EUR/USD recovered recently above the 1.1025 resistance level and it might continue to rise. USD/CHF is currently consolidating and it seems like it is sighting an upside break above 0.9940.

Important Takeaways for EUR/USD and USD/CHF

- The Euro is showing a lot of positive signs above the 1.1040 level against the US Dollar.

- There was a break above a key bearish trend line with resistance near 1.1045 on the hourly chart of EUR/USD.

- USD/CHF is facing a strong resistance near the 0.9940 and 0.9950 levels.

- There are two bullish trend lines forming with support near 0.9920-0.9930 on the hourly chart.

EUR/USD Technical Analysis

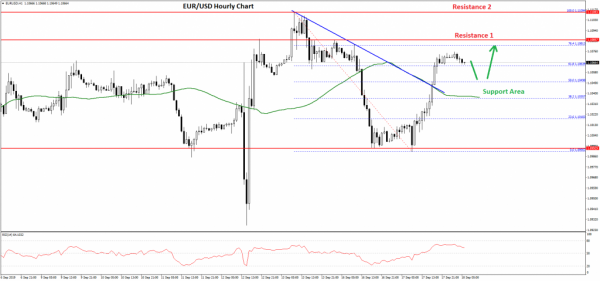

After a sharp decline, the Euro found support near the 1.1000 area support against the US Dollar. The EUR/USD pair traded as low as 1.0990 on FXOpen and recently started a solid recovery.

The pair broke the 1.1025 and 1.1040 resistance levels to start a decent recovery. Moreover, there was a break above the 1.1050 resistance and the 50 hourly simple moving average.

During the rise, there was a break above a key bearish trend line with resistance near 1.1045 on the hourly chart of EUR/USD. The pair even surpassed the 61.8% Fib retracement level of the last decline from the 1.1109 high to 1.0990 low.

At the moment, the pair is consolidating gains above the 1.1060 support level. If there is a downside correction, the pair could test the 1.1040 support level. The main support is near the 1.1035 level and the 50 hourly SMA.

On the upside, an immediate resistance is near the 1.1080 level. The 76.4% Fib retracement level of the last decline from the 1.1109 high to 1.0990 low is also near the 1.1080 level.

Therefore, an upside break above the 1.1080 and 1.1085 levels will most likely open the doors for more gains. The next key resistances are near 1.1100 and 1.1110, followed by 1.1140.

USD/CHF Technical Analysis

The US Dollar started a nice upward move from the 0.9850 support area against the Swiss franc. The USD/CHF pair broke the 0.9880 and 0.9900 resistance levels to move into a bullish zone.

Moreover, the pair settled above the 0.9900 level and the 50 hourly simple moving average. It traded as high as 0.9968 and recently started a downside correction. It tested the 0.9920 level and it is currently trading in a range.

On the upside, there is a strong resistance forming near the 0.9940 and 0.9950 levels. The 50% Fib retracement level of the last decline from the 0.9968 high to 0.9920 low is also near 0.9945.

If there is an upside break above 0.9940 and 0.9950 resistance levels, the price could jump towards the 0.9980 and 1.0000 levels. An immediate resistance could be 0.9960 or the 76.4% Fib retracement level of the last decline from the 0.9968 high to 0.9920 low.

On the downside, there are many supports above the 0.9920 level. Additionally, there are two bullish trend lines forming with support near 0.9920-0.9930 on the hourly chart.

If there is a downside break below both trend lines, the pair might even break the 0.9920 support. The next major support is near the 0.9900, below which USD/CHF could continue to decline towards the 0.9850 support area in the near term.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals