Key Highlights

- The British Pound started a decent recovery above 1.2850 against the US Dollar.

- GBP/USD surpassed a key bearish trend line at 1.2835 on the 4-hours chart.

- UK’s GDP grew 0.3% in Q3 2019 (Preliminary) (QoQ), better than the last -0.2%.

- UK’s Claimant Count could change 20.0K in Oct 2019, less than the last 21.1K.

GBP/USD Technical Analysis

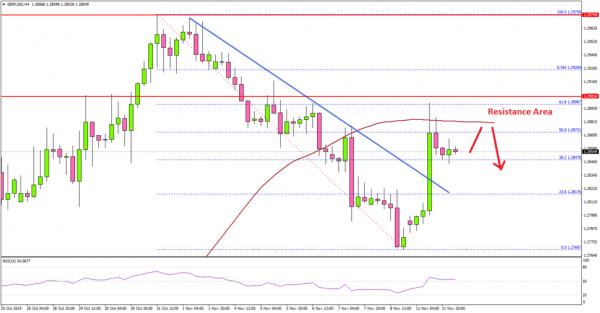

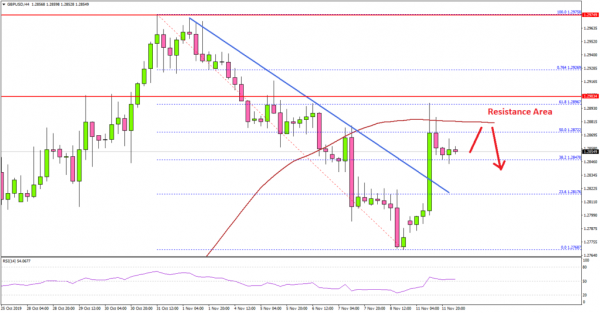

After a sharp decline, GBP/USD found support near 1.2770. As a result, the British Pound started a strong recovery and broke the 1.2800 and 1.2850 resistance levels against the US Dollar.

Looking at the 4-hours chart, the pair gained pace after it surpassed the 1.2800 and 1.2820 levels. During the recovery, the pair surpassed a key bearish trend line at 1.2835.

It even climbed above the 1.2850 resistance and the 100 simple moving average (red, 4-hours). Moreover, the pair broke the 50% Fib retracement level of the last decline from the 1.2975 high to 1.2768 low.

However, there are many hurdles on the upside near 1.2900 and 1.2920. Besides, the 76.4% Fib retracement level of the last decline from the 1.2975 high to 1.2768 low is at 1.2926.

If the pair continues to rise, it could even surpass the 1.2975 high and the 1.3000 resistance. Conversely, the pair could decline and revisit the 1.2850 support area. Any further losses may perhaps push GBP/USD towards 1.2820.

Fundamentally, the UK Gross Domestic Product report for Q3 2019 (Prelim) was released by the National Statistics. The market was looking for the GDP to grow by 0.4% compared with the previous quarter.

However, the actual result was lower than the forecast, the GDP grew at 0.3% in Q3 2019. However, it was much better than the last contracting quarter (-0.2%).

The report added:

GDP grew steadily in the third quarter, mainly thanks to a strong July. Services again led the way with construction also performing well. Manufacturing failed to grow as falls in many industries were offset by car production bouncing back following April shutdowns.

Overall, GBP/USD might correct a few pips before making an attempt to rise above 1.2620. Conversely, EUR/USD is still trading in a bearish zone below the 1.1080 level.

Upcoming Economic Releases

- UK Claimant Count Change Oct 2019 – Forecast 20.0K, versus 21.1K previous.

- UK ILO Unemployment Rate Sep 2019 (3M) – Forecast 3.9%, versus 3.9% previous.

- German ZEW Economic Sentiment Nov 2019 – Forecast -13, versus -22.8 previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals