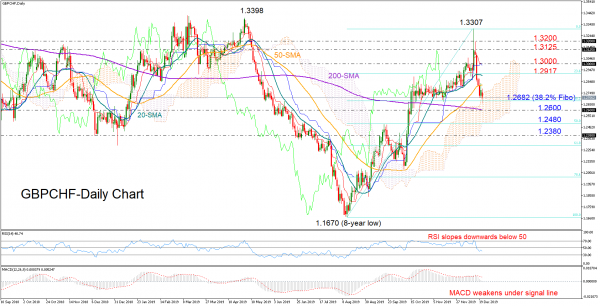

GBPCHF lost significant ground and dived below its 20- and 50-day simple moving averages (SMAs) after unsuccessfully attempting to grow into the 1.3300 region.

The market is currently trading in bearish waters according to the RSI, which is strengthening to the downside and below 50, while the slowing MACD that deviates under its red signal line endorses the negative correction as well.

The 38.2% Fibonacci of 1.2682 of the 1.2670-1.3307 bullish wave is keeping the bears under control at the moment. If it soon gives up, letting the sell-off to continue, the 200-day SMA at 1.2600 could next come in defence. Failure to hold above the latter, would bring the 50% Fibonacci of 1.2480 under the spotlight, while slightly deeper the 1.2380 area could next unfold.

On the upside, the pair needs to surpass the 23.6% Fibonacci of 1.2917 to retest the 1.3000 level. Breaking higher, the area between 1.3125-1.3200 could capture the bulls ahead of the 1.3300 mark.

In the medium-term picture, the pair maintains an uptrend despite the recent sharp pullback. For that to change, the price would have to retreat below 1.2480.

In brief, GBPCHF is expected to trade bearish in the short-term, while in the medium-term, the positive outlook is likely to stay intact as long as the market holds above 1.2480.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals