The pair rallies for the third straight day, boosted by fresh hopes on US/China trade deal that prompted investors into riskier assets.

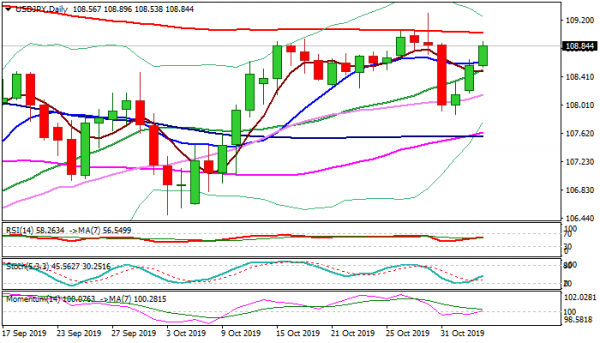

Last week’s strong fall after failure to clear 200DMA (109.02) was contained by daily Kijun-Sen (107.88) where the pullback off 109.28 spike high (30 Oct) bottomed and formed a higher low.

Fresh advance returned above daily Tenkan-sen (108.58) and pressuring again key 109 resistance zone.

Firm break above 200DMA is needed to complete corrective phase and expose another key barriers at 109.31/38 (1 Aug high/Fibo 61.8% of 112.40/104.44 fall) and weekly cloud (109.57/111.01), break of which would generate strong bullish signal for continuation of larger uptrend from 104.44 (26 Aug low).

Today’s close above daily Tenkan-sen is needed to keep bullish bias.

Daily momentum is breaking into positive territory and underpins the advance, along with north-heading stochastic and MA’s in bullish setup.

Res: 108.89, 109.02, 109.36, 109.57

Sup: 108.58, 108.25, 108.14, 107.88

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals