Dollar and Canadian are both trading with an undertone as markets await BoC and FOMC rate decisions, as well as US GDP data. Sterling appears to be mildly firmer as UK is finally heading towards election in mid-December. But there is no clear follow through buying. Swiss Franc and Euro are also trying to reverse some of this week’s losses against the greenback. Australian Dollar remains the strongest one this week but upside is capped by slowing consumer inflation.

Technically, EUR/USD’s recover ahead of 1.1062 minor support retains near term bullishness. Focus could be back on 1.1179 temporary top and break will resume recent rally. USD/CAD recovered ahead of 1.3016 key support but upside is held below 1.3122 minor resistance. Thus, outlook stays bearish. USD/CHF lost upside momentum after hitting 0.9970 and focus is back on 0.9907 minor support. EUR/CHF also lost upside momentum after failing 1.1062 key cluster resistance and deeper fall could be seen today.

In Asia, Nikkei closed down -0.57%. Hong Kong HSI is down -0.54%. China Shanghai SSE is down -0.45%. Singapore Strait Times is up 0.31%. Japan 10-year JGB yield is down -0.0099 at -0.119. Overnight, DOW dropped -0.07%. S&P 500 dropped -0.08% after making new record high at 3047.87. NASDAQ dropped -0.59%. 10-year yield dropped -0.018 to 1.835.

BoC expected to stand pat, Fed expected to cut

BoC is widely expected to keep policy rate unchanged at 1.75%. Upside surprise in GDP growth and solid inflation offered BoC much room to stand on the sideline. Additionally, the newly-elected government’s fiscal stimulus is expected to support the economy in the coming year. There is no imminent need for the central bank to act in either direction. Ongoing trade war uncertainty and global economic slowdown would be the main focuses of policy makers ahead, and that could determine whether BoC needs to do anything next year.

On the other hand, markets are generally expecting Fed to cut interest rate again by -25bps to 1.50-1.75% today. Fed fund futures are pricing in 97.8% chance for that. The main question is whether chair Jerome Powell will signal that it’s the end of the so called “mid-cycle adjustment”. Such message could also be reflected in changes in the forward guidance too. There is prospect of a Dollar rebound should Fed affirm this message.

Here are some suggested readings on Fed and BoC:

US-China trade deal might not be ready for APEC, farm purchase a sticky point

According to a Reuters report, the text of US-China trade deal might not be ready for signing at the APEC summit in Chile on November 16-17. An unnamed official was quoted saying “If it’s not signed in Chile, that doesn’t mean that it falls apart. It just means that it’s not ready. Our goal is to sign it in Chile. But sometimes texts aren’t ready. But good progress is being made and we expect to sign the agreement in Chile.”

Though, White House spokesman Judd Deere insisted, “As the president said several weeks ago, we have reached a phase-one agreement with the Chinese and both sides are working to finalize the text for a signing in Chile.”

Separately, it’s reported that the amount of farm purchases is a sticky point for the text of the agreement. US is pushing China to spell out that it would buy as much as USD 50B of American farm products. But China would want to make it flexible and make the purchases based on market conditions. An unnamed Chinese officials said “China does not want to buy a lot of products that people here don’t need or to buy something at a time when it is not in demand.”

And separately again, China’s UN Ambassador Zhang Jun warned on Tuesday that US criticism on China’s Xinjiang policy is not helping trade negotiations. The US, UK and 21 other states pushed China to stop detaining ethnic Uighurs and other Muslims in Xinjiang Zhang said, “the trade talks are going on and we are seeing progress. I do not think its helpful for having a good solution to the issue of trade talks.”

UK to hold election on Dec 13, Brexit uncertainty remains

UK Prime Minister Boris Johnson finally won his bid for early election yesterday by 438-20 votes in the Commons. The bill will now be passed to the House of Lords. LibDems and SNP abstained as their motion for elections on December 9 was rejected. Election will be held on December 12 and early results should be know on the next day. While the chance of no-deal Brexit has further diminished, it’s still unknown if UK will finally leave the EU on the next Brexit deadline on January 31. After the elections, Johnson might have majority to push through the deal, or Labour could take over the government and then renegotiate the deal before another referendum. Or, no party would win conclusively and Brexit deadlock would continue.

Suggested readings:

NIESR expects no economic boost from Johnson’s new Brexit deal

NIESR said in a report that “we would not expect economic activity to be boosted by the approval of the government’s proposed Brexit deal.” Instead, the new Brexit deal could lover UK GDP growth by -3.5% in the long run, comparing with continued EU membership.

Under the main-case scenario, economic conditions are set to “continue roughly as they are” with “underlying growth remaining weak and well under its historic trend.” As likelihood of no-deal Brexit is reduced, so is downside risks to growth.

NIESR also expected a cut in BoE Bank Rate by -25bps to 0.50% in 2020. Together with loosened fiscal policy, both are expected to support growth in the near term.

Australia CPI slowed to 0.5% qoq in Q3, inflation remains subdued

Australia CPI slowed to 0.5% qoq in Q3, down from Q2’s 0.6% qoq, but matched expectations. Annually, CPI rose to 1.7% yoy, up fro 1.6% yoy and matched expectations. RBA trimmed mean CPI rose 0.4% qoq, 1.6% yoy, matched expectations.

ABS Chief Economist, Bruce Hockman said: “Annual inflation remains subdued partly due to price rises for housing related expenses remaining low, and in some cases falling in annual terms. Prices for utilities (-0.3 per cent) and new dwelling purchase by owner-occupiers (-0.1 per cent) both fell slightly through the year to the September 2019 quarter, while rents (0.4 per cent) recorded only a small rise”.

Westpac said that there was some AUD depreciation pass-through to inflation but there is no broader impact of wider inflationary pulse. There is little pressure on the RBA to cut again this year. And Westpac maintains the forecast of another cut in February 2020.

Elsewhere

Japan retail sales rose 9.1% yoy in September, well above expectation of 6.9% yoy. UK BRC shop price index dropped -0.4% yoy in September. Swiss will release KOF leading indicator. Germany will release unemployment and CPI. Eurozone will release confidence indicators. Later in the day, US will release ADP employment and Q3 GDP.

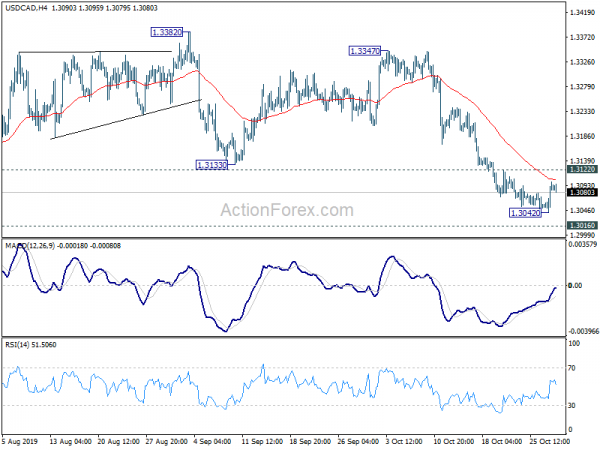

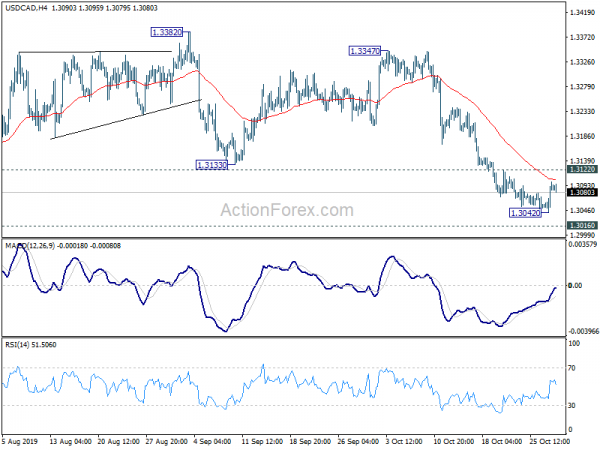

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3053; (P) 1.3077; (R1) 1.3111; More…

A temporary low is formed at 1.3042 in USD/CAD, ahead of 1.3016 key support. Intraday bias is turned neutral first. On the upside, break of 1.3122 minor resistance will confirm short term bottoming. Intraday bias will be turned back to the upside for 55 day EMA (now at 1.3202). On the downside, however, decisive break of 1.3016 will carry larger bearish implications and target 1.2781 support next.

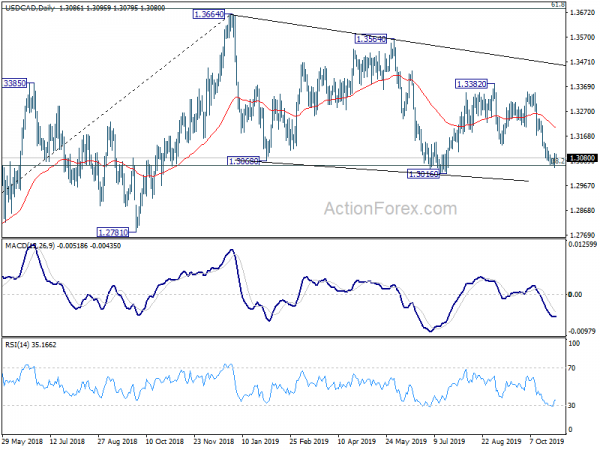

In the bigger picture, 38.2% retracement of 1.2061 to 1.3664 at 1.3052 remains intact. Medium term rise from 1.2061 low is in favor to resume sooner or later. Firm break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will confirm and target 1.4689 high. However, sustained break of 1.3052 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Sep | 9.10% | 6.90% | 1.80% | |

| 0:01 | GBP | BRC Shop Price Index Y/Y Sep | -0.40% | -0.60% | ||

| 0:30 | AUD | CPI Q/Q Q3 | 0.50% | 0.50% | 0.60% | |

| 0:30 | AUD | CPI Y/Y Q3 | 1.70% | 1.70% | 1.60% | |

| 0:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 0.40% | 0.40% | 0.40% | |

| 0:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 1.60% | 1.60% | 1.60% | |

| 6:30 | EUR | France GDP Q/Q Q3 P | 0.20% | 0.30% | ||

| 7:45 | EUR | France Consumer Spending M/M Sep | -0.70% | 0.00% | ||

| 8:00 | CHF | KOF Leading Indicator Oct | 94.2 | 93.2 | ||

| 8:55 | EUR | Germany Unemployment Rate Oct | 5.00% | 5.00% | ||

| 8:55 | EUR | Germany Unemployment Change Oct | 0K | -10K | ||

| 10:00 | EUR | Economic Sentiment Indicator Oct | 101.1 | 101.7 | ||

| 10:00 | EUR | Business Climate Oct | -0.21 | -0.22 | ||

| 10:00 | EUR | Industrial Confidence Oct | -8.9 | -8.8 | ||

| 10:00 | EUR | Services Sentiment Oct | 9 | 9.5 | ||

| 10:00 | EUR | Consumer Confidence Oct | -7.6 | -7.6 | ||

| 11:00 | EUR | Germany CPI M/M Oct P | 0% | 0% | ||

| 11:00 | EUR | Germany CPI Y/Y Oct P | 1.00% | 1.20% | ||

| 12:15 | USD | ADP Employment Change Oct | 132K | 135K | ||

| 12:30 | USD | GDP Annualized Q3 P | 1.60% | 2.00% | ||

| 12:30 | USD | GDP Price Index Q3 P | 1.90% | 2.60% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 1.75% | 1.75% | ||

| 14:30 | USD | Crude Oil Inventories | -1.7M | |||

| 15:15 | CAD | BoC Press Conference | ||||

| 18:00 | USD | FOMC Rate Decision | 1.75% | 2.00% | ||

| 18:30 | USD | FOMC Press Conference |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals