There’s a barrage of crucial events coming up next week, with three major central bank meetings and an avalanche of economic data set to dominate the agenda. The Fed is almost certain to cut rates again, but may signal that the bar for any further action is high. The Bank of Japan is a wild card – it’s a close call whether it will cut too or wait a little longer. In Canada, the BoC will probably maintain a neutral stance, while in the UK, a General Election may be announced at any moment. The latest US employment data will be the icing on the cake.

Fed to cut, but will it also signal a pause?

It’s going to be an action-packed week in the United States, with preliminary GDP data for Q3 hitting the markets on Wednesday, a few hours before the Fed concludes its meeting. Personal income and spending figures will follow on Thursday, alongside the core PCE price index for September, before the all-important nonfarm payrolls report for October is released on Friday. Last but not least, is the ISM manufacturing PMI, which funnily enough may attract the most attention given the hardships faced by the sector amidst the trade war.

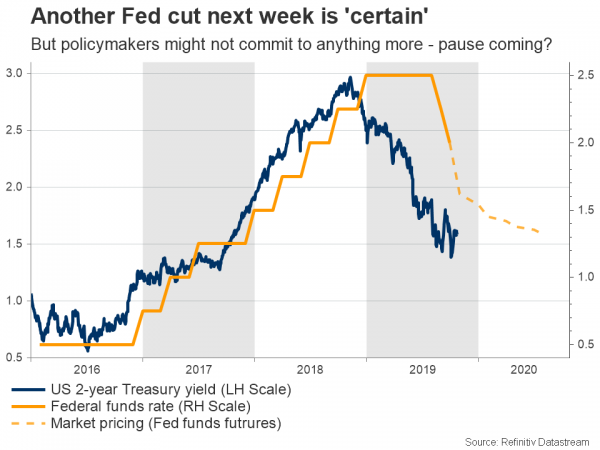

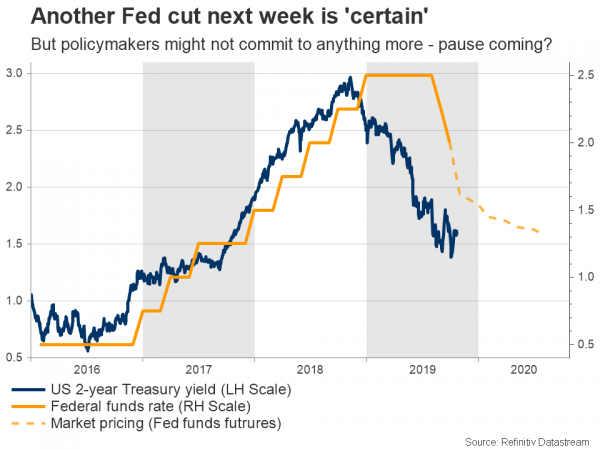

The Fed is virtually certain to cut rates for a third consecutive time, with investors assigning a 90% probability for such an action. Thus, the market reaction will depend mostly on the signals policymakers send about the likelihood of future action, not on the rate cut itself. Considering the recent trade ceasefire and a slightly better global backdrop, the risks seem skewed towards the Fed not committing to anything further at this stage. Chairman Powell could indicate the central bank has already done enough and that the recent stimulus needs time to work, effectively hinting that the bar for another cut in December is quite high.

That message may be a touch less dovish than markets are primed for and could therefore help the beleaguered dollar recover some ground. That said, a bigger determinant for the dollar’s short-term direction may be Friday’s jobs report and ISM index. Nonfarm payrolls are seen at 105k, less than the 136k in September, and barely enough to keep up with US population growth. The unemployment rate is thus forecast to tick up, albeit from a very low level, while wage growth is expected to pick up some speed. Meanwhile, the ISM print is projected to rise, but remain below 50, signaling that manufacturing remains in recession.

In the bigger picture, it’s still hard to throw in the towel on the dollar. For all its troubles, the US economy is still much stronger than Europe, and unless the Fed gets ‘ahead of the curve’ by slashing rates much more aggressively or Berlin finally decides to roll out some fiscal stimulus, it’s difficult to envision sustained weakness in the greenback.

Will the Bank of Japan follow the Fed’s lead?

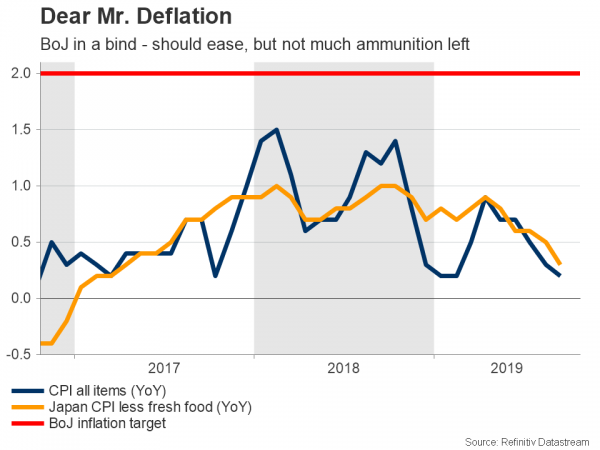

In Japan, the nation’s central bank will conclude its latest meeting on Thursday, and markets seem split on whether Governor Kuroda and his colleagues will enlarge their already-massive stimulus program, factoring in a 50% probability for a small 10 basis points rate cut.

One look at economic data suggests that more easing is warranted. Inflation is moving in the wrong direction and is close to 0% again, exports are contracting as the trade war damages global demand, and the recent sales tax hike will likely restrain household spending – which has been resilient so far. Additionally, if the BoJ does nothing, then the yen would likely spike higher, making it more difficult for inflation to rise and stifling the competitiveness of exports.

There are three key arguments against acting now. First, domestic demand hasn’t softened yet. Second, lower negative rates would probably hurt the profitability of financial institutions, particularly pension funds. Finally, the BoJ’s policy ammunition box is almost empty, so the officials may prefer to use their final ‘bullets’ for a stormier day.

It’s a close call and recent reports suggest that the BoJ board is divided as well, though most policymakers are apparently leaning towards holding their fire for now.

Pound turns its sights to a General Election

There’s no time to breathe in the UK, with a flood of Brexit headlines hitting the wires daily. The coming week will feature the ‘battle of the election’, with PM Johnson pushing for a General Election on December 12, hoping to regain a strong Parliamentary majority with which he can push his deal through. However, he needs two thirds of Parliament to trigger an early election, and the opposition Labour party has been adamant it won’t support one until the EU has granted a lengthy extension.

Political theatrics aside, a pre-Christmas election looks all but inevitable, and it may be a matter of time before one is announced. As for the pound, since an election could increase the probability of the favorable outcomes – the deal being ratified or another referendum taking place – the broader relief rally may not be over just yet.

BoC to reaffirm ‘steady as she goes’ stance

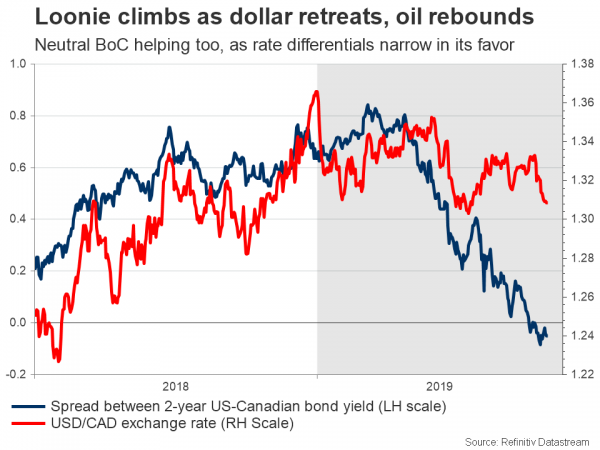

The Bank of Canada (BoC) will also decide on Wednesday, and in contrast to its US counterpart, no action is expected. The domestic economy has truly been an oasis of strength in a desert of global weakness in recent quarters, with the data staying robust even in the face of mounting trade tensions. Indeed, the latest business survey by the BoC itself showed that firms remain optimistic, reinforcing this positive narrative.

Markets agree wholeheartedly, assigning practically no chance for a rate cut next week, and only a 25% chance for one by June next year. A confirmation that the BoC is firmly neutral could help the loonie cement its status as the best-performing major currency so far this year.

The nation’s GDP numbers for August will be released on Thursday.

Euro area growth figures could chart the euro’s course

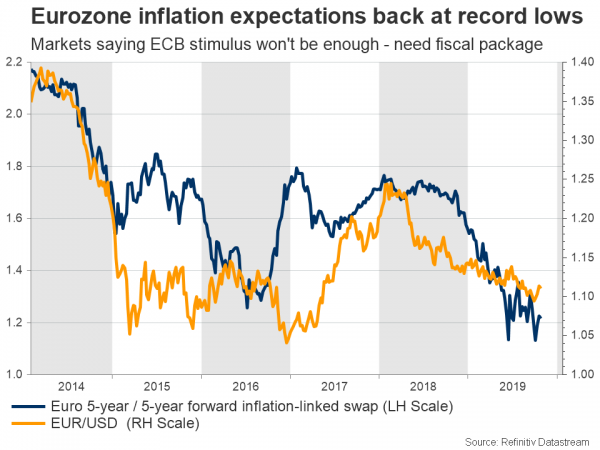

In euro land, inflation figures for October and the preliminary estimate of GDP for Q3 will both be released on Thursday. They could prove crucial in shaping market expectations about any further ECB stimulus in the coming months.

To be fair though, monetary policy in Europe is exhausted already. Indeed, market-based inflation expectations remain extremely low, indicating that investors don’t believe ECB stimulus alone will be enough for the economy to recover. For the Eurozone’s fortunes to truly turn around, and by extension for the euro to be able to rally in a sustainable manner, markets may need to see Germany announce a meaningful fiscal stimulus package – which is unlikely anytime soon.

Australia’s inflation prints for Q3 to guide RBA’s next move

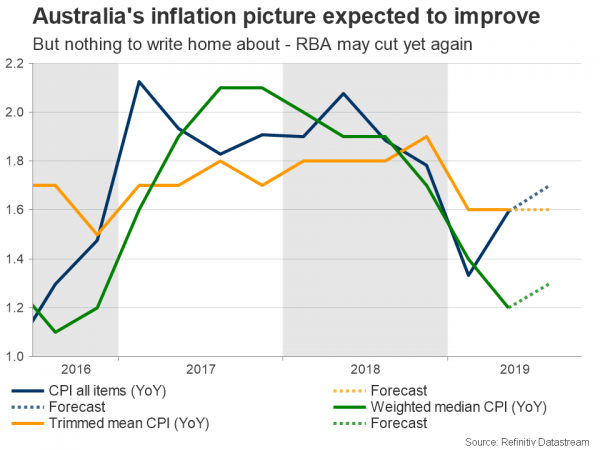

Finally, the latest inflation stats out of Australia early on Wednesday will reveal whether the trade-sensitive economy continued to lose momentum as the US-China battle escalated over the summer. Forecasts point to a slight uptick in most inflation rates, though all measures are expected to remain well below the RBA’s 2-3% target range.

That would hardly be reassuring for the central bank, which cut rates for a third time this year at its last meeting to boost the sluggish economy. Markets currently assign a 50% chance for another cut by year-end. The aussie has recovered a little lately as trade tensions eased and the US dollar retreated, however the outlook remains cloudy, as there are no convincing signs that the economy will turn around soon or that the US-China ceasefire will hold for long.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals