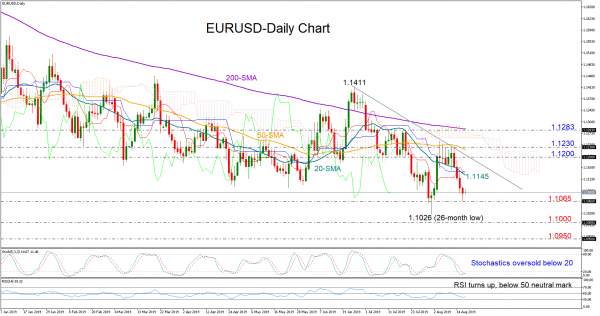

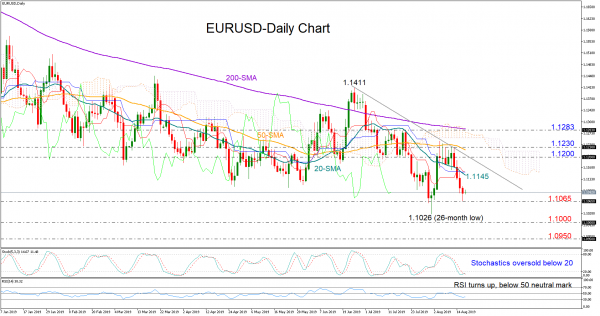

EURUSD surrendered most of its monthly gains and dropped below 1.1100 after finding a wall around the 50-day simple moving average (SMA) and the 1.1230-1.1250 area.

Technically, the price could pause negative momentum in the very short-term as the Stochastics signal oversold conditions. The RSI seems to be easing downside movement as well, though as long as it holds under its 50 neutral-mark, any upside correction in the price is likely to appear insignificant. Note that the red Tenkan-sen reversed back south after jumping above the blue Kijun-sen, alleviating hopes for a meaningful rally.

The 1.1000-1.0950 region will come into focus if the market closes decisively below 1.1065, while lower another key support to watch is 1.0830.

In case the pair bounces above the 20-day SMA (1.1145), the spotlight will turn straight to the tentative descending line drawn from the 1.1411 peak. If the bulls manage to break that border (1.1200) and clear the 1.1230 resistance, the way would open towards the 200-day SMA currently at 1.1283.

Meanwhile in the medium-term (three-month picture), EURUSD is slightly bearish as it trades a touch below the lower boundary of the 1.1100-1.1411 range zone.The downward-sloping 50- and the 200-day SMAs reduce the odds for a brighter outlook.

In brief, EURUSD could face limited upside pressures in the short-term, while in the medium-term the sentiment is likely to stay negative.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals