Higher oil prices do not have as much of a slowing effect on the U.S. economy as they did years ago. However, the uncertainty that the crisis could impart could potentially be more meaningful.

Oil Prices Now Have Mixed Effect on the U.S. Economy

Tensions have risen in the Middle East following the killing of Iranian General Qassem Soleimani on Friday, January 3. Investors instinctively turn to oil prices whenever tensions in the Middle East flare, and indeed oil prices are up roughly 5% since Friday. Could higher oil prices have a crippling effect on the U.S. economy?

As shown in the top chart, consumer purchases of “gasoline and other energy goods” accounted for roughly 4% of total personal consumption expenditures (PCE) at the time of the oil price shocks in the 1970s. Today, those goods account for only 2% of PCE. So oil prices would need to shoot much higher from their current levels to have a meaningful effect on consumer purchases of other goods and services. (Oil prices more than doubled after the OPEC oil embargo in late 1973 and again following the Iranian revolution in early 1979.)

In addition, higher oil prices currently have more of a stimulative effect on the U.S. economy, which partially offsets the some of the drag from slower real PCE growth, than they have had historically. As shown in the middle chart, American production of crude oil has mushroomed over the past decade due in large part to technological advances in drilling. Higher oil prices, if sustained, encourage more investment in the energy sector. Furthermore, other industries are not as dependent on oil as an energy source as they were in the 1970s. In short, the direct effects of the Iranian crisis on the U.S. economy appear to be rather small.

However, the uncertainty that the crisis imparts could potentially be more meaningful. Stock markets have weakened since Soleimani’s death, and credit spreads have moved out a bit. These moves represent a modest tightening in financial market conditions that, if sustained, could impart some headwinds on the economy. In addition, American consumers and businesses could potentially turn cautious. The start of the Iraq war in early 2003 appears to have had little effect on consumer confidence and consumer spending at that time, and we would expect that the current tensions in the Middle East would have a similar negligible effect on U.S. consumers. That said, consumer spending could potentially take a more meaningful hit if a marked cycle of violence were to take hold.

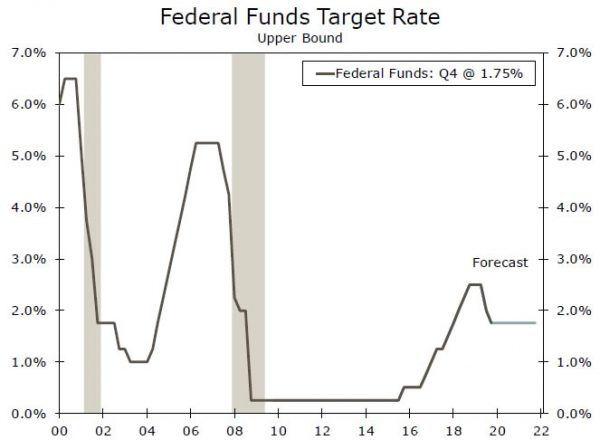

We have been forecasting that Fed will keep rates on hold for the foreseeable future (bottom chart). Although it would be premature to expect a Fed rate cut based on what has happened to date with respect to the Iranian crisis, the uncertainty that it raises makes us feel more confident in our view that the FOMC will not be hiking rates anytime soon. Financial market participants seem to agree as market pricing suggests there is little chance of a rate hike this year.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals