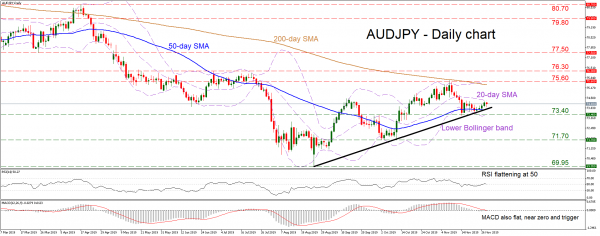

AUDJPY has been posting higher highs and higher lows above a medium-term uptrend line since late August, when the pair touched 69.95, its lowest level in a decade. The short-term outlook therefore seems to have turned positive, though a decisive break above 75.60 is needed to confirm that.

Short-term oscillators paint an entirely flat picture, providing no signals about directional momentum. The RSI is flatlining near its neutral level, while the MACD is hovering near zero and its red trigger line.

If the bulls take the reins again, their first obstacle may be the intersection of the 75.60 zone, the 200-day simple moving average (SMA), and the upper Bollinger band. An upside violation would signal the continuation of the recent uptrend, turning the focus to 76.30.

If sellers stay in charge and manage to penetrate below the crossroads of the 73.40 area, the uptrend line drawn from the August lows, and the lower Bollinger band, that would turn the bias back to neutral, setting the stage for more declines. In that case, the October lows at 71.70 may be the next target.

In short, the short-term picture now looks positive, though a move above 75.60 is required to reaffirm that. On the contrary, a break back below 73.40 would bring the positive outlook into doubt.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals