Sterling rebounds strongly as news emerged that UK Prime Minister Boris Johnson’s new Brexit plan is well received by Conservatives. The news is more than enough to offset poor PMI data released earlier today. New Zealand and Australian Dollars are following as second strongest for today, paring some of this week’s loses. Swiss Franc and Canadian are the weakest for now, followed by Dollar.

Technically, GBP/USD’s break of 1.2346 dampens our original bearish view and focus is back on 1.2582 resistance. EUR/GBP’s recovery from 0.8786 could have completed earlier than expected too and focus is back on this low. Elsewhere, USD/CAD’s rally is on track to 1.3382 resistance. Break will resume whole rise from 1.3016.

In Europe, currently, FTSE is down -1.17%. DAX is down -2.76%. CAC is up 0.34%. German 10-year yield is down -0.036 at -0.581. Earlier in Asia, Nikkei dropped -2.01%. Hong Kong HSI rose 0.26%. Singapore Strait Times dropped -0.50%. Japan 10-year yield dropped -0.0234 to -0.19.

UK Johnson’s Brexit proposal well received by Tories

Sterling is lifted by news that Prime Minister Boris Johnson’s new Brexit proposal was well received by his fellow Conservatives. Steve Baker said the plan offered a “glimpse” of the possibility of a “tolerable” deal. John Baron also said Johnson had produced “improved proposals.” Both were committed Brexiteers whole opposed to Theresa May’s withdrawal agreement.

On the other hand, Stephen Hammond and Greg Clark also backed the new proposal. Hammond said he “warmly” welcomed the fact Johnson had put forward proposals, as well as his “constructive tone.” Both were former pro-EU former ministers, ejected from the party after voting against Johnson’s orders last month.

Together with Northern Ireland’s DUP, there is now a realistic chance of passing a modified Brexit deal in the Parliament. If that happens, the ball would be on EU’s court to accept it.

UK PMI services dropped to 49.5, vast service sector joined manufacturing and construction in decline

UK PMI Services dropped to 49.5 in September, down from 50.6 and missed expectation of 50.3. All Sector PMI Output dropped to 48.8, down from 49.7, worst reading since July 2016. it’s also the first back-to-back contraction since 2012. Markit noted that new and outstanding business both declined. There was fastest rate of job shedding since August 2000, and weakest expectations for activity since July 2016.

Chris Williamson, Chief Business Economist at IHS Markit, said: “A trio of grim reports on the economy means that the vast service sector has now joined manufacturing and construction in decline… At current levels the surveys point to GDP falling by 0.1% in the third quarter which, coming on the heels of a decline in the second quarter, would mean the UK is facing a heightened risk of recession… The increasingly dire readings push the surveys further into territory that would normally be associated with policy stimulus from the Bank of England, suggesting a greater likelihood that the next move in interest rates will be a cut.”

US initial jobless claims rose to 219k, above expectations

US initial jobless claims rose 4k to 219k in the week ending September 27, above expectation of 215k. Four-week moving average of initial claims was unchanged at 212.5k. Continuing claims dropped -5k to 1.651m in the week ending September 21. Four-week moving average of continuing claims dropped -5.75k to 1.662m.

Fed Evans: The two rate cuts were just modest adjustment for risk management

Chicago Fed President Charles Evans said “the U.S. economy continues to grow above trend … U.S. economic outlook is quite good, it still has strong fundamentals.” The two rate cuts this year were “modest adjustments” as “risk management to help make things work out better as we strive to bring in growth at about 2% over the next 18 months”. He added that “if there is an event that shocks the world economy or the U.S. economy, these modest adjustments are not going to be nearly enough”.

ECB officials warned of Japanese style vivious cycle of declining inflation expectations

ECB Vice President Luis de Guindos urged that Eurozone shouldn’t for Japan’s footstep that led to persistently low inflation. He said “we have learned from the experience in Japan that it is possible to get caught in a vicious cycle of declining inflation expectations, falling inflation and a binding lower bound on nominal interest rates from which it is difficult to escape.”

Finnish central bank chief Olli Rehn also urged to “take care to avoid the sort of harmful equilibrium that arises from prolonged low inflation and zero interest rates, as this would significantly constrain the capacity for monetary policy to balance the economic cycle.” And, “this would bring about a lengthy shortfall in economic growth with respect to its potential and hinder efforts to boost employment.”

At the same even in Madrid, de Guindos also warned that markets could be under pricing risks of no-deal Brexit. He said “We have not gauged so far the impact that Brexit is having (…) I think we are really underestimating the impact of the present uncertainty and that’s why I have fears, concerns that the impact of a disorderly Brexit would be much higher than the one that they (markets) are discounting now.”

Eurozone retail sales rose 0.3% mom, matched expectations

Eurozone retail sales rose 0.3% mom, matched expectations. The volume of retail trade increased by 0.4% mom for non-food products and by 0.1% mom for automotive fuels, while food, drinks and tobacco remained unchanged.

EU28 retail sales rose 0.2% mom. Among Member States for which data are available, the highest increases in the total retail trade volume were registered in Portugal (1.1% mom), Estonia (1.0% mom) and Finland (0.8% mom). The largest decreases were observed in Austria, Slovakia (both -1.3% mom) and Croatia (-1.1% mom).

Eurozone PPI dropped -0.5% mom, -0.8% yoy, worse than expectation

Eurozone PPI came in at -0.5% mom, -0.8% yoy in August, worse than expectation of -0.2% mom, -0.4% yoy. Industrial producer prices dropped by -1.9% mom in the energy sector, while remaining stable for intermediate goods and capital goods, and increasing by 0.1% mom for durable consumer goods and by 0.2% mom for non-durable consumer goods. Prices in total industry excluding energy remained stable.

EU28 PPI came in at -0.4% mom, -0.3% yoy. The largest decreases in industrial producer prices were recorded in Spain (-1.4% mom), Greece (-1.3% mom), Belgium, Denmark and Lithuania (all -0.7% mom), while the highest increases were observed in Bulgaria (0.7% mom), Hungary (0.4% mom) and Slovenia (0.3% mom).

Eurozone PMI composite finalized at 50.1, Risk of recession is now very real

Eurozone PMI Services was finalized at 51.6, down from August’s 53.5. PMI Composite was finalized at 50.1, down from August’s 51.9. That’s the lowest level since June 2013. Looking at the member states, Germany PMI Services dropped to 48.5, an 83-month low. Italy rose to 2-month high of 50.6. France hit 5-month low of 50.8. Ireland hit 78-month low of 51.0. Spain also hit 2-month low at 51.7.

Chris Williamson, Chief Business Economist at IHS Markit said: “The PMI surveys painting the darkest picture since the current period of expansion began in mid-2013. GDP looks set to rise by 0.1% at best in the third quarter, with signs of further momentum being lost as we head into the fourth quarter, meaning the risk of recession is now very real… The growing risk of recession, coupled with a further moderation of inflationary pressures, will add to expectations that the ECB will need to do more to stimulate the economy in coming months.”

Funo: BoJ will reexamine economic and price trends at next meeting

Bank of Japan board member Yukitoshi Funo said Japan is facing a situation where momentum towards price stability would be undermined. The central bank would “reexamine” the outlook at next meeting. He also said BoJ is ready to respond to prevent risks from materializing.

He warned of heightened downside risks from global slowdown. And, “We are facing a situation where we need to pay more attention than before to the risk that the momentum towards the price stability target will be undermined… With that situation in mind, we will reexamine economic and price trends at the next policy setting meeting”.

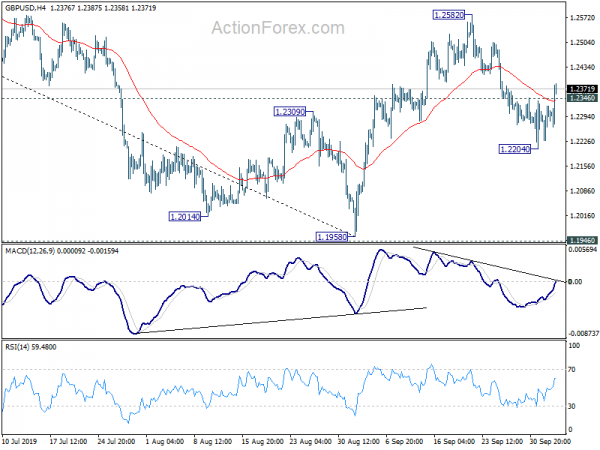

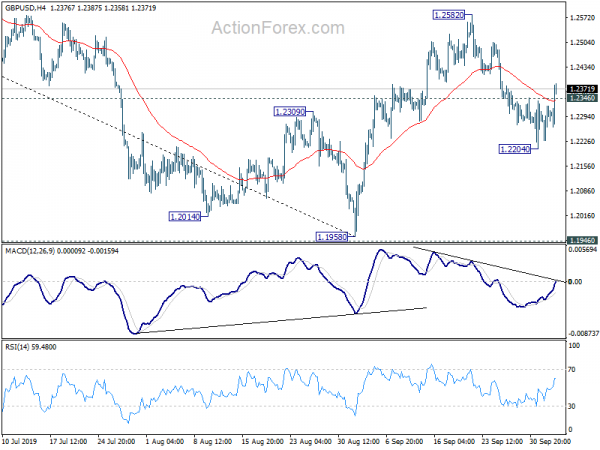

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2243; (P) 1.2283; (R1) 1.2340; More….

GBP/USD’s break of 1.2346 minor resistance dampens our original bearish view and suggests that pull back from 1.2582 has completed. Intraday bias is turned back to the upside. Break of 1.2582 will resume the rebound from 1.1958. On the downside, though, break of 1.2204 will turn bias back to the downside for 1.1946/58 key support zone next.

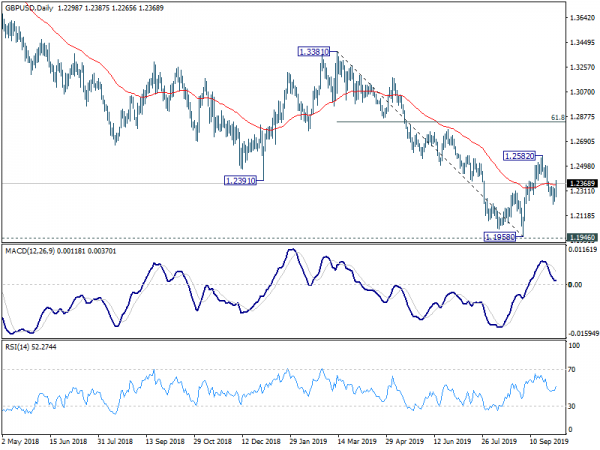

In the bigger picture, we’d remain cautious on medium term bottoming around 1.1946 (2016 low). Sustained trading above 55 week EMA (now at 1.2724) will extend the consolidation pattern from 1.1946 with another rise to 1.4376 resistance. Nevertheless, decisive break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Services Index Sep | 51.5 | 51.4 | ||

| 01:30 | AUD | Trade Balance (AUD) Aug | 5.93B | 6.00B | 7.27B | 7.25B |

| 07:45 | EUR | Italy Services PMI Sep | 51.4 | 50.3 | 50.6 | |

| 07:50 | EUR | France Services PMI Sep F | 51.1 | 51.6 | 51.6 | |

| 07:55 | EUR | Germany Services PMI Sep F | 51.4 | 52.5 | 52.5 | |

| 08:00 | EUR | Services PMI Sep | 51.6 | 52 | 52 | |

| 08:30 | GBP | Services PMI Sep | 49.5 | 50.3 | 50.6 | |

| 09:00 | EUR | PPI M/M Aug | -0.50% | -0.20% | 0.20% | 0.10% |

| 09:00 | EUR | PPI Y/Y Aug | -0.80% | -0.40% | 0.20% | 0.10% |

| 09:00 | EUR | Retail Sales M/M Aug | 0.30% | 0.30% | -0.60% | -0.50% |

| 12:30 | USD | Challenger Job Cuts Y/Y Sep | -24.80% | 39.00% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 27) | 219K | 215K | 213K | 215K |

| 13:45 | USD | Services PMI Sep F | 50.9 | 50.9 | ||

| 14:00 | USD | ISM Non-Manufacturing PMI Sep | 55.1 | 56.4 | ||

| 14:00 | USD | Factory Orders M/M Aug | -0.50% | 1.40% | ||

| 14:30 | USD | Natural Gas Storage | 86B | 102B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals