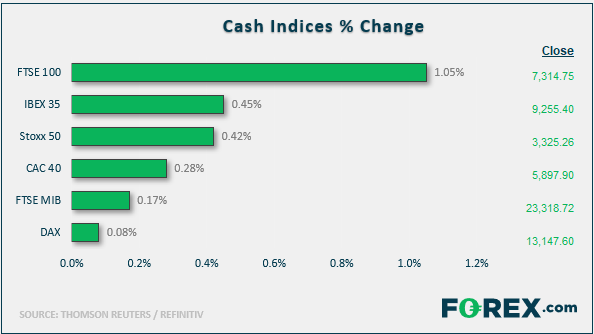

Market update: In FX, GBP and to a lesser degree EUR sold off this morning although both were off their worst lows but still down on the day following the earlier release of poor services PMI data from the UK and Eurozone. Stocks were higher, although mainland European indices came off their best levels while FTSE was up 1% at the time of writing, supported by a weaker sterling. Gold was up as German, UK and US 10-year yields fell, and the yen strengthened. Crude oil was a touch higher after two days of sharp gains. The price of Bitcoin dropped to its lowest level since May, reaching a low so far of $6930.

Christine Lagarde gave her first proper speech as ECB’s president and although she shied away from providing any significant hints about changes in interest rates, she did call for a strategic review of monetary policy in the near future and greater fiscal spending.

Data recap: the latest services PMI data from the UK and Eurozone disappointed expectations, hurting both the pound and the euro:

- The Eurozone Composite PMI unexpectedly fell to 50.3 in November from 50.6 in October, worse than expected

- Eurozone Manufacturing PMI remained in the contraction for the 10th consecutive month, coming in at 46.6 vs. 46.4 expected and 45.9 last.

- Eurozone Services PMI fell to a 10-month low of 51.5 vs. 52.2 last and 52.4 expected

- On a country level, French manufacturing PMI rebounded to expansion territory at 51.6 vs. 50.7 last, while services PMI was unchanged at 52.9. German manufacturing PMI improved to 43.8 from 42.1, while services PMI slowed to 51.3 from 51.6.

- UK Flash Services PMI printed 48.6 for November, suggesting the sector contracted. It fell more than one whole point from 50.0 in October and was also worse than 50.1 expected.

- UK flash Manufacturing PMI eases to 48.3 compared with 48.8 expected and 49.6 last.

Coming up:

- Canadian retail sales: headline expected to print -0.3% m/m vs. -0.1% last; Core expected to come in at -0.1% vs. -0.2% in the previous month

- US Markit Flash Manufacturing and Services PMIs, expected at 51.5 and 51.2 respectively

- Revised UoM Consumer Sentiment and Inflation Expectations

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals