Make the Most of the Weekend to Improve Your Trading

One of the greatest aspects of the FX market is that it is a true 24-hour a day market; however, this does not extend to weekends. While there are a handful of markets to trade during the weekend, forex traders are better off using this time to educate themselves, spend time researching and manual back-testing, as well as, strategizing for the week ahead.

This article covers the following:

- Why trading is closed over the weekend

- Weekend trading opportunities

- What DailyFX traders do at the weekend

- Further reading to improve your forex trading

Why is trading closed over the weekend?

Trading the forex market is closed on the weekends because institutional forex traders and large banks (the buyers and sellers of foreign exchange) operate during working hours in the week and take time off on weekends. Most jobs operate in this manner and the forex market is no different. However, just because the forex market is offline, it doesn’t mean you have to be. The weekend presents a great opportunity for traders to learn, reflect and plan for the upcoming trading week.

When preparing for the week ahead, it is essential for traders to know when each of the major trading sessions come online, as each session has its own characteristics that need to line up with your trading strategy.

Major forex trading sessions:

|

Session |

Major Market |

Time (GMT) |

|

US |

NEW YORK |

13:00 – 22:00 |

|

ASIAN |

TOKYO |

00:00 – 09:00 |

|

EUROPEAN |

LONDON |

08:00 – 17:00 |

Weekend Trading Opportunities: Boost your Knowledge and Plan Your Trades

1) Explore free forex trading education

This is one of the more common ways to spend trading time over weekends when most FX brokers are closed for trading. While the markets may be closed, there is a wealth of online educational content that allows traders to access materials for weekend study.

DailyFX has a whole host of free educational material for all types of traders. Some of these include:

2) Make the Most of Your Trading Platform

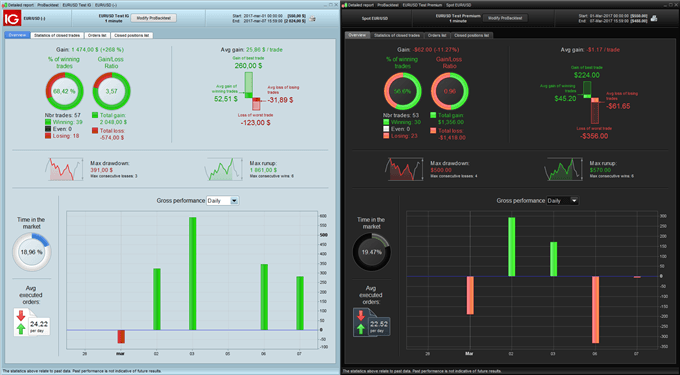

Weekends are the ideal time to learn the ins and outs of a trading platform and find out how your chosen platform can assist your trading. A selection of advanced trading platforms allows traders to analyze a number of different strategies, applied to past data, for a better understanding of how these strategies would have played out. This process is called back-testing and is an excellent way of testing a strategy before employing it in live conditions.

The process of back-testing involves the selection of an earlier date and time on the chart (to a period in which you are unfamiliar with price action), ‘locking the view’ and analyzing the detailed report afterwards to gauge how well the strategy would have done.

Popular platforms with this capability include ProRealTime and MT4 charting packages. Below is an example of the back-test function on the advanced charting package, ProRealTime:

It must be mentioned that just because a strategy performed in a particular manner in the past, doesn’t mean that it will perform in that way in the future. The goal of back-testing is to simulate how a strategy would have played out and observe the variability of expected vs actual results of the strategy.

This is perfect to do when the market isn’t actually moving, allowing traders an environment to better manage the emotions of trading.

3) Strategize for the Week Ahead

One of the benefits of trading being closed is the fact that it allows traders to take a step back to evaluate the week that has just passed. This can be a phenomenal time to account for the week’s trading activities and update your trading journal.

Many traders following a trading plan may use this time to review, edit, and modify their plans based on recent observations. If you don’t yet have a trading plan, the weekend can be a great time to build one.

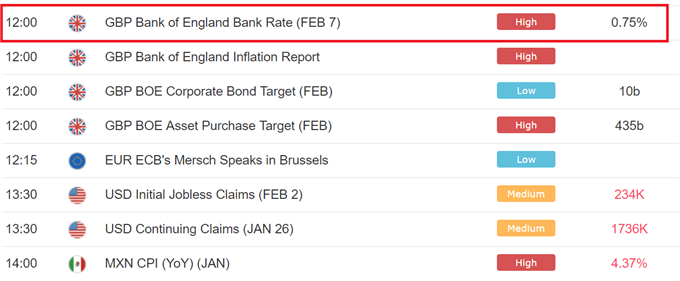

For traders that are already comfortable with their plan, they can look to the week ahead to focus their approach, given the expected economic data releases. The DailyFX economic calendar allows for traders to organize events based on release date, importance, and currency pair.

Example of the DailyFX Economic Calendar

The economic calendar is available 24/7, meaning traders can strategize for the week ahead even when the market is closed.

What do DailyFX Traders Do Over the Weekends?

Below are some top tips and advice from our analysts on how to be productive over the weekends:

Paul Robinson –

“It’s important for traders to enjoy the weekend downtime, but it’s also important to carve out some of the quiet time for review of the prior week’s activity. Review your trade history; make notes on the good and the bad. Make sure your pending ideas are well formulated and trigger levels clearly in place in time for market open.”

James Stanley –

“Weekends are key for FX traders, there are no prices moving and there’s no need to react. FOMO is at a minimum because there’s simply nothing to do, and this can be a good time to manually back-test or even just read a new book on a new concept, make some tweaks to the trading plan or plot the week ahead.”

Michael Boutros –

“For the most part, weekends are time to step away from the charts and reset. Sunday evenings are a time for reflection and planning, studying price-action and coming up with a game-plan. I use this time to fine-tune my charts and consider the setups I want to actively track throughout the upcoming week; and have my levels and trade ideas planned out and ready to go.”

Further reading to Improve Your Forex Trading

- It’s often easier to remain calm when prices aren’t ticking, however, active traders need this calm state of mind when the market is moving. Learn how to manage the emotions of trading.

- One market that is open on the weekend is Bitcoin. However, Bitcoin has proven to be very volatile, so it’s essential for new traders to read the introduction to Bitcoin trading to understand the basics of the cryptocurrency.

- Weekends are meant for research, so why not read through our Traits of Successful Traders research to find out the number one mistake traders make

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals