EMA Trading: Overview

- What is “EMA” in Forex Trading?

- Three-Step EMA Trading Strategy

- Step 1: Find the Trend in Your Forex Pair

- Step 2: Using EMA to Time Entries

- Step 3: Using EMA to Find Exit Positions

What is “EMA” in Forex Trading?

The EMA is a consequent of the simple moving average (SMA). The EMA is an indicator offered on most charting packages which enables traders to identify trends as well as potential entry and exit signals. When it comes to trending markets, traders have many options in regard to strategy. This article will review EMA’s and how they can be used to create a complete strategy for forex trends.

Three-Step EMA Trading Strategy

The EMA trading strategy discussed below will revolve around the use of a series of EMA’s (Exponential Moving Average). These averages work the same as a traditional SMA by directly displaying an average of price for a selected period on the graph. However, the EMAs calculation incorporates a weight to put a greater emphasis on most recent price. This weight is placed to remove some of the lag found with a traditional SMA. This makes the EMA a perfect candidate for trend trading.

Step 1: Find the Trend in Your Forex Pair

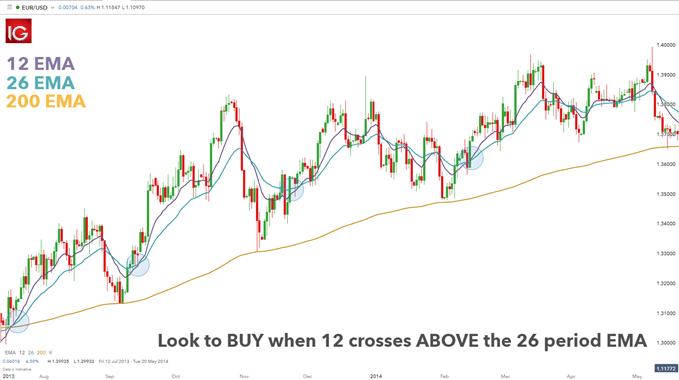

Before entering into a trend-based position, traders need confirm the trend. The chart below shows a EUR/USD Daily chart. Notice the pair is forming higher highs along with higher lows, which makes the EUR/USD pair a strong candidate for an uptrend. This analysis can be confirmed by the use of a 200 EMA as marked on the chart. Traditionally traders are bullish when price is above the 200 EMA and bearish if price resides under the average.

EUR/USD trend analysis:

Step 2: Using EMA to Time Entries

Once market direction is identified, traders can then use a series of EMA’s to enter the market. Below includes a 12 and 26 period EMA have been added to the graph. Since traders are looking to buy in an uptrend, it is important to identify areas where momentum is turning back in the direction of the trend. EMA’s can help traders decipher this by recognizing an area where the shorter period (12) moving average crosses above the longer period (26) EMA. At this point traders can look to buy the market.

The EUR/USD chart shows several possible buy entries using EMA’s. Remember, this process can be replicated for a downtrend by selling in the event that the 12 period EMA crosses below the 26.

EUR/USD entries:

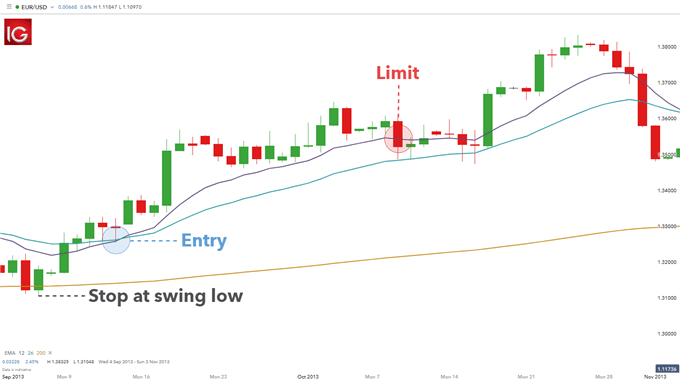

Step 3: Using EMA to Find Exit Positions

Now that a trade has been opened, traders need to identify when it is time to exit the market. This is the third and final step in developing a successful strategy. Traders may choose a variety of stop/limit and risk-reward combinations here to suit their trading needs. However, EMA’s can be incorporated into the market exit strategy as well. Trader buy on a return to bullish momentum therefore, traders should close positions when momentum subsides. This can be found in an uptrend when price moves back and touches the 12 period EMA.

Stops should also be placed when trading with the trend. One simple methodology is to place stops under a swing high or low on the graph. This way if the trend turns, any positions can be exited for a loss as quickly as possible. The chart below exhibits this technique using a portion of the trade example above.

EUR/USD exits:

EMA Trading: A Summary

EMA’s are versatile in that the can be used to identify trend, entries and exit points. This provides a complete trade process for traders looking for a simple trend trading system. The EMA is often seen as complex in nature however, the above article shows how simple and effective this indicator can be for both novice and experienced traders alike.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals