The Santa rally continued on Wall Street as investors remained optimistic about US-China trade relations in 2020. This followed a statement by a Christmas Eve message from Donald Trump, who said that the ‘deal is done and being translated.’ A Chinese official said that the two sides were in close contact and close to a signing ceremony. The Nasdaq reached an important level of $9,000 for the first time ever. It made its 11th consecutive day of positive returns. The S&P500 rose by 0.5% while the Dow gained by 0.4%.

The Japanese yen strengthened against the USD after the country released a series of data earlier today. The unemployment rate improved to 2.2% from the previous 2.4% while the Tokyo headline CPI rose by 0.8%. The country’s flash PMI data for December showed a decline of -0.9%. This is an improvement from the previous decline of -4.5%. The industrial production forecast for December rose by 2.5% from the previous 1.1%. Meanwhile, retail sales declined by -2.1% from the previous -7.0%.

The price of crude oil continued to rally as positive Wall Street gains raised hopes of high demand in 2020. It is trading at the highest level since September this year. This is in response to the OPEC decision to slash production during the meeting held this month. The cartel decided to cut oil production by about 500k barrels a day until March. This added to the existing 1.2 million barrels. The market will receive the final inventory data for the year. The market expects inventories to decline by more than 1.72 million barrels.

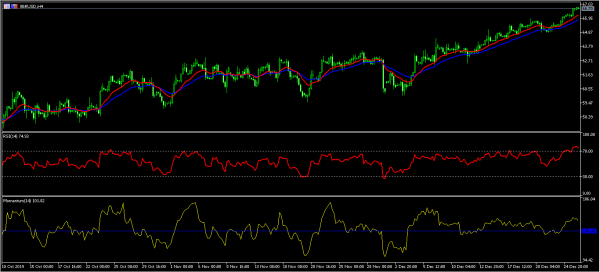

XBR/USD

The XBR/USD pair rallied to a high of 66.72, which is the highest level since September this year. The price is above the 14-day and 28-day moving averages. The RSI moved to the overbought level of 70 while the momentum indicator remained above 100. The Parabolic SAR is below the price. There is a likelihood that the pair will continue moving higher.

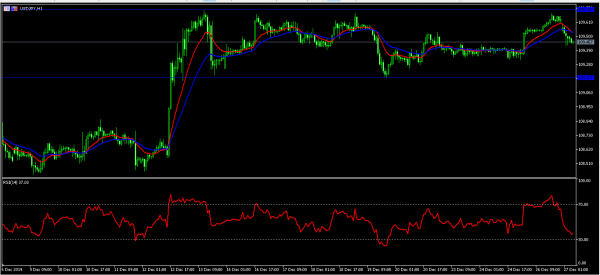

USD/JPY

The USD/JPY pair declined and reached a low of 109.45 from yesterday’s high of 109.68. The drop was in reaction to the better Japan unemployment rate. The price is below the 14-day and 28-day moving averages. The RSI has moved from a high of 73 to a low of 36. The price is still between the support and resistance level of 109.77 and 109.71. The pair may continue moving lower today.

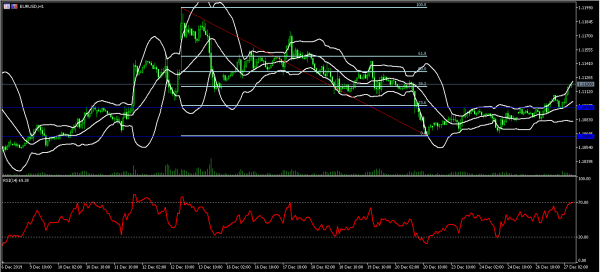

EUR/USD

The EUR/USD pair rose to a high of 1.1120. As the pair rose, it moved above the previous channel of 1.1095 and 1.1065. The price is along the 38.2% Fibonacci Retracement level. The price is along the upper line of the Bollinger Bands while the RSI has moved to the overbought level of 70. The pair may continue moving higher to test the important 50% Fibonacci Retracement level of 1.130.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals