U.S. Review

The U.S. Economy Continues to Trek Along

- It was as busy a week as one can get in terms of economic data. Third quarter GDP results hit the wire on Wednesday, followed by a 25 bps cut from the FOMC. A solid outturn for October payrolls and a modest improvement in the ISM manufacturing index were other notable developments that suggest the U.S. economy continues to trek through a forest of uncertainty.

- The U.S. economy expanded at a 1.9% annualized pace in the third quarter, led by consumer spending. Ongoing trade tensions remain perhaps the most significant risk to the outlook, and is one Chair Powell acknowledged in the post- FOMC meeting press conference.

The U.S. Economy Continues to Trek Along

Employers added 128K new jobs in October, which should allay fears of a severe slowdown in hiring. Looking through temporary factors relating to the 2020 Census and the strike from GM, the pace of hiring now looks to have picked up a bit since the summer (top chart). The unemployment rate ticked up a tenth, but that was due to a larger gain in the labor force, rather than a large decline in employment. Average hourly earnings were held back from the GM strike, but a sustained slowdown here could dampen the all-important consumer sector.

Personal consumption expenditures rose at a 2.9% annualized pace in the third quarter, and once again accounted for all of the gain in output (middle chart). The consumer has been the most, if not only, resilient sector in the face of trade uncertainty. Outside trade, the ongoing struggle at Boeing manifested itself in third quarter GDP, contributing to the 3.8% decline in equipment spending. On Tuesday, Boeing’s CEO began his testimony before Congress, which also marked the anniversary of the first of two deadly crashes involving the 737 MAX. Perhaps most notable were the documents released by the House Transportation Committee, which suggested Boeing might have known of concerns about the safety of the 737 MAX before the crashes. Improvements to the jet’s systems are underway, and we still expect it to get the all-clear to fly by the beginning of next year, but this new information adds to the negative publicity that has plagued Boeing.

In regards to trade policy, prospects of a “phase one” trade deal diminished this week when Chile canceled its APEC summit due to ongoing domestic protests. President Trump and Chinese leader Xi had been set to meet at the summit on November 16-17 to discuss the deal. The two have agreed to continue working to sign a “phase one” deal, but even if one is reached, a “phase two” deal remains more elusive. The U.S. ditched its planned tariff hike on about $207 billion in Chinese goods originally set to take effect on October 15, but a 15% tariff on an additional $156 billion is still set to take effect on December 15, at which point roughly 97% of U.S. imports from China will be exposed to U.S. tariffs. Exemptions on nearly 1,000 products are also set to expire in December. Equity markets continue to hang on every murmur on the trade war, which remains perhaps the most significant risk to the economic outlook and has caused business investment to falter.

The ISM manufacturing index did improve modestly in October, though it came in below 50 for the third straight month (bottom chart). Weakness in business investment spreading to the consumer side of the economy remains a significant risk, especially as the consumer has been driving growth. It is also a concern Chair Powell acknowledged in the post-FOMC meeting press conference this week, though he notably said, “we really don’t see that.” His comments, which followed the FOMC announcement to cut rates 25 bps for the third time this year, were highly scrutinized. Powell acknowledged risks to the outlook as “having moved in a positive direction.” The largest takeaway from his comments were perhaps that policymakers are in no rush to alter policy, which sent stocks to another record high.

U.S. Outlook

Factory Orders • Monday

It seems like the factory sector is just unable to catch a break as challenges continue to mount, the most recent being the strike at General Motors (GM). The advance look showed durable goods orders fell a larger-than-expected 1.1% in September. Excluding impacts to transportation, which would include the effects from GM and Boeing, durable goods orders still fell 0.3% on the month.

Unfortunately there is little sign of imminent relief. Core capital goods orders, a proxy for quarter-ahead business equipment investment, fell 0.5% in September and is running at a miniscule 0.4% annualized rate over the past three months.

On the heels of continued weakness in the October ISM manufacturing index, the outlook for the factory sector remains weak. As such, we continue to look for activity to remain under pressure in the months ahead.

Previous: -0.1% Wells Fargo: -0.7% Consensus: -0.5%

ISM Non-Manufacturing Survey • Tuesday

Even as the non-manufacturing sector has weathered the economic headwinds of slowing global demand and the trade dispute with China to a better degree than the manufacturing sector, the headwinds have still had a dampening impact on the sector. As seen from the left chart, the headline index has declined, on average, since its late 2018 peak and currently stands at a three-year low. Encouragingly, the overall performance remains in expansionary territory, though the deteriorating trend is consistent with a meaningful slowdown in growth.

One area we continue to maintain a close eye on is the health of the non-manufacturing labor market, which constitutes over 90% of total employment. In September, the employment index fell to its lowest level in five-and-a-half years. Further deterioration would increase concerns about the health of the labor market, and in turn, the sustainability of the current economic expansion.

Previous: 52.6 Wells Fargo: 52.7 Consensus: 53.5

Michigan Consumer Sentiment • Friday

On balance, consumer sentiment has held up well in the face of elevated economic anxiety seen throughout the year. The headline sentiment index, as measured by the University of Michigan, has improved over the past two months, with the final October reading nearly identical to the year-to-date average of 95.6. As ongoing developments over the trade war with China, impeachment inquiry and geopolitical events have captured the minds of the financial markets and the media, consumers have largely tuned out, instead remaining focused on income and job growth. On that front, consumers remain reasonably optimistic with gains recorded last month in regards to expectations for improved household income, finances and job prospects.

While multiple sources of economic uncertainty will surely keep consumers attentive to potential threats, job and income prospects should remain the primary driver of consumer sentiment.

Previous: 95.5 Consensus: 96.0

Global Review

Eurozone Grows; Latin American Politics Look Shaky

- On Thursday of this week, Eurozone GDP and inflation both beat consensus forecasts. While the Eurozone economy has been subdued for most of this year, better-than-expected growth and inflation were a welcome sight. However, we are not ready to call this the start of a recovery and still believe the ECB will ease monetary policy again in December.

- Protests in Chile have become worse than initially expected, with Chilean President Pinera forced to cancel November’s APEC Summit. In addition, the left-leaning populist ticket of Alberto Fernandez and Cristina Kirchner won the Presidency in Argentina, signaling a debt default could be imminent.

Eurozone Shows Signs of Life

While the economic situation in the Eurozone has not been all that positive, this week’s data provided a bit more optimism for the future. GDP and inflation data both beat consensus forecasts, with GDP expanding at 0.2% quarter-over-quarter in Q3 and core inflation rising 1.1% year-over-year in October. While Thursday’s data were better than expected, we are not ready to give the “all clear” on the Eurozone economy quite yet. In fact, we still believe the European Central Bank (ECB) will look to ease monetary policy further in December in an effort to provide more stimulus to the broader European economy. As of now, we maintain our view that the ECB will cut its deposit facility rate further into negative territory, while asset purchases are likely to remain in place. As a reminder, the ECB cut its main deposit rate 10 bps in September to -0.50% and restarted its QE program, indicating that accommodative monetary policy will be in place as long as necessary. There is also a possibility that the new head of the ECB, Christine Lagarde, pushes for countries to implement fiscal stimulus to support the economy.

Emerging Market Politics Souring

Historically one of the more politically stable countries in Latin America, Chile is currently on the verge of a prolonged political crisis. Following the government’s decision to increase subway fares, violent protests have broken out within the capital city of Santiago, which are slowly escalating across the entire country. While the demonstrations started in response to increased subway fares—which have since been rolled back—protests have turned into a referendum on wealth inequality and increased standard living costs. In response, Chilean President Sebastian Pinera has declared a state of emergency and decided to cancel the Asia Pacific Economic Cooperation (APEC) Summit in mid-November. Protests have had a significant impact on Chilean asset prices, in particular the currency; however, given that U.S. President Trump and Chinese President Xi were expected to sign phase one of a trade deal at the APEC Summit, protests could have larger implications for the global economy and asset prices as well. As of now, we expect Chilean protests to subside in the short-term, while we also expect the cancellation of the Summit not to disrupt U.S.- China negotiations or a potential trade deal.

Adding to the political uncertainty in Latin America, Argentina elected Alberto Fernandez as president and former President Cristina Kirchner as vice president this past week. The Fernandez- Kirchner ticket represents a political shift back to the more populist style policies that likely resulted in Argentina entering a deep recession through most of the 2000s and multiple defaults on Argentina’s sovereign debt. Looking ahead, we expect additional volatility to hit Argentine assets prices as Fernandez and Kirchner look to implement their political policies, while the status of the current IMF program is now in question. President-elect Fernandez has already suggested he will look to negotiate a haircut with bondholders on existing debt, while we believe terminating the IMF program would likely result in another default, with a Q1-2020 default built into our current Argentina forecasts. Looking ahead, we will monitor closely the new administrations political policies and how Argentina’s economy evolves in response.

Global Outlook

Turkey CPI Inflation • Monday

From the end of 2018 and over the course of this year, inflation in Turkey has come down quite significantly. Prices hit a peak in October of last year, increasing a little over 25% on a year-on-year basis; however, in September CPI inflation fell to about 9.3%, the lowest since 2017. As a result of falling prices, the Central Bank of Turkey has opted to aggressively ease monetary policy, cutting its main policy rate 1,000 bps this year and signaling additional rate cuts could be coming. The pace of monetary easing from the central bank makes us a bit concerned, as too aggressive policy rate cuts runs the risk of sparking a push higher in inflation. In addition, we also have concerns surrounding the independence of the central bank as President Erdogan has looked to exert more influence over monetary policy decisions. If inflation continues on a downward trajectory, we would expect the central bank to cut rates again before the end of the year, which could place depreciation pressure on the lira.

Previous: 9.26% Consensus: 8.60% (Year-over-Year)

Australia Cash Rate • Tuesday

As the Australian economy has come under pressure as a result of U.S.-China trade tensions, a structural slowdown in China and domestic imbalances, the Reserve Bank of Australia (RBA) has embarked on a monetary easing cycle, cutting its main Cash Rate three times this year. At its most recent meeting in October, the RBA cut rates 25 bps, and again cited these developments as rationale. In addition, the RBA also highlighted the role that easier global monetary policy has played when making monetary policy decisions and cited rate cuts from major central banks as additional rationale for cutting its Cash Rate. However, the RBA signaled in October that Australia’s economy may be starting to improve as tax cuts and government infrastructure spending are becoming supportive of the economy. Despite the RBA’s more upbeat assessment of the domestic economy, we believe the RBA will hold rates steady next week, although move forward with a 25 bps rate cut in early 2020.

Previous: 0.75% Consensus: 0.75%

Canada Unemployment • Friday

Following a slowdown in 2018, Canada’s economy has performed relatively well throughout 2019. Perhaps the strongest part of the economy has been the labor market, with the unemployment rate falling to 5.5% in September. In addition, the pace of job creation remains solid, with the economy creating over 81,000 jobs in August alone, while over the course of the year, the large majority of jobs have been full-time positions. Another indicator we track, average hourly earnings, has also steadily increased this year, with wages firming to 4.3% year-over-year. A strengthening economy, along with a tight labor market, has provided the Bank of Canada (BoC) with rationale to keep policy rates on hold for now, while most major central banks have started monetary easing cycles. We currently forecast the BoC to cut rates in December; however, we note the basis for this forecast in not an assumption for a weaker labor market, but rather easier monetary policy from the Fed.

Previous: 5.5% Consensus: 5.5%

Point of View

Interest Rate Watch

FOMC Cuts Rates. Now What?

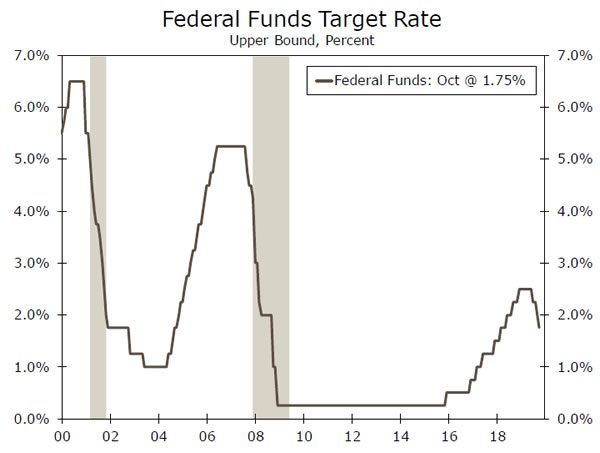

As widely expected, the Federal Open Market Committee (FOMC) decided at its policy meeting on October 30 to reduce its target range for the fed funds rate 25 bps. The rate cut was the third in as many consecutive meetings (top chart). The committee noted the “implications of global developments for the economic outlook as well as muted inflation pressures” as factors that supported its decision to cut rates.

But the FOMC also suggested that it may now be on hold, at least for the time being. Specifically, the committee vowed to “continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.” In other words, the FOMC does not appear to have a preconceived notion of how policy should evolve from here. Rather, it is in “data dependent” mode.

We continue to maintain our view that the FOMC will opt to keep rates on hold at its next policy meeting on December 11. The FOMC has cut rates 75 bps since July, and the committee may judge that a pause may be warranted to assess how the economy is responding to the delayed effects of previous easing. Moreover, continued dissents—the presidents of the Boston and Kansas City Federal Reserve Banks preferred again to keep rates on hold— indicate that the committee is not unified in the belief that additional easing is necessary at this time.

But we feel the conditions will be in place to induce the FOMC to cut rates one more time (by 25 bps) early next year. Real GDP in Q3- 2019 grew only 1.9% (annualized) on a sequential basis and 2.0% on a year-overyear basis. We forecast that real GDP will again grow at a sub-2% rate in Q4 (middle chart). Furthermore, inflation is benign (bottom chart) and inflation expectations remain below 2%. If, as we forecast, real GDP growth subsequently edges a bit higher next year, then we believe the committee will conclude that no further easing is needed after Q1-2020. But we also think that the FOMC will refrain from raising rates for the foreseeable future. In other words, interest rates likely will remain low for quite some time.

Credit Market Insights

Argentine Debt Under Pressure

Following the primary vote in Argentina, Argentine stock, bond and currency markets have slipped. The primary suggested president Mauricio Macri may lose in a relative landslide in the actual presidential election in October. The initial response to the primary vote was a 17% selloff in the Argentine peso, while yields on sovereign debt surged, including an increase to 12.65% from 9.51% on Argentina’s 100-year bond. Argentine bonds slipped again this week, after the Fernandez-Kirchner ticket won the presidential election, increasing market participants’ concerns of a further economic crisis, while raising fear that the country is heading toward default. Given Argentina’s sovereign debt is mainly denominated in dollars, euros and yen, the sharp selloff in the peso makes this debt more expensive to pay back. Adding to investor’s worries, Fernandez previously stated that he may seek to end Argentina’s bailout package with the IMF, which is likely necessary in order for the country to avoid defaulting on its debt obligations.

In an effort to stem peso depreciation after the election, Argentina’s government imposed even stronger capital controls, limiting dollar purchases to $200 per month from $10,000 per month. However, despite the central bank’s effort to protect the peso, we expect Argentina will default on its sovereign debt obligations in Q1-2020 given the future relationship with the IMF in question, and declining FX reserves in addition to Argentina’s unfavorable debt profile.

Topic of the Week

Holiday Sales Outlook

The “official” holiday shopping season starts on Black Friday, or the day after Thanksgiving, but today marks the start of the most crucial two months of the year for most retailers. Our Holiday Sales Outlook looks for holiday sales, which we define as total retail sales less sales at auto dealers, gasoline stations and restaurants, to rise 5% compared to last year (top chart). That’s a pretty sizeable gain, especially when you consider it is roughly a full percentage point ahead of the average annual increase for this expansion. But, a banner year for 2019 holiday sales says a lot more about where we have been than where we are going.

Let us not forget a 5% gain this year comes after last year’s dud of a sales season. After a pretty average gain in November 2018 holiday sales, December sales fell 2.7% which is the largest one-month decline in the measure since data started being collected in 1992. So what happened? The government shutdown was widely blamed for a steep sell-off in equity markets and the trade war was just getting underway. The jump in the personal saving rate is emblematic of consumers’ apprehension which resulted in the weakest annual increase in holiday sales of the current expansion.

The weak outturn in 2018 admittedly flatters the yearover- year comparisons for 2019 holiday sales figures. But still, consumers are positioned to spend. Equity markets soared to all-time highs this week and a majority of retailers have seen strong spending momentum headed into the holiday season. Compared to last year, holiday sales are up 3.7% on a year-to-date basis through September (bottom chart). The trade war, however, has only escalated, but the expansion of the trade war into consumer goods was timed to avoid impacting holiday spending, and we suspect that plan worked.

We expect a solid year fo

r holiday sales, but as this year passes, the pace of consumer spending is likely to slow as the moderation in consumer confidence begins to manifest itself in softer spending.

r holiday sales, but as this year passes, the pace of consumer spending is likely to slow as the moderation in consumer confidence begins to manifest itself in softer spending.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals