European majors stage a strong come back today as supported by positive data. Germany investor confidence recorded a strong rebound while UK PMI services was revised up. On the other hand, despite continuous risk aversion on Middle East tensions, Yen is pairing some of last week’s gains. Dollar follows and turn soft too. Gold and oil prices are off day high but remain firm.

Technically, EUR/USD is staying in consolidation from 1.1239 temporary top. Further rise is expected through this resistance. But we’d likely see some more consolidations first. EUR/JPY recovered strongly ahead of 119.99 support, maintaining near term bullishness. Further rise remains in favor through 122.65 resistance at a later stage. USD/CHF’s recovery is held well below 0.9977 resistance and near term outlook stays bearish.

In Europe, currently, FTSE is down -0.83%. DAX is down -1.27%. CAC is down -0.93%. German 10-year yield is down -0.0147 at -0.295, defending -0.3 handle. Earlier in Asia, Nikkei dropped -1.91%. Hong Kong HSI dropped -0.79%. China Shanghai SSE dropped -0.01%. Singapore Strait Times dropped -0.62%. Japan 10-year JGB yield dropped -0.0148 to -0.031.

Germany still trying to save JCPoA, Iran nuclear deal

German appears to be still trying to save the JCPoA (Joint Comprehensive Plan of Action, or the Iran nuclear deal. Foreign Ministry spokesman said “our goal remains to save the agreement. We are in talks on that.” EU foreign affairs chief Josep Borrell also said he regretted Iran’s move and emphasized, “full implementation of Nuclear Deal by all is now more important than ever, for regional stability & global security.”

On Sunday, Iran’s state television announced to step further away from the 2015 nuclear deal. The limits set down regarding the country’s nuclear work will no longer be respected., from uranium enrichment centrifuges to its enrichment capacity, the level to which uranium could be enriched, the amount of stockpiled enriched uranium or Iran’s nuclear Research and Development activities.

Eurozone investor confidence rose to 7.6, investors making advance concessions to hard data

Eurozone Sentix Investor Confidence rose to 7.6 in January, up form 0.7, above expectation of 3.0. That’s also the third consecutive rise, and the highest level since November 2018. Current Situation Index rose from -1.0 to 5.5, third increase in a row, highest since June 2019. Expectations Index rose from 2.5 to 9.8, also the third increase in a row, highest since February 2018.

Sentix said: “This development is remarkable in two respects. For one thing, investors are once again making advance concessions to the ‘hard’ data. The manufacturing sector in particular is not yet showing any convincing signs of an upswing, at best signs of stabilization.”

Eurozone PMI composite finalized at 52.8, worst quarter since 2013

Eurozone PMI Services was finalized at 52.8 in December, up from November’s 51.9. PMI Composite was finalized at 50.9, up from November’s 50.6. Looking at the member states, Italy PMI Composite hit 11-month low at 49.3. Germany PMI Composite recovered to 50.2, revised up from 49.4, hitting a 4-month high. France PMI Composite dropped to 3-month low of 52.0.

Chris Williamson, Chief Business Economist at IHS Markit said: “Another month of subdued business activity in December rounded off the eurozone’s worst quarter since 2013. The PMI data suggest the euro area will struggle to have grown by more than 0.1% in the closing three months of 2019.” He added, “while the tide may be turning, downside risks to growth in the year ahead nevertheless remain notable. While US-China trade wars have eased, any escalation of trade tensions between the US and Europe will likely hit exports further. Brexit also remains a major uncertainty and is likely to continue to dampen growth in Europe. Nonetheless, in the absence of any major adverse developments we expect to see growth starting to improve as 2020 proceeds, with low inflation and easing financial conditions supporting consumer spending in particular.”

Also released, Eurozone PPI came in at 0.2% mom, -1.4% yoy in November versus expectation of 0.0% mom, -1.6% yoy. Germany retail sales rose 2.1% mom in November vs expectation of 1.0% mom.

UK PMI services finalized at 50.0, overall stagnation of UK economy at the end of 2019

UK PMI Services was finalized at 50.0 in December, up from November’s 49.3. PMI Composite was unchanged at 49.3. Stabilization of the service sector was offset by a sharp and accelerated decline in manufacturing output (index at 45.6).

Tim Moore, Economics Associate Director at IHS Markit, said: “The latest PMI surveys collectively signal an overall stagnation of the UK economy at the end of 2019”. But “it is notable that the forward-looking business expectations index is now the highest since September 2018 and comfortably above its ‘flash’ reading for December. The modest rebound in new work provides another signal that business conditions should begin to improve in the coming months, helped by a boost to business sentiment from greater Brexit clarity and a more predictable political landscape.”

Japan PMI manufacturing finalized at 48.4, negatively contribute to GDP to Q4

Japan PMI Manufacturing was finalized at 48.4 in December, down from November’s reading of 48.9. Key findings include: 1) Production Cut at strongest rate since March; 2) Weak domestic and external conditions weigh on demand; 3) Output charges reduced as firms try to stimulate sales.

Joe Hayes, Economist at IHS Markit, said: “Japan’s manufacturing sector has ended 2019 where it started, stuck in contraction with little hope of an imminent turnaround. Taking all fourth quarter survey data as one, the manufacturing economy has endured its worst performance in over three years, with momentum clearly to the downside heading into 2020… Overall, the manufacturing sector appears set to negatively contribute to GDP in the fourth quarter and, if considered in tandem with the December flash services PMI figures, the chance of an economic contraction in the fourth quarter looks strong.”

China PMI services dropped to 52.5, overall economy continued to stabilize

China Caixin PMI Services dropped to 52.5 in December, down from 53.5, missed expectation of 53.2. PMI Composite fell fro a 21-month high of 53.2 to 52.6. Markit said December saw softer, but still strong, rise in business activity. Total new work continued to rise solidly. Output charges rose in manufacturing sector, but fell at services companies.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “Rates of expansion in both the services and manufacturing sectors moderated. However, China’s overall economy continued to stabilize… Looking forward, the phase one trade deal between China and the U.S. should be able to help corporate sentiment recover. China’s economy is likely to get off to a quick start in 2020, but it will still be constrained by limited demand for the rest of the year.”

EUR/USD Mid-Day Outlook

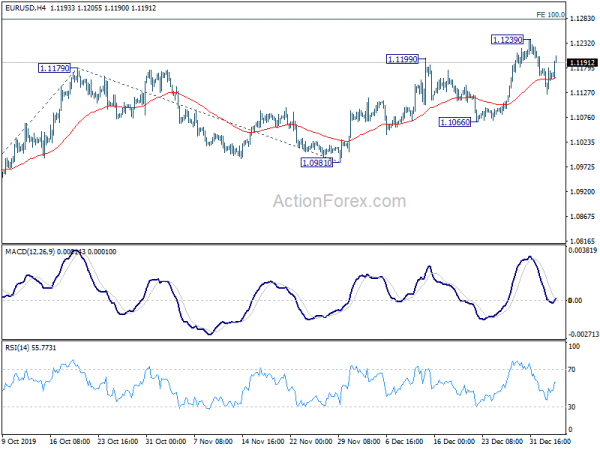

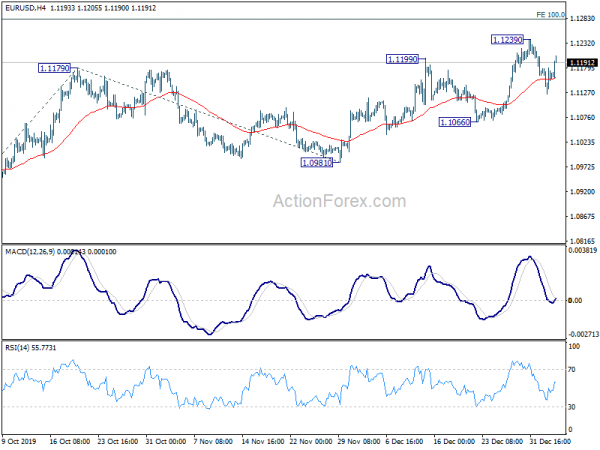

Daily Pivots: (S1) 1.1127; (P) 1.1154; (R1) 1.1182; More…

EUR/USD rebounds strongly today but stays below 1.1239 temporary top. Intraday bias remains neutral first. With 1.1066 support intact, near term outlook stays bullish and further rally is in favor. On the upside, above 1.1239 will extend whole rally from 1.0879 to 100% projection of 1.0879 to 1.1179 from 1.0981 at 1.1281 next. However, on the downside, break of 1.1066 will suggest that whole rise from 1.0879 has completed. In this case, intraday bias will be turned back to the downside for 1.0981 support for confirmation.

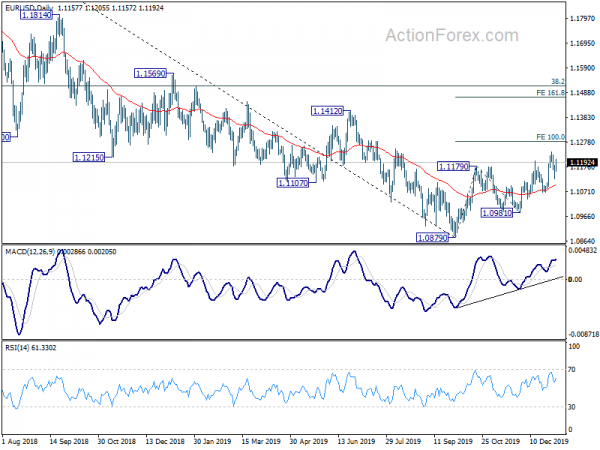

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Mfg Index Dec | 48.3 | 48.1 | ||

| 00:30 | JPY | Jibun Bank Manufacturing PMI Dec F | 48.4 | 48.8 | ||

| 01:45 | CNY | Caixin Services PMI Dec | 52.5 | 53.2 | 53.5 | |

| 07:00 | EUR | Germany Retail Sales M/M Nov | 2.10% | 1.00% | -1.90% | |

| 08:15 | EUR | Spain Services PMI Dec | 54.9 | 53.9 | 53.2 | |

| 08:45 | EUR | Italy Services PMI Dec | 51.1 | 51.1 | 50.4 | |

| 08:50 | EUR | France Services PMI Dec | 52.9 | 52.4 | 52.4 | |

| 08:55 | EUR | Germany Services PMI Dec | 52.9 | 52 | 52 | |

| 09:00 | EUR | Eurozone Services PMI Dec | 52.8 | 52.4 | 52.4 | |

| 09:30 | EUR | Eurozone Sentix Investor Confidence Jan | 7.6 | 3 | 0.7 | |

| 09:30 | GBP | Services PMI Dec | 50 | 49.2 | 49 | |

| 10:00 | EUR | Eurozone PPI M/M Nov | 0.20% | 0.00% | 0.10% | |

| 10:00 | EUR | Eurozone PPI Y/Y Nov | -1.40% | -1.60% | -1.90% | |

| 13:30 | CAD | Raw Material Price Index M/M Nov | 1.50% | -1.90% | ||

| 13:30 | CAD | Industrial Product Price M/M Nov | 0.40% | 0.10% | ||

| 14:45 | USD | Services PMI Dec F | 52.2 | 52.2 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals