentiment data based onall live IG trades in the forex, commodity and indices markets and acts as a contrarian signal. A successful sentiment trading strategy would look to make a trade in the opposite direction whenever sentiment shows a strong directional bias. This may seem counter-intuitive but is well-founded and will be explained in this article.

Trading with IG Client Sentiment talking points:

- What is IG Client Sentiment?

- Why is client sentiment a contrarian indicator?

- How to create a sentiment trading strategy using IG CS

- Learn more about trading with sentiment

What is IG Client Sentiment?

IG Client Sentiment, or IG CS, uses data derived from IG retail traders with live positions. Essentially, traders are able to see where the majority of traders are positioned, whether long or short, when analyzing trades. Traders can access IG Client Sentiment data using our interactive tool wheremarkets and asset classes can be filtered accordingly.

IG Client Sentiment is viewedas ‘fading the crowd’ or going the opposite direction of retail traders. All of this is made possible with IG’s accurate, real-time data on the most frequently traded markets – which can be used in any sentiment trading strategy.

It’s crucial to note that traders should not trade based on IG Client Sentiment alone but should combine sentiment with technical analysis and ensure that the appropriate trade size (in relation to the account size) is used at all times.

Why is Client Sentiment a contrarian indicator?

Before implementing a sentiment trading strategy, it’s essential to understand why client sentiment is regarded as a contrarian signal.

IG Client Sentiment is regarded as a contrarian indicator for two main reasons.

- Trading against the trend: The majority of retail traders (the population of the IG CS data) are trend fighters. Unfortunately, this appears to be human nature more than logic as this pattern continues to play out. These traders attempt to call tops and bottoms in the market by trading reversals in strong trending markets. This goes completely against the fundamental concept of, ‘The trend is your friend’

- Exiting the trade: If the market is in an uptrend and sentiment is overwhelmingly short, all those short traders will eventually need to do the opposite to close the position, which would involve buying to close. Whether a stop or limit is hit, or the trade is closed manually, this will involve ‘buying’ which drives the prices upwards. If short traders significantly outweigh long traders, those short traders will eventually have to buy to close their positions creating buying momentum that will benefit long traders, not short traders.

RECOMMENDATIONS

We have created innovative HIGH GAIN PROFIT robot. We recommend our BEST ROBOT FOREXVPORTFOLIO v11, which is already being used by traders all over the world, successfully making unlimited profits over and over again.

For beginners and experienced traders!

You can WATCH LIVE STREAMING with our success forex trading here

How to Create a Sentiment Trading Strategy using IG CS

This section expands on IG CS by incorporating it in a sentiment trading strategy. The steps involved are listed below:

- Use IG Client Sentiment to establish the market and direction of the trade

- Is the market range-bound or trending?

- Overlay net-long/short positions over the price chart to see the while picture.

1) Use IG Client Sentiment to establish the market and direction of the trade

Traders can look to sentiment at the very start of the analysis process or they can conduct thorough technical and/ or fundamental analysis and seek out client sentiment as confirmation of the trade.

Starting with client sentiment can be extremely useful as it can inform which market to trade and in what direction, before any other analysis is even done. Thereafter, traders can use technical analysis to spot ideal entry and exit points for that market.

Establishing the market and direction: Look for markets exhibiting extremes in positioning. Strong upward (downward) trending markets combined with extreme net-short (net-long) client positioning, results in a bullish (bearish) signal.

Using IG Client Sentiment for a clear directional bias

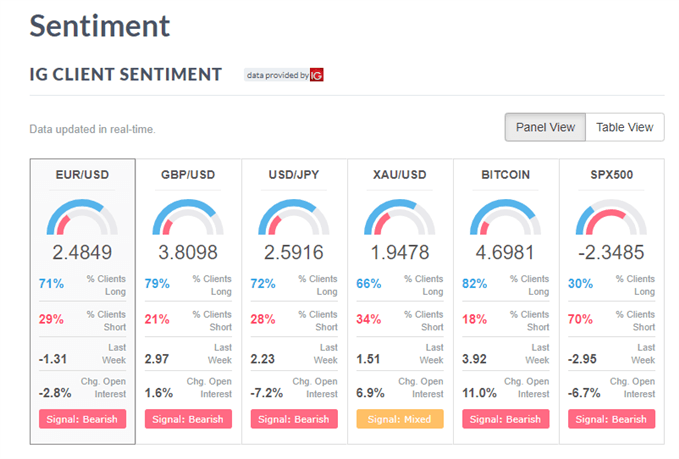

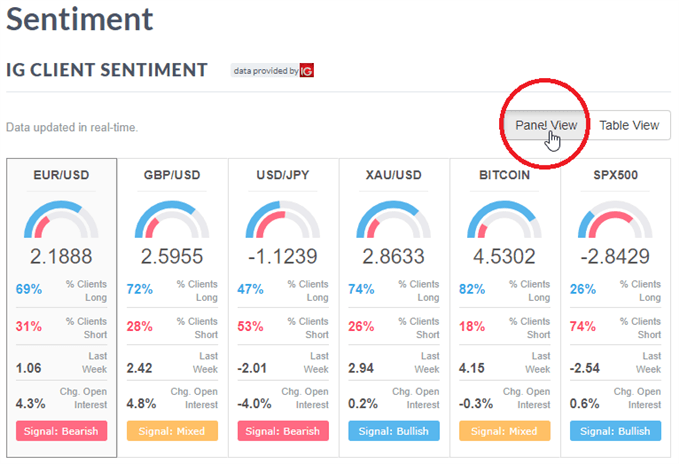

The ‘Panel View’ on the IG Client Sentiment tool, as shown below, displays the number of traders holding long positions in a selected market (major forex pair, gold, Bitcoin or the SPX500) to the number of traders holding short positions in the same market. This is presented in either a percentage form or a ratio form (dividing the larger percentage by the lower percentage).

Traders should be drawn to extreme levels (very short or very long) when analyzing sentiment, as this is where the tool provides clearer signals. As can be seen in the above graphic, there is a relatively extreme figure of -2.8429 for the SPX500, also known as the S&P 500.

Readings that are below zero indicate a net short position in the pair, while readings above zero indicate that traders are net long in the pair. It is widely considered that readings greater than +2 and less than -2, indicate a meaningful bias among retail traders as this translates in to 66.6% of traders net-long/short.

Therefore, with a reading of -2.8429 on the SPX500, this indicates that for every one trader holding a long position there are 2.8429 that are holding short positions; which represents a sizeable imbalance in the positioning of the pair.

General trading signals produced by IG Client Sentiment

Trend Direction | IG Client Sentiment | Signal |

Up trend | -2 | Long |

Down trend | +2 | Short |

Up trend | +2 | Mixed |

Down trend | -2 | Mixed |

At this stage, we know which market to trade and know the direction to trade it but there are further factors to consider and these are explored in the remainder of the article.

2) Is the Market Range-Bound or Trending?

After realizing that most traders are short the S&P 500, one could reasonably assume that this must be the correct trade to place. This, however, could not be further from the truth.

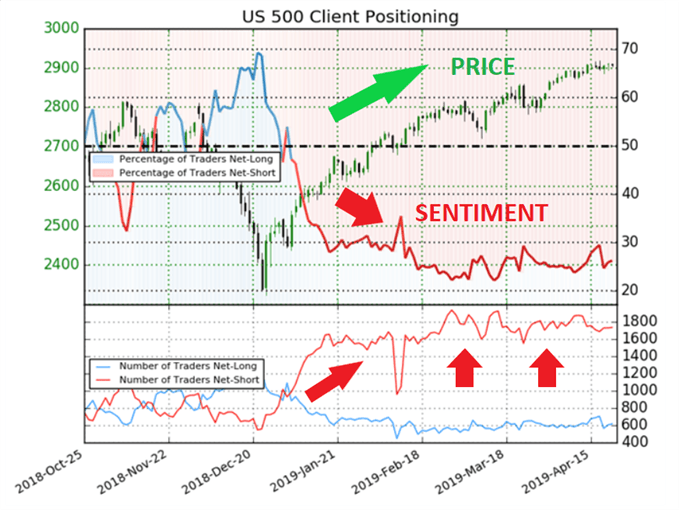

Taking a look at the SPX500 chart below, it is clear to see a strong uptrend despite retail traders remaining strongly net short. This seems counter-intuitive but reinforces the notion that retail traders tend to be trend fighters.

Trending markets: It’s human nature to look for bargains which is why retail traders often look to “call the bounce”, selling in an advancing market and buying a falling market.

Range-bound markets: In well-established ranging markets, preferably with low volatility, selling at the highs and buying at the lows makes sense.

To their detriment, retail traders tend to focus more on catching reversals in strong trending markets than trading ranges. Therefore, when trading on sentiment, traders will find more reliable (contrarian) signals in strong trending markets.

3) Overlay net-long/short positions over the price chart

To make the analysis easier, DailyFX provides IG client sentiment information that is overlaid on a price chart as shown below:

The top section of the diagram shows how price has evolved (black and green candles) and the blue/red sentiment line shows when traders are net long/ net short. If there is a large distance between the sentiment line and the price, this can be considered as a signal to trade in the direction of the trend. In the above diagram, price is in a strong up trend and sentiment is showing nearly three times more short traders for every long trader, therefore, this can be regarded as a bullish signal.

The lower section of the diagram simply shows the actual number of short and long traders overtime. Since traders had become increasingly more net-short, it’s no surprise to see this line advancing upwards.

While IG Client Sentiment is a useful tool, it doesn’t mean that it’s perfectly predictive. Traders should still look to utilize strong risk management in their trades, even with the assistance of IG CS.

Learn more about trading with sentiment

- IG Client Sentiment can be applied across all markets. Find out how forex traders can apply sentiment analysis for forex trading.

- Another way to analyze client sentiment is to look at the daily and weekly changes in net-long/short positions. This and otherinsightful information can be found in our client sentiment trading guide, which can be foundon the right-handsideon the client sentiment page.

- Listen to this educational podcast on the Commitment of Traders (CoT) report and how this can be used alongside IG Client Sentiment data.

- Read our educational article for further information on how to use the CoT report in forex trading.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals