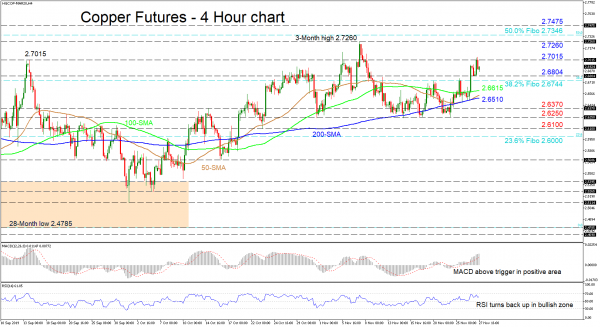

Copper futures are attempting to push back up to retest the 2.7015 resistance from the high of September 16, which halted gains from the bounce off the 200-period simple moving average (SMA).

Aiding the positive view are the 50- and 100-period SMAs that have held above the 200-period SMA and the recent upward turn in the slope of the 50-period SMA. Furthermore, the MACD, currently in the positive region, has distanced itself above its red trigger line, while the RSI is pointing up in the bullish territory.

If buyers persist, the price could move up to re-test the 2.7015 resistance and if overrun, the climb could stretch to the three-month high of 2.7260. Overcoming this peak, the 2.7346 level, which is the 50.0% Fibonacci retracement of the down leg from 2.9915 to 2.4785, could halt further advances towards the 2.7475 resistance.

To the downside, the bears would initially need to steer below the recent swing low at 2.6804 and the nearby 38.2% Fibo of 2.6744. Moving lower, the 100-period SMA at 2.6615 and the 50- and 200-period SMAs around 2.6510 could halt the descent towards the 2.6370 support. Surpassing this, the commodity could face significant upside pressure from a key support barrier of 2.6250, which would need to give way for the 2.6100 obstacle to unfold.

Summarizing, copper futures are neutral-to-bullish and a break above the 2.7260 peak would strengthen this view. However, if the price were to drop below 2.6250, the bias may turn neutral-to-bearish.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals