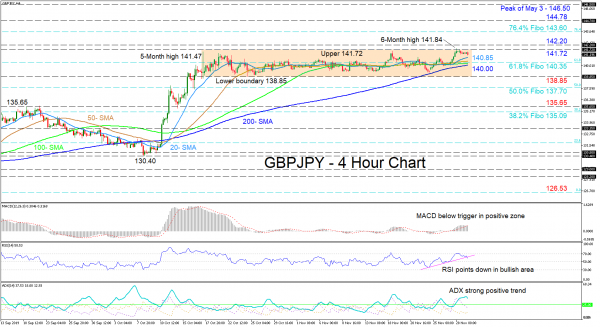

GBPJPY’s recent bounce off the 200-period simple moving average (SMA) pushed the price above the other SMAs but was halted at the 141.72 upper boundary of the range, where momentum seems to have faded again. The pair continues to be confined in a sideways move between 138.85 and 141.72, which commenced on October 17.

The short-term oscillators reflect the stall in the positive directional momentum. The MACD, in the positive region, has slipped below its red trigger line, while the RSI, in the bullish zone, has declined below the uptrend line. However, the ADX indicates a strong positive trend is still in place, concurring with the view from the rising 200-period SMA.

If sellers pick up, immediate support could come from the tough region of 140.85 to 140.00, consisting of the 61.8% Fibonacci retracement of the down leg from 148.86 to 126.53 and all the SMAs. Surpassing this, the lower boundary at 138.85 may challenge the bears ahead of the 50.0% Fibo of 137.70. Diving lower, the 135.65 swing low area and neighboring 38.2% Fibo at 135.09 could halt further declines.

Otherwise, if buyers resurface, initial downside pressure could come from the 141.72 and 142.20 barriers ahead of the 76.4% Fibo of 143.60. Overcoming this, next to restrict the climb is the 144.78 resistance before the pair can stretch to test the peak of 146.50 from May 3.

Overall, the short-term bias is neutral-to-bullish. A break above 141.72 or below 138.85 would reveal the next direction.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals