The forex markets are trephining in rather tight range today. Dollar turned mixed overnight after poor ISM manufacturing data. Chance of another Fed cut in October, as priced in by fed fund futures, rose to 63.1%. But outlook could change drastically with upcoming data, including ADP jobs today, ISM services tomorrow and non-farm payrolls on Friday. The greenback remains the third strongest for the week for now, following Canadian and then Yen. Australian Dollar remains the weakest, followed by New Zealand.

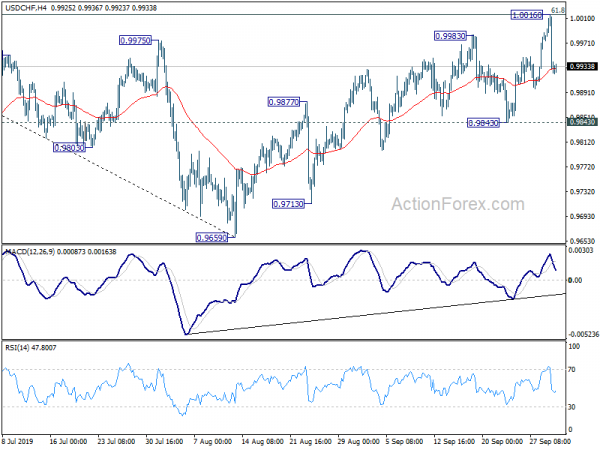

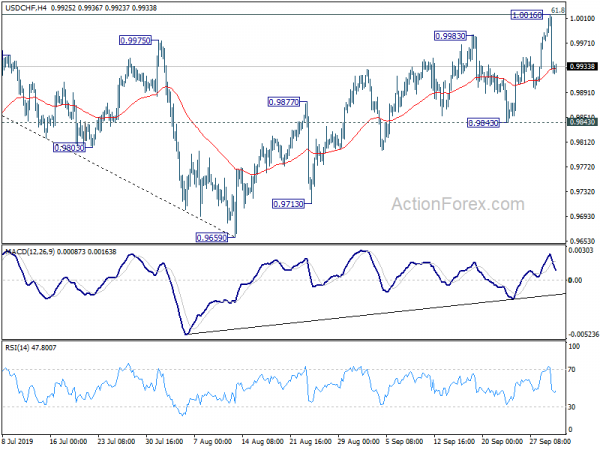

Technically, Swiss Franc is one that’s worth a watch today. Intraday bias in USD/CHF turned neutral after yesterday’s sharp retreat. But rebound from 0.9659 is still in favor to continue as long as 0.9843 support holds. EUR/CHF’s recovery could have completed at 1.0921 already and focus is back on 1.0811 low. EUR/USD, on the other hand, has formed a temporary low and some consolidation is likely for today. AUD/USD recovers mildly after breaching 0.6677 low. But as long as 0.6739 minor resistance holds, medium term down trend is on track to resume.

In Asia, currently, Nikkei is down -0.58%. Hong Kong HSI is down -0.27%. China is still on holiday. Singapore Strait Times is down -1.01%. Japan 10-year yield is down -0.0044 at -0.155. Overnight, DOW dropped -1.28%. S&P 500 dropped -1.23%. NASDAQ dropped -1.13%. 10-year yield dropped -0.031 to 1.644.

ECB Draghi: Fiscal and monetary policy together would lead to faster return to price stability

Outgoing ECB President Mario Draghi called for euroarea-wide fiscal stimulus aimed at boosting investment. He said yesterday in Athens “fiscal policy playing a more supportive role alongside monetary policy would lead to a faster return to price stability and therefore fewer side effects.”

And, “fiscal policy becomes more powerful when monetary policy is close to the effective lower bound, as the multipliers are higher.” “Supportive fiscal policy can complement monetary policy in cutting through the obstacles that are weighing on demand — which is the case in the euro area today”.

He added, “if fiscal and structural policies also play their role in parallel — and more so than we see today — the side effects of monetary policy will be less, and the return to higher rates of interest will be faster.”

UK Johnson to unveil final compromise Brexit proposal today

UK Prime Minister Boris Johnson is set to address the Conservative Party’s annual conference today. There, he’s expected to present a “fair and reasonable compromise” offer on Brexit for EU. His office reiterated that “the prime minister will in no circumstances negotiate a delay” beyond October 31, if the final proposal is not accepted.

What Johnson would offered is reported to be a new “two borders for four years” plan which will leave Northern Ireland in a special relationship with Europe until 2025. It’s reported that Northern Ireland’s Democratic Unionist party (DUP) is largely “content” with the proposals. However, Ireland’s Foreign Minister Simon Coveney said the proposals would not provide the basis for a deal with the European Union and are “concerning.”

UK BRC shop price dropped -0.6%, falling demand squeezes retailers’ tight margin

UK BRC Shop Price Index dropped -0.6% yoy in August. BRC Chief Executive Helen Dickinson OBE said: “While consumers may welcome lower prices, falling consumer demand is squeezing retailers’ already tight margins. With business costs continuing to rise – including business rates, wage bills, and pension costs – the high street risks more big name closures. Reform of business rates remains the most effective way Government can support the retail industry – and they should grasp the opportunity with both hands.”

Mike Watkins, Head of Retailer and Business Insight, Nielsen: “With consumers feeling uncertain about spending, retailers continue to focus on limiting price increases coming through the supply chain. Prices have fallen in non foods helped by seasonal reductions and many food retailers have introduced price cuts to help regain momentum after a challenging summer. Competition for discretionary spend will intensify across all channels as we head towards the end of the year and we anticipate more promotional savings for shoppers and inspiring media campaigns that help to drive incremental sales.”

ISM manufacturing dropped to 47.8, lowest in a decade

US ISM Manufacturing Index dropped to 47.8 in September, down from 49.1 and missed expectation of 50.4. That’s also the worst reading in a decade since June 2009. Only one of the components, supplier deliveries was in expansion at 51.1. New orders rose 0.1 to 47.3. Production dropped -2.2 to 47.3. Employment dropped -1.1 to 46.3. Prices rose 3.7 to 49.7.

Looking ahead

Swiss will release CPI in European while UK will release PMI construction. But main focus would be on US ADP employment later in the day.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9896; (P) 0.9957; (R1) 0.9990; More…

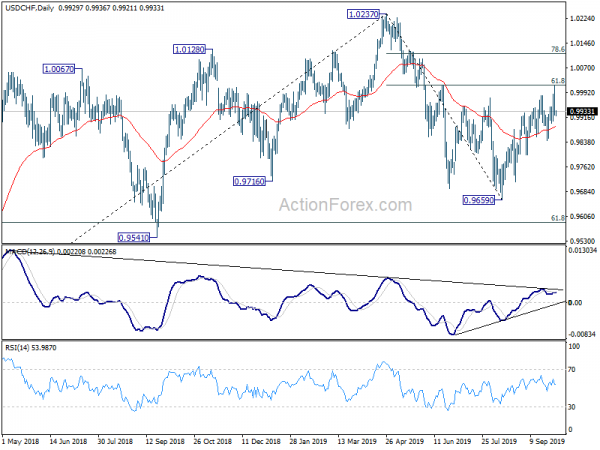

USD/CHF formed a temporary top at 1.0016 after hitting 61.8% retracement of 1.0237 to 0.9659 at 1.0016, and retreated sharply. Intraday bias is turned neutral for some consolidations first. But outlook stays mildly bullish as long as 0.9843 support holds. Further rally is still expected. On the upside, break of 1.0016 will target 78.6% retracement at 1.0113 next. However, on the downside, firm break of 0.9843 will indicate near term reversal and turn outlook bearish for 0.9659 low.

In the bigger picture, the structure of the fall from 1.0237 suggests that it’s a corrective move. Sustained break of 0.9975 will argue that such correction has completed at 0.9659, ahead of 61.8% retracement of 0.9186 to 1.0237 at 0.9587. But decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, medium term outlook will stay neutral first. Meanwhile, break of 0.9695 support will extend the correction to 0.9541 support instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | GBP | BRC Shop Price Index Y/Y Aug | -0.60% | -0.40% | ||

| 23:50 | JPY | Monetary Base Y/Y Sep | 3.00% | 3.40% | 2.80% | |

| 05:00 | JPY | Consumer Confidence Index Aug | 38.2 | 37.1 | ||

| 06:30 | CHF | CPI M/M Sep | 0.10% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y Sep | 0.30% | 0.30% | ||

| 08:30 | GBP | Construction PMI Sep | 45 | 45 | ||

| 12:15 | USD | ADP Employment Change Sep | 140K | 195K | ||

| 14:30 | USD | Crude Oil Inventories | 2.4M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals