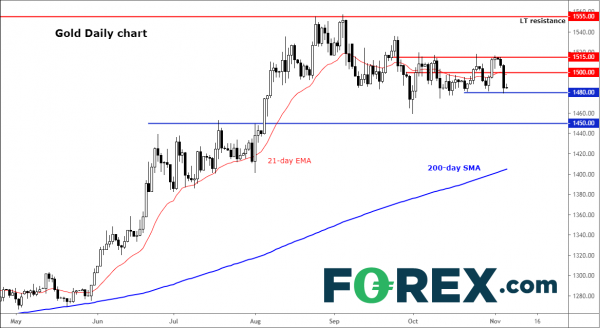

At the time of writing, gold was somewhat desperately trying to cling onto key support around $1480, finding mild support thanks to the stock market rally pausing for a breather. The precious metal fell sharply on Tuesday, partly because we saw further unexpected improvement in economic data and thawing of US-China trade frictions, both helping to underpin the buck and undermine haven assets. With bond prices falling and yields on the rise, investors are evidently reducing their expectations over aggressive rate cuts from global central banks. So, gold’s weakness makes some sense.

However, while further short-term falls look somewhat more likely than it did a couple of weeks ago, the longer-term outlook remains positive for gold. A potential trade deal might not be a bad thing for gold, after all. One has to remember that China is a big consumer of the precious metal. The prospects of a trade deal therefore boosts the physical demand outlook for gold both directly, and indirectly via a stronger yuan. So, I think the longer-term outlook remains supportive if you look at it from this angle. Also, with indices breaking to fresh multi-year or record highs in the face of declining earnings growth, the risks of a stock market correction rises by each passing day. A sharp retreat in equities should help to boost the appeal of safe haven gold.

But right now, the fundamental conditions are not as supportive as they had been before, and with Tuesday’s big drop the short-term technical outlook is also looking a bit more bearish now. A potential break and hold below key support at $1480 could pave the way for a drop to that longer-term support circa $1450. The bulls meanwhile will now want to see Tuesday’s losses being erased, or a distinct reversal pattern to unfold at lower levels first, before the short-term technical outlook turns positive again.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals