Where are we at with US-China talks?

US-China. Risk overall continues to ebb and flow on US-China trade uncertainty and looks somewhat asymmetric, tilted to the downside, based on our view that the HK Bill if passed through the House of Reps could seriously complicate trade talks and the signing of phase 1. The HK Human Rights and Democracy Act is a direct obtrusion on China’s control of Hong Kong and may likely draw a response in kind from China. The need to rollback pre-existing tariffs, seen as major leverage for the US, could also further delay any phase 1 deal.

However, it’s not all doom and gloom as equities saw a calm finish last week off the back of a few positive notes. China extended an invite to the US to come to Beijing. Huawei received a 90-day license extension. And Vice-Premier Liu He said he was “cautiously optimistic”. Furthermore, China have announced their intention to increase penalties for IP theft (a major sticking point), though, how genuine this is remains to be seen.

Is the global manufacturing malaise stabilising?

China PMIs. Something to pay attention to late in the week. Another decline could seriously impinge on the soft landing narrative markets have been forming over the past few weeks and draw a market-negative reaction. As the recent batch of China activity data in October came out worse than expected, consensus for this print is currently 49.5, still in contractionary territory.

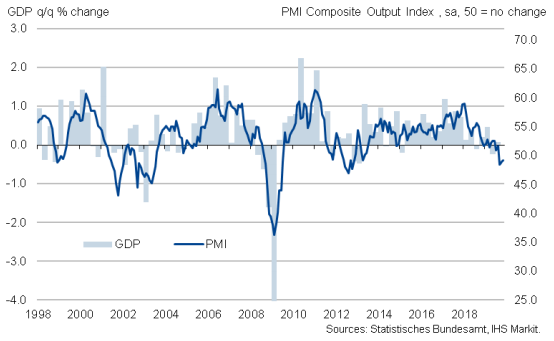

European PMIs. The major focus on Friday in German manufacturing sentiment saw a slight improvement, 43.8 vs 42.9 expected, possibly confirming expectations that the worse of Europe’s manufacturing downturn is over. However, services PMIs were a bit underwhelming. Keep watching this space.

US PMIs. Manufacturing sentiment remained strong in the US yet again coming in 52.2 vs 51.5 expected. If PMI data continues to favour the US, we think this lends a hand to a more constructive view on USD outperformance against G10 currencies.

Political risks intensify

A few developments over the weekend have made political risks more apparent for financial markets. In the UK, party manifestos outlining economic policies were released. Expectedly, Labour’s economic policies drew considerable attention and could be cause for concern for investors and businesses having detailed significant tax hikes to both individual and corporation. As it stands though, Conservatives still lead the polls ahead of the Dec. 12 election and we favour medium-term GBPUSD bullishness.

In the EU, Lagarde looks to take stock of the ECB’s current policy set-up and noted that they remain flexible going forward. Whether negative rates have run their course will be the key question investors want answered. Germany’s coalition government is looking tenuous also. EURUSD backs down to 1.1 from Friday trading.

In the US, Michael Bloomberg captured headlines by announcing his intention to run in the US 2020 presidential race. He’s coming late to the party, but his pro-business views and staggering wealth that makes him the 8th richest American should go some way to help his campaign.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals