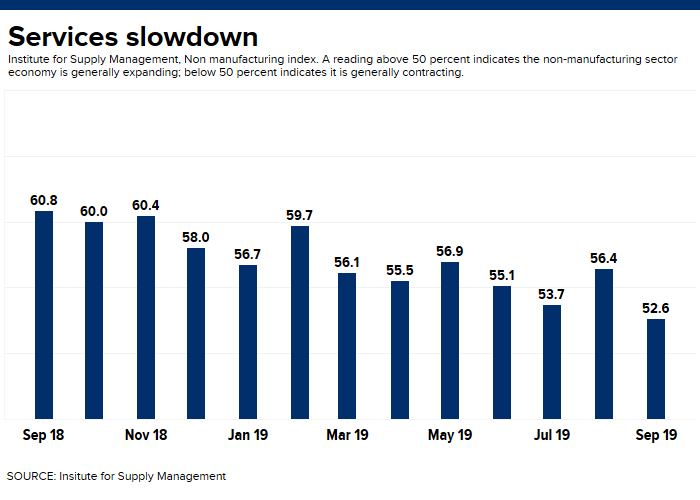

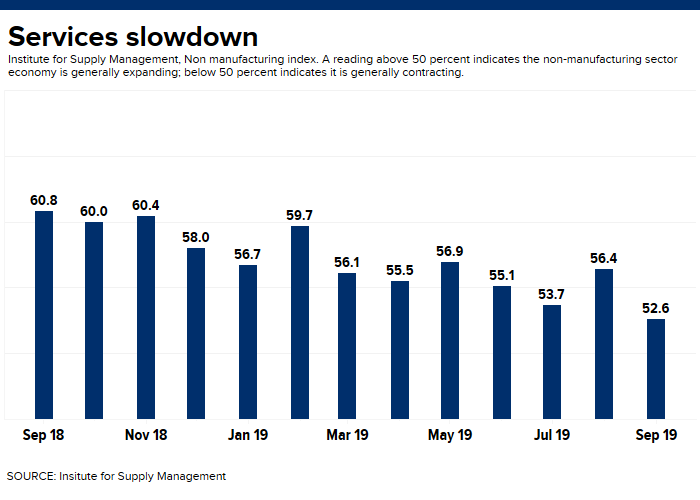

The services sector continued its expansion in September but at a considerably slower pace than expected, according to the ISM Non-Manufacturing Index released Thursday.

The closely watched measure came in at 52.6, compared with an expected reading of 55.3 from economists surveyed by Dow Jones. It was the weakest reading since August 2016.

Markets initially sold off sharply following the news, with the Dow Jones Industrial Average down as much as 300 points before erasing losses.

ISM officials said the overall weakness arose from fears over tariffs, labor resources and the general direction of the economy. The news comes just two days after the ISM’s companion manufacturing index also showed substantial weakness.

“Net, net, look out below is what purchasing managers from services industries are shouting at the markets as the fears of recession continue to mount,” Chris Rupkey, chief financial economist at MUFG, said in a note. “Stock investors don’t like that the doom and gloom in the manufacturing sector is starting to infect the bigger part of the economy that employs millions of workers in services industries including health care, retailing, business administration, accounting, computer services on and on.”

The survey gauges the percentage of companies expecting to expand their businesses. Anything above 50 represents growth; a reading above 48.6 has been consistent with broader economic growth.

The report comes amid worries that the U.S. economy faces a recession as global growth slows and tariffs put a dent in business plans to expand. For example, CNBC’s All-America Economic Survey on Thursday found that just 23% of Americans believe the economy will improve in the next year, the lowest level of optimism in three years.

Market anticipation for Fed interest rate cuts also reacted sharply to the report and were fully pricing in another quarter-point move lower at the Federal Open Market Committee meeting Oct. 29-30.

In Tuesday’s report, the ISM Manufacturing Index for September reading was 47.8, its worst showing since June 2009, just as the Great Recession was ending. Thursday’s nonmanufacturing reading shows the weakness appears to be bleeding into the broader economy even though manufacturing represents just 11.3% of U.S. economic activity.

Weakness in the nonmanufacturing survey was broad-based.

New orders plunged to 53.7, 6.6 points lower than the August reading, while employment slipped from 53.1 to 50.4, its worst February 2014. Prices increased to 60 from 58.2.

Should the payroll weakness continue, it would be “consistent with payroll growth of just [50,000] or so in a couple months time,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note. “The bad news is that the survey has overstated job growth for most of this year, and if that persists, then zero payroll readings are not far off.”

Individual ISM respondents had varying takes on business conditions.

“While Chinese tariffs are understandable, they are impacting our supply chain decisions,” said one survey respondent in the “other services” category. “We are actively pursuing alternate sources for our China-based production. At this point, we have not passed on tariff costs to our customers, but we are evaluating all options.”

Five sub-indexes in the survey showed growth from August while five declined. The biggest expansion came in order backlogs, which rose 5 points, from a contracting 49 to an expanding 54. New export orders rose 1.5 points to 52.

At an industry level, 13 reported growth while four saw declines.

Other comments were less negative.

A respondent in construction reported being “very busy” and “shorthanded” regarding labor, while a finance and insurance industry participant indicated being “on track to end the year generally as anticipated, considering interest-rate changes, trade and tariff issues and other economic indicators and trends.”

Join to ourTrading at home group

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals