Yen weakens broadly today following recovery in major treasury yields, as a sign of stabilization in sentiments. Most notably, German 10-year yield closed above -0.6% at -0.585, while US 10-year yield closed above 1.6% at 1.622. Australian Dollar is currently the second weakest, after poor business condition and confidence data. Canadian Dollar is the third weakest. On the other hand, New Zealand Dollar is the strongest for now, followed by Sterling and Swiss Franc.

Technically, further rise is expected in Yen crosses in general. But current rebound in USD/JPY, EUR/JPY and GBP/JPY are seen as corrective. Thus, we’ll look for signs of loss of momentum ahead. Meanwhile, there could also be more upside in Sterling should today’s job data beat expectations again, just like yesterday’s GDP data. 0.8891 cluster support in EUR/GBP is the key to confirm underlying momentum in the Pound. We’d remain skeptical if this cluster support is not taken out decisively.

In Asia, Nikkei closed up 0.29%. Hong Kong HSI is up 0.04%. China Shanghai SSE is down -0.19%. Singapore Strait Times is up 0.39%. Japan 10-year JGB yield is up 0.0332 at -0.222. Overnight, DOW rose 0.14%, S&P 500 dropped -0.01%. NASDAQ dropped -0.19%. 10-year yield rose 0.072 to 1.622. 30-year yield rose 0.078 to 2.098.

US Mnuchin: Currency manipulation is a focus in upcoming China trade talk

US Treasury Secretary Steven Mnuchin said currency manipulation will be a focus in the upcoming trade talk with China. He said yesterday that “I expect the governor of the People’s Bank of China to come over for these talks… So part of the conversations we will be having with them is around currency and currency manipulation.”

He added that “If the RMB depreciates 15 percent and you put on a 15 percent tariff, that means that U.S. companies can buy in dollars items 15 percent cheaper. So the fact that they buy things 15 percent cheaper means that China is paying for indeed the tariff”. And, “it really is simple math with depreciation of the RMB.”

Separately, Mnuchin also told Fox yesterday that there was a “conceptual” agreement on enforcement of the agreement. “They’re coming here. I take that as a sign of good faith that they want to continue to negotiate, and we’re prepared to negotiate,” Mnuchin said.

UK Johnson pledges no further Brexit delay after another Commons defeat

UK Prime Minister Boris Johnson suffered his sixth consecutive defeat at the Commons yesterday. His second call for snap election was also rejected as widely expected. The Commons is now suspended for five weeks.

At the same time, Johnson pledged after the vote that “this government will press on with negotiating a deal, while preparing to leave without one,” referring to Brexit. And, “I will go to that crucial summit in Brussels on Oct. 17, and no matter how many devices this Parliament invents to tie my hands, I will strive to get an agreement in the national interest.”

Johnson also insisted “this government will not delay Brexit any further.” That even the Parliament has passed a law that requires Johnson to seek Brexit delay from October 31 if he couldn’t get a deal.

Australia NAB business condition and confidence dropped

Australia NAB Business Confidence dropped to 1 in August, down from 4. Business Condition dropped to 1, down from 3. Both readings are well below long-run averages. And the outcome suggests that “momentum in the business sector continues to weaken, with both confidence and conditions well below the levels seen in 2018”. NAB added that the results are “in line with the weak outcome for the private sector in the Q2 national accounts, prompting us to review our outlook for interest rates”.

Elsewhere

Japan M2 rose 2.4% yoy in August, matched expectations. China CPI was unchanged at 2.8% yoy in August, above expectations of 2.6% yoy. PPI dropped further to -0.8% yoy, down from -0.3% yoy, but beat expectations of -0.9% yoy. Looking ahead, UK employment data will be a major focus in the European session. Later in the day, Canada will release housing starts and building permits.

USD/JPY Daily Outlook

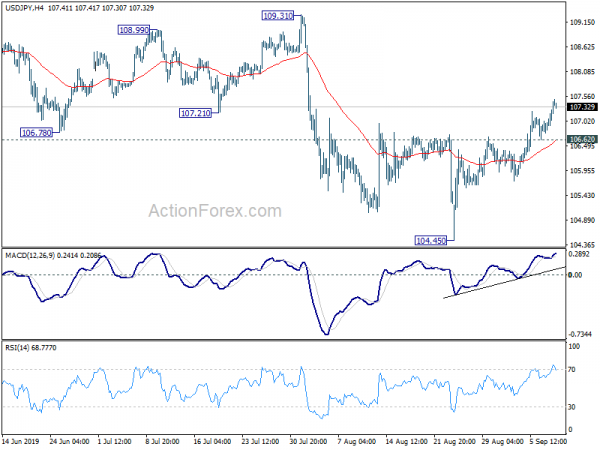

Daily Pivots: (S1) 106.90; (P) 107.09; (R1) 107.41; More…

USD/JPY’s rebound from 104.45 extends higher to 107.49 so today. Intraday bias remains on the upside. Sustained trading above 55 day EMA (now at 107.17) will pave the way to 109.31 key resistance. On the downside, break of 106.62 minor support will turn bias back to the downside for retesting 104.45 low instead.

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Firm break of 104.69 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. In any case, break of 109.31 resistance is needed to be the first sign of medium term bottoming. Otherwise, further decline will remain in favor in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Aug | 2.40% | 2.40% | 2.40% | 2.30% |

| 1:30 | CNY | CPI Y/Y Aug | 2.80% | 2.60% | 2.80% | |

| 1:30 | CNY | PPI Y/Y Aug | -0.80% | -0.90% | -0.30% | |

| 1:30 | AUD | NAB Business Confidence Aug | 1 | 4 | ||

| 1:30 | AUD | NAB Business Conditions Aug | 1 | 2 | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Aug P | -37.10% | -33.00% | ||

| 8:30 | GBP | Jobless Claims Change Aug | 29.3K | 28.0K | ||

| 8:30 | GBP | Claimant Count Rate Aug | 3.20% | |||

| 8:30 | GBP | ILO Unemployment Rate 3Mths Jul | 3.90% | 3.90% | ||

| 8:30 | GBP | Average Weekly Earnings 3M/Y Jul | 3.70% | 3.70% | ||

| 8:30 | GBP | Weekly Earnings ex Bonus 3M/Y Jul | 3.80% | 3.90% | ||

| 10:00 | USD | NFIB Small Business Optimism Aug | 103.5 | 104.7 | ||

| 12:15 | CAD | Housing Starts Aug | 213K | 222K | ||

| 12:30 | CAD | Building Permits M/M Jul | 2.10% | -3.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals