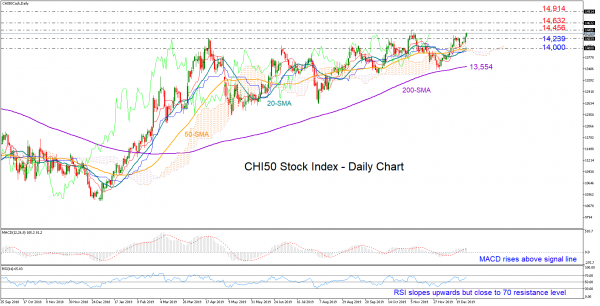

ChIna’s 50 stock index (CHI50) closed the year slightly below the 2019 top of 14,456 on Tuesday.

Technically, the positive momentum in the MACD, which jumped above its red signal line, suggests that there is still some room for improvement in the short-term. The RSI is bullish as well, though the indicator is not far below its 70 overbought mark which previously acted as resistance, hinting that any additional upside move may come softer in the coming sessions.

Therefore, in the short-term all eyes will be on 14,446, which if violated could re-activate the positive outlook in the bigger picture and push the index up to the 14,632 barrier. More interestingly, a steeper increase may finally challenge the 2018 top of 14,914.

In case the bullish action fades and the price drops below 14,239, traders would like to see a closure below 14,000 to reduce exposure in the market, with support probably arising next somewhere near the 200-day simple moving average (SMA) currently at 13,554 – a familiar support area for bearish actions in the past.

In brief, CHI 50 stock index is facing a bullish bias in the short-term, though it remains to be seen whether the market can overcome this year’s peak, improving the outlook in the bigger picture too.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals