The price of crude oil declined after Saudi Aramco launched its long-awaited initial public offering. The IPO is expected to raise more than $60 billion by selling up to 3% of the company. Riyadh hopes that the IPO will value the company at $2 trillion while bankers handling the deal believe that a valuation of between $1.2 trillion and $1.5 trillion is more realistic. The company reported more than $111 billion in net income in 2018, making it one of the biggest in the world. Meanwhile, the market expects that Saudi and OPEC will slash production to push prices higher, which could lead to more interest in the company.

The USD index was relatively unchanged as Asian traders reacted to US jobs numbers released on Friday. The numbers showed that the economy added more than 128k jobs in October. Jobs growth was affected by the General Motors strike, which shaved close to 50k workers from employment rolls. Also, 20,000 temporary census workers were laid off. The unemployment rate moved up slightly to 3.6%, which is still close to a half-decade low. The dollar is also reacting to weak ISM manufacturing PMI data from the US. The number showed that the PMI remained in the contraction zone of 48.3. Later today, the market will receive factory order numbers from the US.

The euro rose slightly ahead of important PMI data from Europe. In Germany, the manufacturing PMI is expected to improve slightly by rising from 41.7 to 41.9. In Italy, the PMI is expected to decline from 47.8 to 47.6 while in Spain, it is expected to decline from 47.7 to 47.5. In the United Kingdom, the PMI is expected to improve slightly from 43.3 to 44.0. Meanwhile, in the European Union, the PMI is expected to remain unchanged at 45.7. Many traders believe that the European economy has bottomed. They believe that the region could see some strength as the new Christine Lagarde era starts.

EUR/USD

The EUR/USD pair rose slightly to a high of 1.1170, which is close to Friday’s high. On the hourly chart, the price is slightly above the 28-day and 14-day moving averages. The RSI is relatively unchanged at the current level of 58. The two lines of the Relative Vigor Index have declined to the neutral level. On the hourly chart, the pair is facing significant resistance.

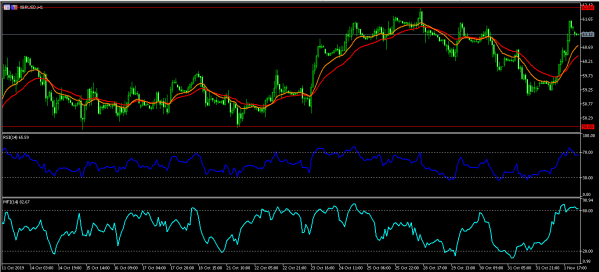

XBR/USD

The XBR/USD pair declined today as the market reacted to the Saudi Aramco IPO offering. The pair declined from Friday’s close of 61.60 to a low of 61.10. On the hourly chart, the pair is above the 14-day and 28-day moving averages and still close to the resistance level of 62.04. The money flow index remains at the overbought level of 80. The pair may remain at the current levels as traders reflect on the Aramco offering.

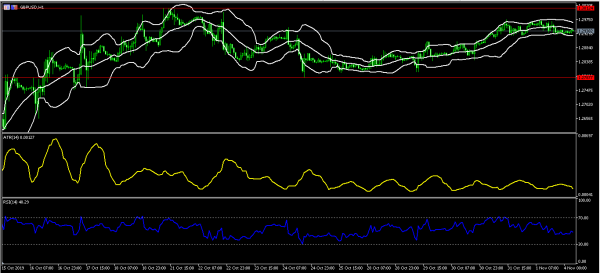

GBP/USD

The GBP/USD pair was relatively unchanged in the Asian session. The pair is trading at 1.2940, which is along the middle line of the Bollinger Bands. The average true range has remained weak while the RSI is neutral. The pair may see significant movements later this week as the Bank of England delivers its interest rates decision.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals