The economic calendar will only marginally get busier in the coming week and trading volumes are not expected to pick up much as New Year celebrations get underway. However, key manufacturing gauges out of China and the United States could spoil the festive rally in equities as trade deal optimism continues to support risk assets heading into 2020. Meanwhile, in FX markets, the threat of another flash crash similar to the one seen in January 2019 will likely keep traders on edge.

No improvement anticipated in Chinese PMIs

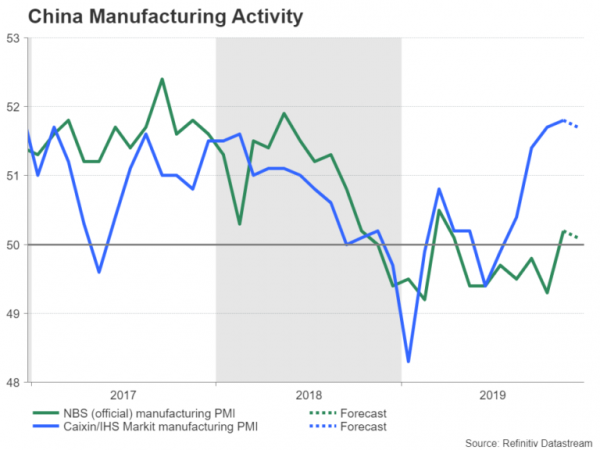

China’s official manufacturing PMI will hit the markets on Tuesday, but with the economy still appearing to be slowing, the data may not be how traders would want to bid farewell to 2019 on the last trading day of the year. The non-manufacturing PMI is also released the same day, while the Caixin/Markit manufacturing PMI is due on Friday.

Although both the official and Caixin/Markit PMIs have shown signs of stabilization in China’s trade war-hit manufacturing sector, there are doubts as to how sustainable this improving picture is given that the ‘phase one’ deal won’t remove much of the tariffs imposed by the US on Chinese imports and the global economy remains on a shaky ground.

The official manufacturing PMI is forecast to slip 0.1 points to 50.1 in December and the Caixin/Markit is expected to dip by the same amount to 51.7.

Worse-than-expected numbers in the PMIs could cause some New Year jitters, with the Australian dollar being the main victim from any spike in risk aversion, though it would probably require a big miss in the forecasts to offset the current positive sentiment. The aussie hit a 5-month high this past week and with the currency looking a little overbought, a sell-off could see it tumbling back towards the $0.69 level.

Quiet week in Europe

It will be another sleepy week in Europe with the final readings of IHS Markit’s manufacturing PMIs for December being the only highlight. The lacklustre agenda may turn markets’ attention on domestic German data as investors fret about the health of the Eurozone’s growth engine.

The German data will start the week on Monday, with November retail sales up first, followed by unemployment numbers for the same month on Friday, as well as the flash inflation print for December.

On Thursday, the final manufacturing PMIs for December are published for the Eurozone and the United Kingdom. No revision is expected to the Eurozone’s preliminary reading of 45.9 but the UK’s PMI is predicted to be revised up slightly to 47.6. The UK will also see the release of the construction PMI for December on Friday.

Recent figures out of the Eurozone have been mostly encouraging with increasing signs that the economic slowdown is bottoming out. However, neither is there any evidence that growth is about to kick off into full gear and recession risks persist, particularly in Germany.

Recession fears are also lingering in the UK as the threat of a ‘no-deal’ or a ‘hard’ Brexit are keeping investors nervous about the outlook for the British economy as lawmakers prepare to rush through Boris Johnson’s Withdrawal Agreement in Parliament before the January 31 deadline.

Hence, next week’s releases have the capacity to trigger some spikes in the euro and the pound if there are large deviations from the forecasts, amid the still-many uncertainties and the thin liquidity in the holiday period. The pound has managed to stabilize from its steep selloff that was brought on from Johnson setting a hard deadline to strike a post-Brexit trade deal with the EU and is on track to finish the year with more than 2% gains versus the US dollar. However, the euro’s recent rebound hasn’t been enough to recoup its year-to-date losses versus the greenback and is on track to end 2019 down by almost 3%.

Spotlight on ISM manufacturing PMI

The US will have a somewhat busier seven days, providing some excitement for the markets as the festivities begin to wind down. The main spotlight will be on the closely watched ISM manufacturing PMI on Friday, but the Conference Board’s consumer confidence index due on Tuesday will also be important.

The ISM’s Purchasing Managers’ Index has been pointing to a contraction in the manufacturing sector since August and the consensus forecast is for a fifth straight reading below 50 in December. However, the PMI is projected to tick up slightly, from 48.1 to 49.0, which would suggest an easing of the pace of decline in manufacturing activity.

Any unexpected weakness could spark fresh worries about the American economy as well as raise doubts about the speed of any recovery now that a ‘phase one’ trade deal is pretty much a done deal. However, as long as consumption data remain solid, the reaction to poor manufacturing numbers is likely to be contained.

After last week’s upbeat personal income and spending figures, the consumer confidence indicator is expected to further reassure investors that consumption is still going strong in the US. The index is forecast to increase to 128.5 in December from 125.5 in November.

Before all that, the Chicago PMI for December and pending home sales for November will attract some attention on Monday. Also to watch are the Federal Reserve’s minutes of the December meeting on Friday. The minutes aren’t expected to reveal anything new on the Fed’s current stance on monetary policy so traders will mostly be focusing on what the data will be telling about the state of the US economy as it enters 2020.

The dollar has been on the backfoot since news of an interim trade deal with China first emerged as it’s lost some of its safe-haven allure, standing firm only against the Japanese yen – another haven currency. And although if there are more positive US reports in the coming weeks, this should continue to limit dollar selling, there is a risk of steeper declines if the trade optimism holds and the economic outlook for the rest of the world starts to brighten. On the other hand, if US data disappoint but it comes against a backdrop of weaker growth elsewhere, this is likely to provide stronger support for the greenback as it would feed the narrative that the US has the least ugly economy in the world.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals