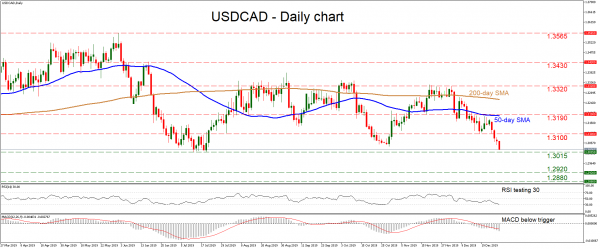

USDCAD posted significant losses in recent days, with the pair now looking ready to test the 2019 low of 1.3015 at any moment. If sellers manage to pierce and close below that zone, that would turn the broader picture to negative, setting the stage for more declines in the New Year.

Short term momentum oscillators are endorsing the bearish picture. The RSI is currently testing its 30 line, while the MACD – already negative – is also below its red signal line.

If the pair drops and closes below 1.3015, the next target for the sellers might be the 1.2920 zone, marked by the low on October 16, 2018. A downside break would turn the attention to 1.2880, the September 20, 2018 trough. Even lower, the October 2018 low of 1.2780 might provide support as well.

Should the bulls take the wheel, their first obstacle to the upside would likely be the 1.3100 handle, where a positive violation could bring the intersection of the 1.3190 area and the 50-day simple moving average (SMA) into play next.

In short, a clear move below 1.3015 would mark a lower low on the daily chart, turning the broader outlook to bearish.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals