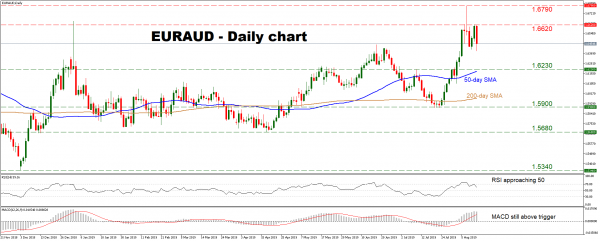

EURAUD posted substantial losses in recent days, after touching a 10-year high of 1.6790 last week. Despite this pullback though, the medium-term uptrend is still in play, with a clear break back below 1.6230 and the 50-day simple moving average (SMA) needed to call that into question.

Momentum oscillators suggest that the latest retreat may continue for now. The RSI is pointing lower and may test its 50 line soon, while the MACD seems to be coming closer to its red trigger line.

If the bears remain in the driver’s seat, the crossroads of the 1.6230 zone and the 50-day SMA may be the first support barrier. A move below that area would paint a more neutral bias, shifting the focus to the 200-day SMA, currently at 1.5976. Further down, the 1.5900 handle may provide a stronger obstacle.

On the other hand, if the bulls retake control then the 1.6620 hurdle may come back into play, with an upside break opening the way for another test of 1.6790, the 10-year high.

In short, the big picture remains positive as long as the price remains above 1.6230 and the 50-day SMA.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals