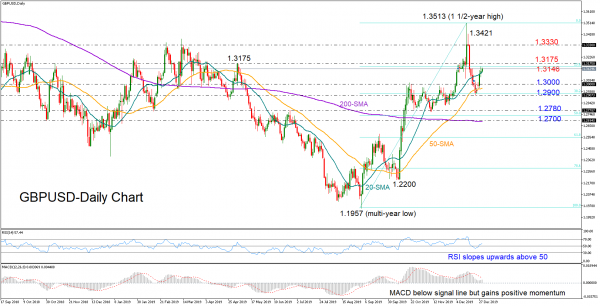

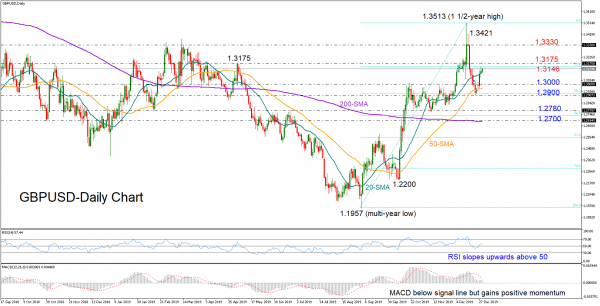

GBPUSD is pushing on with efforts to correct the sharp sell-off off the 1 ½-year high of 1.3513 which led to 1.2900 last week.

The price has returned into the 1.3100 territory and is trying to expand above the 20-day simple moving average (SMA). However even though the RSI and the MACD are holding an upward direction, questions are arising as to whether the bulls are strong enough to overcome the 1.3146-1.3175 area, which includes the 23.6% Fibonacci of the 1.1957-1.3513 area.

Failure to clear the 1.3146-1.3175 region could bring the bears back into play, with the price probably retreating to retest the 1.3000 level and then the 1.2900 mark, around which the 38.2% Fibonacci is nearby. Breaching the latter, the downfall could stretch towards 1.2780, while slightly lower the 200-day SMA at 1.2700 will be closely watched for a steeper decline if violated.

In the positive scenario, where the bulls dominate above 1.3175, the price may attempt to close above 1.3330 as it did earlier this month. In case it succeeds this time, the door would next open for 1.3400, where any move higher could meet a tougher wall at the 1.3513 peak.

Turning to the three-month picture, the pair is holding a bullish profile reflected by the higher highs and higher lows since the market bottomed at 1.1957. With the 50-day SMA trending upwards and above the longer-term 200-day SMA, hopes that the market may maintain its positive direction remain alive.

Summarizing, GBPUSD’s recent rebound is likely to be short-lived in the short-term if the price fails to overcome the 1.3146-1.3175 zone. Yet, in the medium-term picture, technical signals are still encouraging for the positive outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals