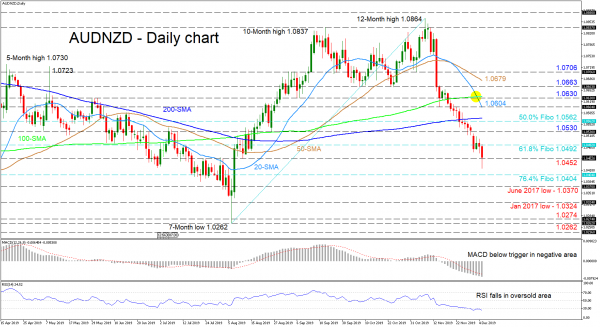

AUDNZD bears seem to be in control after the reversal at the twelve-month peak of 1.0864 and the break below the 1.0663 low – having dropped past all simple moving averages (SMAs) – turning the medium-term bias back to a mostly neutral phase.

Even though the pair has encountered some upside pressure at the 1.0452 level, the short-term oscillators concur with the negative picture and continue to reflect strong negative momentum in place. The MACD, in the negative region, is falling/increasing below its red trigger line, while the RSI declines in the oversold territory. However, traders need to be aware of the RSI in the oversold zone, in case buyers pick up.

If sellers steer the price below the 1.0452 low, support could come next at the 1.0404 level, which is the 76.4% Fibonacci retracement of the up leg from 1.0262 to 1.0864. If the bears persist, the 2017 lows of 1.0370 and 1.0324, from June and January respectively, could halt further loss of ground towards the 1.0262 low region.

Alternatively, if buyers retake the reins and push back up past the 61.8% Fibo of 1.0492, the 1.0530 resistance could be next to resist advances. If surpassed, the fortified 1.0562 level – where the 50.0% Fibo and 200-day SMA lie – could halt further gains towards the inside swing low of 1.0604, where the 20-day SMA is also currently located.

In brief, the short-term bias is bearish holding below the 1.0492 level, with a decisive break below 1.0452 reinforcing the negative picture.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals