Highlights

- As economies grapple with low economic growth and inflation, more unconventional macroeconomic policy ideas have come to the fore. The most buzzworthy one is Modern Monetary Theory (MMT).

- MMT is a set of economic theories which stress the importance of government spending in the economy. It has three main tenets: there is no limit on the ability of governments that borrow in its domestic currency to fund themselves; expansionary fiscal policy leads to lower interest rates; and inflation is the only constraint on central-bank financed government spending.

- MMT-based policies would ultimately be an experiment and do carry a greater risk of unintended consequences, such as run-away inflation, capital outflows, and an overall unstable macroeconomic environment.

- However, MMT could prove to be a useful tool in an economic downturn in the event that monetary and conventional fiscal options have been exhausted. In this scenario, MMT policies should be developed within a rules-based framework to mitigate the risks cited above.

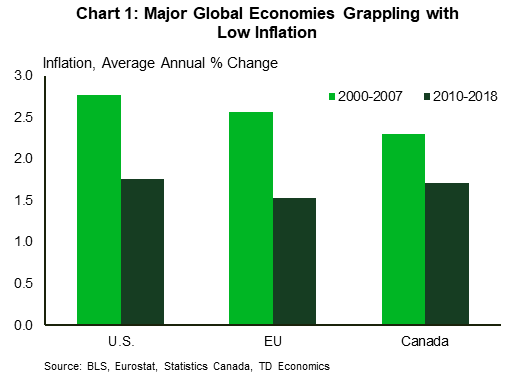

It’s been ten years since the global financial crisis, but its effects are still seen throughout the world. Most major economies are grappling with a low growth, low inflation environment (Chart 1). Productivity has also remained stubbornly low, even negative for some economies. To combat these forces, central banks have dug deeper into their toolkits for unconventional policies to provide a boost to lackluster demand.1 However, these policies have produced only limited success.

With subdued demand and muted inflationary pressures, even more unorthodox ideas have come to the fore. The most buzzworthy one is Modern Monetary Theory (MMT).

MMT has become increasingly popular in recent years as it offers alternative policy prescriptions that, in theory, could boost economies out of the low growth-low inflation trap. In its simplest form, MMT states that countries with debt denominated in their own currency and a floating exchange rate cannot go “broke”. Governments can spend and pay down debts by printing more money through the central bank. This means the constraint on government spending would not be the level of federal debt, but rising inflation. MMT states that government spending should pull back or institute policies to dampen price pressures if inflation reaches or breaches its pre-determined constraint.

However, MMT is not free of perils. Taken to its extreme, it has the potential to generate significant inflationary pressures, while also leading to a sizeable drop in the currency and a general destabilization of the economy.

However, a rules-based MMT approach can help mitigate this risk. Under well-defined rules, MMT can be used to help struggling economies out of an economic downturn. But, MMT would be a monetary experiment and unintended consequences or “unknown-unknowns” would be at play to a greater extent. This need not be the go-to strategy for countries. Indeed, economies can implement tried and tested structural policies to avoid a situation where MMT is the only viable policy option. Europe and Japan may be reaching the end of the rope in this regard, but the U.S. can still get ahead of the curve.

Specifically, policies such as protected paid time off, a more progressive tax system and increased immigration can put the U.S. on a path towards longer-lasting economic prosperity without having to be exposed to the risks and uncertainties of MMT.

Main Tenets of MMT

MMT is not a set of new theories. These ideas are an evolution of earlier macroeconomic concepts that stressed the importance of government spending in the economy. Of the many ideas espoused by MMT, we can pick out three main tenets from which auxiliary theories are derived. These are the following:

1. There is no limit on the ability of governments that borrow in its domestic currency to fund themselves

The first, and perhaps the most important, tenet of MMT is that there is no limit on the ability of governments that borrow in its domestic currency to fund themselves. The government has ultimate authority over its currency, thus can order the central bank to print more money to pay down its debt, or to finance new spending.

2. Expansionary fiscal policy leads to lower interest rates

The second and perhaps more controversial tenet of MMT is that increased government spending lowers interest rates. This is the opposite of what is taught in a typical macroeconomics course. In the standard macroeconomic framework, an increase in government spending raises interest rates as there is greater demand for loanable funds. This in turn “crowds out” some private sector investment.

But, according to MMT proponents, greater fiscal spending lowers interest rates because on net it increases the amount of reserves held by banks. In fact, MMT contends that the interest rate would move to zero, if not for the central bank intervening and setting a positive benchmark rate. These are contentious claims. We will return to why MMT may not work as intended later in the note.

3. Inflation is the only constraint on central-bank financed government spending

Lastly, MMT contends that inflation is the only binding constraint on central-bank financed government spending. Proponents of MMT argue that governments should only worry about inflation when authorizing more spending, and pay no mind to the budget balance. Budget deficits, as laid out by tenet number one, are not a concern if it is priced in one’s own currency. On the other hand, MMT recognizes that rising inflation can be problematic. If government spending stokes inflationary pressures and has the potential to raise it above a pre-determined tolerable rate, MMT states that various tools should be deployed to counter these pressures. Governments can use tools such as tighter financial and credit regulations, as well as tax increases to put a damper on inflation, depending on the source of price pressures.

What Can We Accomplish With MMT?

Under its core tenets, MMT grants governments significantly more powers and responsibilities. Governments can spend less time fretting about budget deficits — if deficits are in its own currency — and can instead push forward spending agendas that align with its key priorities.

For example, if governments are aiming to maximize employment, they can authorize programs such as a federal jobs guarantee program to help provide public sector jobs to those in need. It will soak up slack in the labor market and move the economy to a level consistent with maximum employment. Specific job programs in areas like building infrastructure, could have long-term benefits for the economy. However, the job guarantee program will be limited by the extent to which it stokes inflationary pressures. The greater the risk of inflation moving above the pre-determined target, the smaller the scope of the program. Also, hiring for the sake of hiring has its own consequences. At its extreme, it implies a large and inefficient government that offers little bang for the buck to economic growth.

Governments can also spend on policies that improve the long-term health of an economy. They can prioritize environmental sustainability, build better infrastructure, or both. In an MMT world, governments have considerably more freedom to spend on policies of their choice. Only rising inflation can ruin the party.

However, in the current context, even rising inflation may be a welcome guest. Since the global financial crisis, most advanced economies have been grappling with low inflation environments and central banks have tried conventional and unconventional methods to boost inflation with little to no success. Prominent economists such as Larry Summers have argued that these conditions are indicative of “secular stagnation” defined as a sustained period of sluggish growth that coincides with low interest rates. In these periods, active fiscal policy, through investment in infrastructure, might be the antidote to lift economies out of this hole, and MMT stands to do exactly that.

The Problems With MMT

Sadly, there’s no such thing as a free lunch, and that goes for MMT. Great things may be accomplished under the MMT doctrine, but it doesn’t come without its own perils. There are fundamental issues with its main tenets, and MMT-based policies could lead to unintended consequences that become severely counterproductive to its intent of boosting economic growth.

The central concerns with MMT are that the core principles make either very strong assumptions or are simply not correct. The first main tenet claims that there is no limit on the ability of governments that borrow in its domestic currency to fund themselves. While this might be true for closed economies, it is not strictly true for open economies, which most are to various extents. A rapid accumulation of debt or printing money to pay down debt could lead to a steep depreciation of the currency and large capital outflows. This would introduce considerable inflationary pressures and potentially destabilize the entire economy.2

The U.S. is a special case. As the global reserve currency and a relatively closed economy, it may evade some of these impacts in the short run. However, over the longer run, it too could face significant depreciation and capital outflows, as investors rethink the status of the U.S. dollar. In contrast, small open economies without a global reserve currency, like Canada, are a lot more susceptible to the negative consequences of MMT.

The second core principle of MMT, that expansionary fiscal policies lead to lower interest rates, may also not be true. Take a scenario in which a government starts a spending program. This, as MMT would claim, expands the amount of reserves held by the banks, increasing the supply of money. But, it could also generate demand for money as fiscal stimulus moves through the economy. Therefore, the net impact on interest rates is unclear.3 If the generated output is far greater than the increase in money supply, interest rates can indeed move higher in response to fiscal stimulus, consistent with conventional macroeconomic theory.

Another problematic aspect of MMT is that it eliminates central bank independence. Decades of research have told us that allowing a central bank to conduct monetary policy independent of political pressures is important to mitigate the negative impact of inflation on growth in the longer run.4 With central banks handing their mandate to fiscal authorities in the MMT world, it is entirely possible that spending agendas are legislated without carefully considering the inflationary impacts and investor confidence. Although proponents of MMT state that governments should enact policies to rein in inflation if the constraint is breached or about to be breached, it may be politically inconvenient to turn off the fiscal taps at any given time.

Even if inflationary pressures were thoroughly considered, there would be a considerable degree of uncertainty around the estimated impact of fiscal stimulus. Government agencies tasked with the analysis would have to make assumptions on factors such as the fiscal multiplier, potential output, program delivery timeline, all of which contribute to large error-bands. This could lead to frequent policy-errors and an unstable macroeconomic environment.

MMT May Prove Useful In Special Circumstances

Given the flaws of MMT and the unintended consequences that can result, its policy prescriptions are likely too risky to adopt when other, better understood, policy options are available. However, under special circumstances, MMT may prove to be a useful tool.

As identified in a recent report, there could come a time where we are in the midst of an economic downturn and both fiscal and monetary policy options are limited: interest rates are at the effective lower bound and fiscal debt is elevated. In this scenario, MMT policies could be what is required to lift economies out of the downturn.

Even in this scenario, it is important for MMT to be adopted in a rules-based framework. The framework should be well-defined and clearly communicated to the public. The circumstances for entry into an MMT-policy regime, the spending agendas that would be enacted, when to exit from the regime, should all be agreed upon and communicated in advance of enacting MMT policies.

As the government and central banks will be working hand-in-hand, a rules-based approach will allow central banks to maintain their independence and credibility, all the while maintaining public confidence that the policies will produce results. If authorities are able to do the latter, economies may require less stimulus to escape the downturn.

Other Policy Options?

Taking a step back, countries should do what they can to avoid a situation where MMT stands as the only viable option for economic stimulus. It may already be too late for Europe and Japan, where fiscal and monetary policy space has eroded to a point where MMT is actively being considered by policy makers.5 For the U.S., it is a long way off from encountering the same troubles. Instead of sitting still, the U.S. should proactively implement policies that can boost long-term growth, thus providing more monetary and fiscal policy options in the event of a downturn. The following policy options could take the U.S. in the right direction:

1. Paid Time Off

One policy prescription that could see immediate results is federally mandating protected time off for all workers. The U.S. is the only country in the entire OECD where workers do not have federally guaranteed paid vacation days or holidays (Chart 2). Even paid maternity leave is not federally instituted. While companies and states can and do voluntarily provide these benefits, a Center for Economic and Policy Research study found that almost one in four Americans do not receive any paid time off.6 This could lead to an overworked population, which doesn’t necessarily mean increased output. In fact, studies have shown that overworking employees could lower a company’s profits through more absenteeism, higher turnover and increased health insurance costs.7

Paid time off also means a healthier labor market. As this report notes, the core age (25-54) female participation rate in the U.S. lags well behind that of males and its international counterparts. A National Bureau of Economic Research report found that about a quarter of the decline in female labor force participation relative to other OECD countries is due to a lack of family-friendly workplace policies, including paid parental leave. With population aging creating challenges for the U.S. labor market, increased female labor force participation can be an important mitigating factor. Parental leave policy is a low hanging fruit that can very possibly achieve this outcome.

In addition, family outcomes may also improve with paid time off. For example, paid time off for mothers has been associated with long-term improvements in educational and earnings outcome for children.8 Instituting this policy at the federal level could ensure a healthier population and robust labor markets. This would put the U.S. economy on a path towards stronger economic growth in the years ahead.

2. More Progressive Tax System

Another policy option would be to implement a more progressive tax system that would reduce inequality, promote inclusive growth and greater participation in the U.S. economy.9 Since the global financial crisis, the richest 20% of American households held a greater —and rising— share of overall household income than the remaining 80% (Chart 3). This trend is worrying because it means that a significant share of the U.S. population is losing out on economic and educational opportunities, which then excludes them from meaningfully contributing to the economy.10 A tax system that redistributes more of the income from the top-end towards the bottom-end of the income distribution would help in halting, and potentially reversing, this trend.

3. Improvements in Immigration Policies

Finally, improvements to immigration policies can also help put the U.S. on a sturdier economic growth path. With population growth slowing due in large to part to aging population, immigration will have to step in to fill the gap (Chart 4). But, which immigration policy changes yield the best results for the U.S. economy? Research by The Wharton School of the University of Pennsylvania examined three immigration policy changes and their many combinations.11 They ran 125 economic simulations to determine that the largest positive impact on GDP and employment came from increasing the number of immigrants. If immigration increased by 50%, GDP per capita would be 3% higher by 2050, compared to keeping the number of immigrants unchanged from 2019. Tilting the mix of immigrants towards those with college-education also had a positive impact.

Bottom Line

In recent times, MMT has increasingly entered policy debates as a possible option to boost economies stuck in a low growth-low inflation environment. While MMT offers policy prescriptions that can benefit economies right away, it should be approached with caution due to the fundamental issues with its theories as well as the unintended consequences of its policies.

However, a rules-based approach to MMT might be more feasible and could become the primary choice for some economies already near a lower bound on policy rates in the next downturn. The U.S. does not fall into this camp, both in terms of the monetary tools still at its disposable and the public policy levers it has yet to pull. Before going down this uncertain and bumpy MMT road, it makes more sense to proactively optimize on the available and time-tested policies to boost long-term growth and relieve pressure on fiscal and monetary policy. It shouldn’t be the case that MMT is turned to as the only tool in the toolbox come the next downturn.

End Notes

- TD Economics, 2019. “What To Expect From Central Banks In The Next Global Downturn”. October 1, 2019. https://economics.td.com/central-banks-downturn

- European Central Bank, 2016. “Dealing with large and volatile capital flows and the role of the IMF”. September 1, 2016. https://www.ecb.europa.eu/pub/pdf/scpops/ecbop180.en.pdf

- Citi Global Perspectives & Solutions, 2019. “Modern Monetary Theory (MMT)”. April 1, 2019.

- Helge Berger, Jakob De Haan, and Sylverster C.W. Eijffinger. “Central Bank Independence: An update of Theory and Evidence”. Journal of Economic Surveys, 2001.

- Recently, ECB President Mario Draghi said Governing Council should be more open to MMT (https://www.bloomberg.com/news/articles/2019-09-23/draghi-says-ecb-should-examine-new-ideas-like-mmt). In Japan, there is an ongoing debate on MMT and its uses (https://www.bloomberg.com/news/articles/2019-06-05/japan-worries-about-its-deficit-as-mmt-argues-there-s-no-need).

- Center for Economic and Policy Research, 2019.”No-Vacation Nation”. May 1, 2019. http://cepr.net/documents/publications/2007-05-no-vacation-nation.pdf

- https://hbr.org/2015/08/the-research-is-clear-long-hours-backfire-for-people-and-for-companies

- https://www.jec.senate.gov/public/_cache/files/646d2340-dcd4-4614-ada9-be5b1c3f445c/jec-fact-sheet—economic-benefits-of-paid-leave.pdf

- A progressive tax system is one that requires higher income households to pay more taxes than lower income households.

- Roy van der Weide and Branko Milanovic, 2018. “Inequality is Bad for Growth of the Poor (but Not for That of the Rich)”. The World Bank Economic Review. https://www.gc.cuny.edu/CUNY_GC/media/LISCenter/Branko%20Milanovic/vdWeide_Milanovic_Inequality_bad_for_the_growth_of_the_poor_not_the_rich_2018.pdf

- The Wharton School of Business, University of Pennsylvania, “Could Increase Immigration Improve the U.S. Economy?”. September 10, 2019. https://knowledge.wharton.upenn.edu/article/us-immigration-policy/

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals