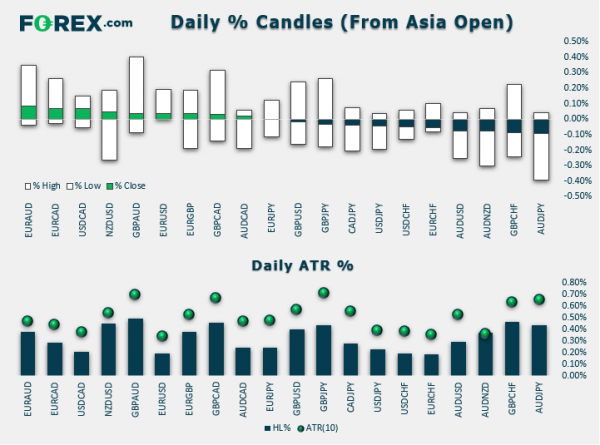

Market update at 13:30 GMT: The AUD and GBP were the weakest while EUR was the strongest in another lacklustre session for FX; European stocks were off their worst levels but still lower on the session. Gold and silver were flat and oil a touch lower following yesterday’s drop.

GBP gave back some gains following its late upsurge yesterday when it found support on the back of the MRP election poll, predicting a 68-seat Tory majority. This is considered to be more accurate than standard polls and if it turns out to be correct then Brexit will likely be ratified by Parliament and the UK leaves the EU with a deal by January 31. But as accurate as MRP might be, traders are taking no chances – and so profit-taking caused sterling to dip again. However, it was testing $1.2900 support at the time of writing, so it had an opportunity to rebound.

AUD was hurt by weaker-than-expected Australian capex data

JPY remained near its recent lows as Japanese retail sales slumped at their fastest pace in 4.5 years in response to the new sales tax hike.

Thanksgiving Day in the US means Wall Street is closed for trading and economic calendar is light – hence, there was a data dump in the US yesterday and probably why Donald Trump decided to sign the Hong Kong bill into law, hoping it will go unnoticed. BUT it didn’t. US stock index futures dropped, leading falls for Asian and European stocks on Thursday. But although China has vowed to retaliate, its Foreign Minister said Beijing will take firm counter measures if the US continues in this way. This suggests the signed bill may not be too detrimental to trade negotiations after all. The FTSE had found support in recent days on relief from dwindling chances that Labour can win Britain’s election. However, along with global shares, the UK benchmark index has been hit by some profit taking and selling pressure.

Stocks on the move by my stock market expert colleague Ken Odeluga:

- Severn Trent, United Utilities and Pennon led the declines in London as utility shares fell the hardest.

- Virgin Money surged as much as 28%, its biggest one day gain ever. Though the financial services group booked an £194m full-year loss, its PPI charge was below estimates and net interest margin beat expectations. It will consider resuming dividend pay outs in 2020.

- Go-Ahead Group, a UK transportation firm, dropped 4% after a trading update pointed to slightly weaker than expected regional bus performance.

- Pebble Group, a media firm, says its planned IPO on small-cap market AIM is fully subscribed, with a max offer of £135m. Trading will commence on 5th December

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals