The US dollar declined sharply after the Federal Reserve delivered the third rate cut of the year. The bank slashed rates by 25 basis points and signaled that it was done with rate cuts this year. In a statement, Jerome Powell said that uncertainty on the economic outlook justified the cut. He also said that they will consider cutting rates if they saw a significant rise in inflation. This rate cut was criticized by a number of Fed watchers, who argued that it was not justified. Firstly, US stocks are at an all-time high. Secondly, the US and China appear to be ready to make a deal, and in the UK, the likelihood of a no-deal Brexit has eased.

The Australian dollar continued to rally even after weak data from China. Manufacturing PMI for October came in at 49.3. This was below the consensus estimates of 49.9. It was also below the September PMI of 49.8. Non-manufacturing PMI declined to 52.8. This was below the consensus estimates of 53.7. This data shows that the Chinese economy is still going through challenges even after the agreement reached between the country and the US.

Later today, the market will receive retail sales data from Germany. Analysts expect the retail sales to rise by an annualised rate of 3.5%. In the European Union, they will receive the consumer prices data. Headline CPI is expected to decline slightly from 0.8% to 0.7%. The preliminary GDP for the EU is expected to show a slight decline from 1.2% to 1.1%. Unemployment rate is expected to remain unchanged at 7.4%. In the US, the market will receive the weekly jobless claims data and personal income and spending data. Canada will release the August GDP data. This will come a day after the Bank of Canada left rates unchanged. Meanwhile, the Bank of Japan resisted pressure to cut rates. The bank left rates unchanged at -0.10%.

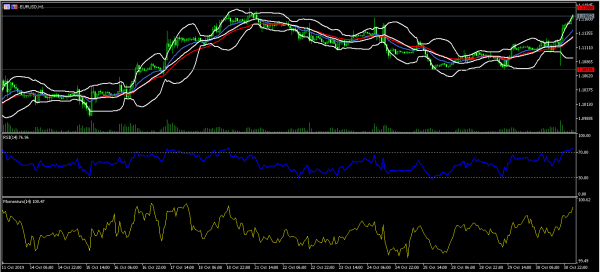

EUR/USD

The EUR/USD pair declined to a low of 1.1080 immediately after the Fed delivered its decision. The pair then rose sharply as the market listened to Jerome Powell. It reached a high of 1.1170 during the Asian session. On the hourly chart, this price is along the upper line of the Bollinger Bands. It is also slightly below the important resistance level of 1.1180. It is above the short and medium-term moving averages. RSI and momentum indicators have continued to soar. The pair may continue soaring to test the resistance level of 1.1170.

XAU/USD

Gold price rose following the Fed decision. The XAU/USD pair rose from a low of 1480 to 1500. On the hourly chart, the price is slightly above the 14-day and 28-day moving averages while the RSI has been on an upward trend. The pair is between the 50% and 61.8% Fibonacci Retracement level while the momentum indicator has moved above 100. The pair may continue moving higher past the 1500 resistance level.

USD/JPY

The USD/JPY pair declined to a low of 108.58 after the Fed rate cut. The pair moved up slightly after the BOJ delivered its interest rates decision. On the 30-minute chart, the pair moved below the 14-day and 28-day moving averages. The RSI is slightly above the oversold level of 30 while the average true range has moved slightly lower. The pair might move slightly higher today ahead of US consumption data.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals