The Dark Cloud Cover pattern is used by many traders to spot reversals in the market and achieve favorable risk to reward ratios. It is fairly easy to spot, however, traders need to view the formation of the Dark Cloud Cover candlestick in conjunction with other crucial factors and avoid simply trading as soon as the pattern appears.

The Dark Cloud Cover is a type of forex candlestick, and before continuing, readers should ensure they have a good grasp on how to read a candlestick chart.

This article will cover the following:

- What is a Dark Cloud Cover pattern?

- How to identify a Dark Cloud on forex charts

- How to trade using the Dark Cloud Cover

- Advantages and limitations

How well do you know your trading patterns? Test yourself with our interactive forex trading patterns quiz

What is a Dark Cloud Cover Pattern?

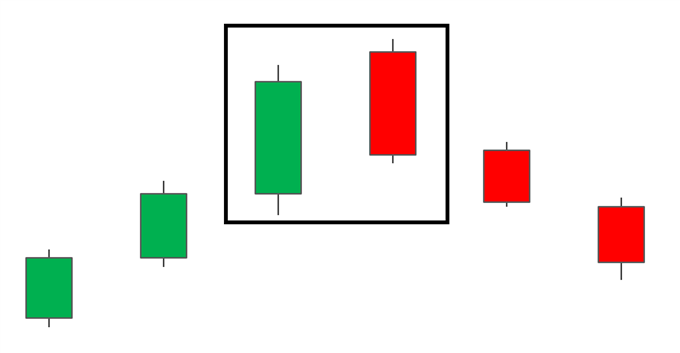

The Dark Cloud Cover pattern is a candlestick pattern that signals a potential reversal to the downside. It appears at the top of an uptrend and involves a large green (bullish) candle, followed by a red (bearish) candle that creates a new high before closing lower than the midway point of the previous green candle.

This candle formation, although very similar, should not be confused with the Bearish Engulfing candle pattern. Both patterns signal a potential trend reversal but the Dark Cloud Cover offers more attractive entry levels due to a higher close of the bearish candle than that observed with the bearish engulfing candle pattern.

How to identify a Dark Cloud on Forex Charts

Dark Cloud Cover checklist:

- Identify existing uptrend.

- Look for signals that momentum is slowing/reversing (stochastic oscillators, bearish moving average crossover, or subsequent bearish candle formations).

- Stocks will gap up, with the red candle opening above the previous green candle however, this is very rarely found in forex candlesticks as these candles will mostly open at the same level as the prior candle’s close, or very close to it.

- Ensure that the red candle closes lower than the midway point of the previous green candle.

- Look for confirmation of the new downward trend

How to trade using the Dark Cloud Pattern

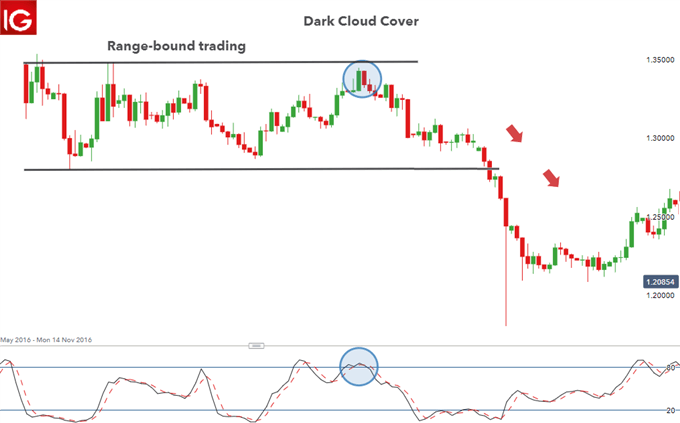

Traders can look to trade more traditional trending markets such as the GBP/USD or EUR/USD, but can also incorporate Dark Cloud Cover technical analysis in ranging markets.

Trending markets

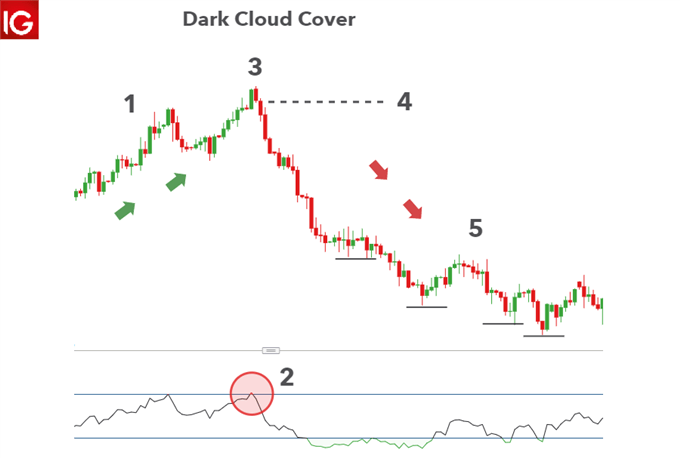

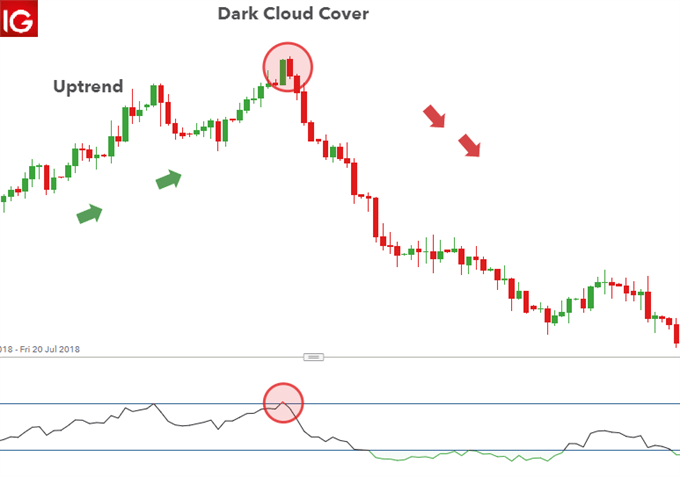

Below is an example of the Dark Cloud Cover pattern in forex, specifically, the GBP/USD forex pair. Refer to the chart for more information.

This Dark Cloud Cover checklist can be used to analyze a potential trade:

- The existence of higher highs and higher lows presents us with an uptrend.

- On the chart, one can observe that the market had started to move more sideways as the latest upward move initially moved sideways and when it did move up, this was not as sharp a move as previously observed. Furthermore, the RSI moved into overbought territory providing a greater level of conviction to the trade.

- The red candle gaps slightly above the previous green candle. In the forex market the candle will mostly open at the same level as the previous close.

- The red bearish candle proceeds lower and closes below the midway point of the bullish candle, showing that the bears are outweighing the bulls at that level.

- Confirmation of continued selling (downward pressure) is seen in the very next candle and subsequent candles after that. Lower highs and lower lows then provide the evidence that the market had reversed successfully, and a downtrend was established.

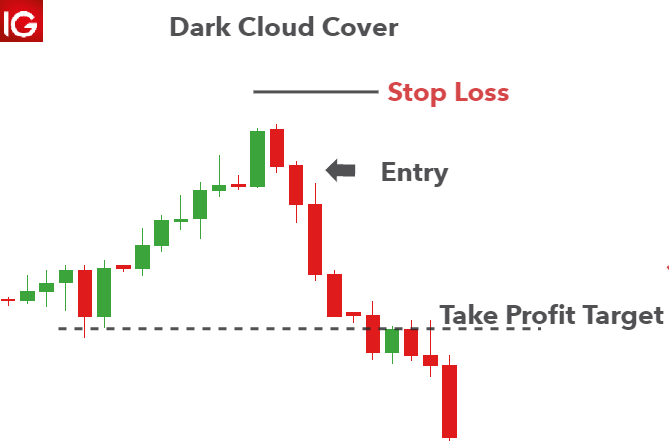

Entry levels, targets and stops can be easily identified when taking a look at the zoomed in chart below. The entry can be placed at the open of the next candle, after the Dark Cloud Cover pattern has formed.

Stops can be placed above the recent swing high and the initial target level can be set at key levels or recent areas of support/resistance. It is worth noting that because the trade is potentially the starting point of an extended move down, traders can set multiple target levels.

Learn more about trading with support and resistance.

Ranging markets

A similar strategy can be applied in a ranging market where price tends to ‘bounce’ between support and resistance. The below example shows a period of consolidation in GBP/USD when it was clearly not trending in any direction. The Dark Cloud Cover pattern appearing near resistance provides a short signal and should there be enough momentum, could turn into a breakout trade – as it did in this example.

Advantages and limitations of the Dark Cloud

The validity of the Dark Cloud, like all other candlestick patterns, depends on the price action around it, indicators, where it appears in the trend, and key levels of resistance. Below are some of the advantages and limitations of this pattern.

|

Advantages |

Limitations |

|

Attractive entry levels as the pattern appears at the start of a potential downtrend |

Should not be traded based on its formation alone |

|

The Dark Cloud Cover can offer a more attractive risk to reward ratio when compared to the Bearish Engulfing pattern |

Where the pattern occurs within the trend is crucial. Must appear at the top of an uptrend |

|

Easy to identify for novice traders |

The Dark Cloud Cover candle requires an understanding of supporting technical analysis or indicators. Popular: Stochastics and RSI |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals