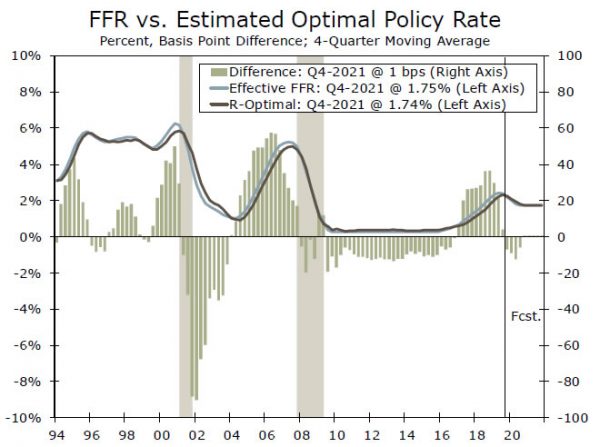

The FOMC’s recent rate cuts have brought the fed funds rate closer to our estimation of the optimal policy rate. In line with our forecast, this suggests the Fed should remain on hold for the foreseeable future.

Reassessing What is Optimal

With the recent de-escalation in trade tensions, we have revised our forecast of the federal funds rate and now expect the FOMC will keep rates unchanged through 2021. Following this change and the swing in the stance of monetary policy over the past year, we have also updated our estimation of the appropriate Fed funds target rate, r-optimal.1

Estimating this optimal rate relative to the effective fed funds rate can help compare monetary policy across different economic cycles and provide some insight to the path of policy going forward. When the effective fed funds rate rises above our estimate of the optimal rate, this suggests that monetary policy is too tight, given the inflationary pressures in the economy and the probability of recession at that time. This often occurs when the FOMC embarks on hiking cycles to prevent the economy from overheating. For instance, in 2000 and 2006, the FOMC raised the rates well beyond r-optimal, exceeding our estimate of the appropriate fed funds rate by 50 bps or so on a four-quarter moving average basis. In both cases, the economy subsequently entered recession. In mid 1990s, the FOMC pushed the effective fed funds rate to around 6%, beyond what our model estimates to be appropriate for that time. The U.S. economy avoided recession following these rate increases, however, at least in part due to the FOMC’s decision to take back some of its increases with 75 bps of easing in 1995 and 1996.

At the end of 2018, the Fed found itself in a familiar position. After hiking rates four times over the year, the FOMC had pushed the fed funds rate almost 40 bps, on a four-quarter moving average basis, beyond our estimate of r-optimal. Increasing trade uncertainty and deteriorating growth abroad, however, ultimately pushed the FOMC to follow a path similar to the 1990’s mid-cycle adjustment. By signaling a shift in policy and cutting rates by 75 bps over three meetings, the FOMC helped assuage fears of recession and revitalize the nation’s struggling housing sector.

If It Ain’t Broke, Don’t Fix It

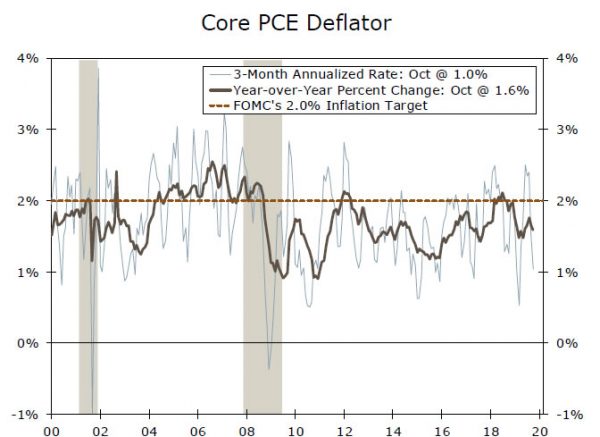

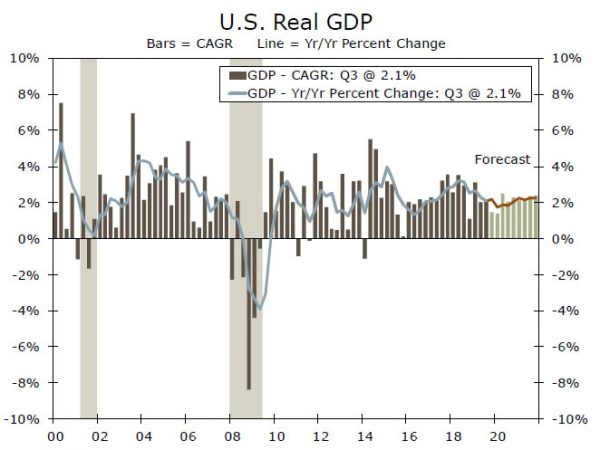

These rate cuts have also put the fed funds rate on a path to coincide with our estimate of the optimal policy rate. This means that if the economy gradually improves in line with our forecast over the next two years, the FOMC should have no need to adjust interest rates through 2021. If real GDP growth should come in significantly stronger than our expectations, then the Fed could begin to discuss hiking rates. But that process probably would not begin until 2021. Moreover, the FOMC is far more likely to risk being too accommodative rather than too tight. As Chairman Powell noted in his December press conference, inflation has repeatedly run below the Fed’s 2.0% inflation target and failing to hit this target on a sustained basis could push inflation expectations even lower.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals