The Double Bollinger Band® strategy has a wide variety of applications but provides the most value when assessing the momentum and volatility of price action. It allows traders to pinpoint entries and exits as well as identify when a trend is maintaining or losing momentum.

Keep reading to discover:

- What is a Double Bollinger Band® strategy?

- How to trade forex with Double Bollinger Bands®

- Advantages and limitations of a Double Bollinger Band® strategy

- Further reading on Bollinger Bands®

This article assumes the reader has a basic understanding of Bollinger Bands®. If you’d like a refresher, read our guide to Bollinger Bands® in forex trading.

What is a Double Bollinger Band® Strategy?

The Double Bollinger Band®Strategy makes use of two Bollinger Bands®in order to filter entries and exitsin the forex market. The strategy aims to enter long (short) trades when price breaks above (below)one standard deviation. The strategy can be applied to ranging markets, as a breakout strategy or when assessing the momentum/slowdown of an existing trend.

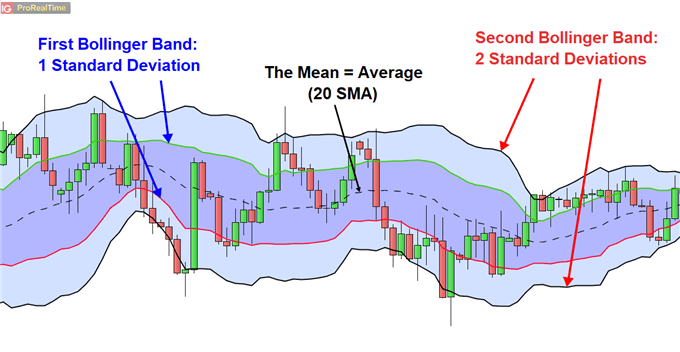

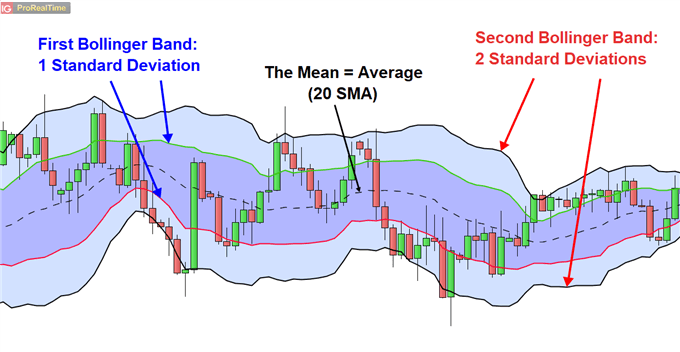

Add the following indicators to the desired market/security:

- Default Bollinger Band® (20 2). The first number relates to the simple moving average and the second, to the number of standard deviations from the mean/average.

- A second Bollinger Band® (20 1). Select the default 20 SMA but this time use the setting with only one standard deviation.

Before getting into the strategy, it is crucial to understand how to interpret the chart below as there is a lot to take in.

Dissecting the chart is easiest to do by starting at the middle and working our way outwards. The dotted line in the middle is the moving average. Then moving out in both directions, the green and red lines represent the single standard deviation, while the outermost lines (in black) represent the two standard deviations.

Statistically speaking, 95% of the observed candles should be contained within the two standard deviations, meaning traders will witness price moving within or across the various segments, triggering many signals.

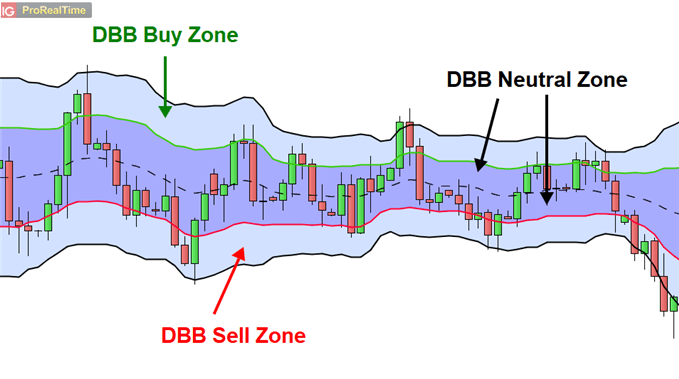

The Double Bollinger Band® strategy incorporates three different zones.

- Double Bollinger Band® (DBB) Buy Zone: This is the light blue area between the first standard deviation and the double standard deviation that is found above the 20 SMA. Presents a buy signal.

- DBB Neutral Zone: This is the purple area between the upper and lower, single, standard deviation. Price trading in this area could be indicative of a choppy market that lacks a directional bias. Trend traders are to avoid taking new positions in this zone. Signals a slow- down in momentum or the beginning of a ranging market.

- DBB Sell Zone: This is the light blue area between the single standard deviation and the double standard deviation that is found below the 20 SMA. Presents a sell signal.

All three zones can be seen in the chart below:

How to Trade Forex with Double Bollinger Bands®

The two main strategies to employ using Double Bollinger Bands® involve breakouts and trend trading and will be explored below.

Double Bollinger Band® Breakout Strategy

The Double Bollinger Band® strategy can be applied when trading breakouts of an existing trading range by observing a break above/below the range; combined with a strong break into the DBB buy zone or DBB sell zone. Witnessing strong breaks provide a greater bias in favour of the breakout as traders look to avoid a false breakout.

Below is an example of a Double Bollinger Band® breakout scenario in the EUR/GBP chart. Towards the end of the range there is a break above the upper band of the single, standard deviation (green line) however, price hadn’t moved high enough to break out of the range. Traders should be looking for price to break out of the range and into the DBB buy zone, with strong momentum.

When looking for further confirmation, traders can view that the break occurs during a new expansion of the Bollinger Bands®, after a period of relatively low volatility (contracting Bollinger Bands®).

The large green candle, pointed out below, provides the necessary confirmation of a breakout and presents a strong buy signal. To mitigate risk, traders can place stops at the 20 SMA with targets set at key levels of resistance all while maintaining a positive risk to reward ratio.

RECOMMENDATIONS

We have created innovative HIGH GAIN PROFIT robot. We recommend our BEST ROBOT FOREXVPORTFOLIO v11, which is already being used by traders all over the world, successfully making unlimited profits over and over again.

For beginners and experienced traders!

You can WATCH LIVE STREAMING with our success forex trading here

Double Bollinger Trend Trading Strategy

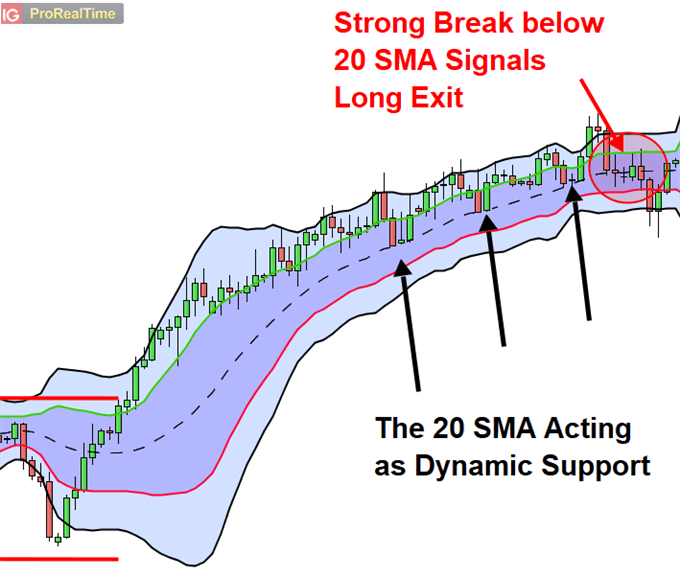

The Double Bollinger Band® trend trading strategy allows traders to assess the momentum of an existing trend. It allows traders to exit on a slow-down or add to existing positions when momentum and volatility increase.

The example below takes a look at the same EUR/GBP chart after the breakout where the currency pair began trending. Price broke above the upper band of the single standard deviation and even breached the upper band of the uppermost line – representing two standard deviations.

Such momentum and volatility in the DBB buy zone presents a buy signal and the Double Bollinger Band® can be used to track the progress of this new uptrend.

As long as price remains between the buy zone and the 20 SMA (dotted mid-line), traders can maintain the long bias. The exit point can either be on a close below the mid line or a breach of the neutral zone into the DBB sell zone, depending on the level of risk tolerance. Those using the mid-line as a stop can manually move their stops along the 20 SMA as price rises.

Advantages and Limitations of a Double Bollinger Band® Strategy

There is no such thing as a strategy that works all of the time. Bearing this in mind, traders should be aware of the advantages and limitations of the Double Bollinger Band® strategy.

Advantages | Limitations |

Low volatility often precedes bigger moves. Having a double Bollinger Band allows traders to assess the degree of volatility when analyzing a potential trade | Large moves into the buy and sell zone can reverse. Hence, risk management is key |

Clear entry and exit signals | |

Easy to identify the momentum of current trend |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals