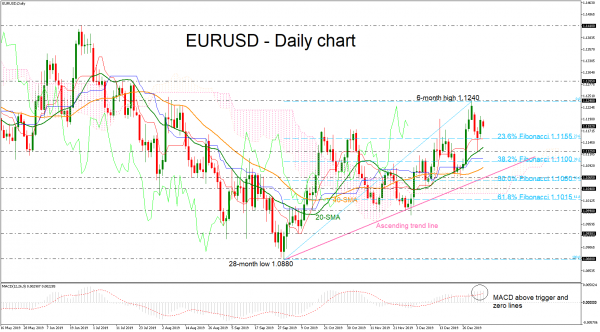

Since the beginning of the year, EURUSD has come under renewed selling pressure, dropping below the six-month high of 1.1240, reached on December 31. However, the pair remains above the 23.6% Fibonacci retracement level of the upward wave from the 28-month low of 1.0880 to 1.1240, around 1.1155 as well as above the ascending trend line, which has been holding since October 1.

Looking at momentum oscillators on the daily chart, they suggest further advances may be on the cards in the short-term. The MACD is holding above its trigger and zero lines, detecting positive momentum, and is also pointing upwards. The price is standing over the Ichimoku cloud and the flat red Tenkan-sen and blue Kijun-sen lines, confirming the rising move in the short-term.

If the bulls retake control and erase today’s losses, the price may stall initially near the latest highs at 1.1240. A potential upside violation of the aforementioned mark would also coincide with a break of the medium-term neutral zone near 1.1285, heading towards the 1.1410 resistance.

On the other side, if the market manages to lose steam and slip beneath the 23.6% Fibo (1.1155) could offer nearby support at the 20-simple moving average (SMA) of 1.1135 and the 1.1125 barrier. A move lower could open the door for the 38.2% Fibonacci of 1.1100 and the uptrend line around 1.1090, which overlaps with the 40-SMA. In case of steeper losses and a penetration of the diagonal line, the picture could switch from near-term positive to negative.

Overall, the outlook retains the upside momentum as EURUSD holds above all the moving average lines and the bullish cross between the 20- and 40-SMAs stays in place.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals