Dollar rebounds strongly as risk of imminent escalation in US-Iran tensions seem to have eased. It’s reported there was no casualties caused by Iran’s retaliation strikes against US forces in Iraq. The greenback is additionally supported by strong ADP employment report. Dollar follows New Zealand Dollar as second strongest. On the other hand, Euro is the weakest one for now, followed by Yen, and then Sterling. Gold and oil reversed earlier gains and are both trading lower for the day.

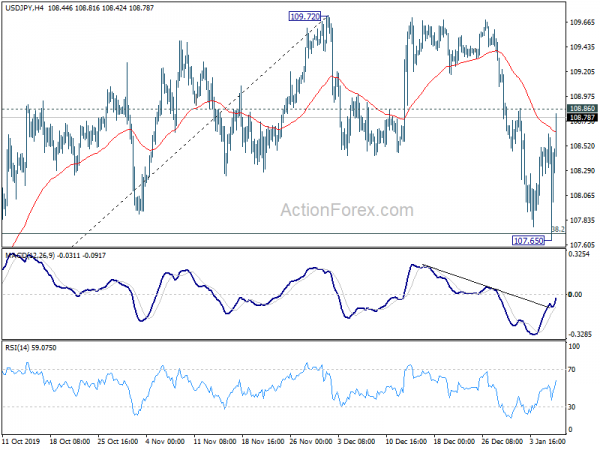

Technically, USD/JPY’s focus is immediately back on 108.86 minor resistance. Break should confirm completion of consolidation from 109.27 at 107.65. Further rise should then be seen back to retest 109.27 high. EUR/CHF should be finally getting rid of 1.0811 low decisively. Larger down trend is resuming for 1.0648 projection level.

In Europe, FTSE is currently down -0.10%. DAX is up 0.34%. CAC is up 0.15%. German 10-year yield is up 0.023 at -0.260. Earlier in Asia, Nikkei dropped -1.57%. Hong Kong HSI dropped -0.83%. China Shanghai dropped -1.22%. Singapore Strait Times dropped -0.06%. Japan 10-year JGB yield rose 0.0034 at -0.006.

US ADP job grew 202k, strong across companies of all sizes

US ADP report showed 202k growth in private sector jobs in December, above expectation of 150k. Service providing sector added 173k jobs while goods-producing sector added 29k. By company size, large companies added 45k, mid-sized companies added 88k, small companies added 69k.

“As 2019 came to a close, we saw expanded payrolls in December,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The service providers posted the largest gain since April, driven mainly by professional and business services. Job creation was strong across companies of all sizes, led predominantly by midsized companies.”

Eurozone economic sentiment rose to 101.5, significant rise in Italy and Spain

Eurozone Economic Sentiment Indicator (ESI) rose 0.3 to 101.5 in December, slightly above expectation of 101.4. The stabilization in the ESI resulted from markedly higher confidence in services (+2.2 to 11.4), construction (+2.2 to 5.0) and, to a lesser extent, retail trade (+1.0 to -0.8), while confidence worsened among consumers (-0.9 to -8.1) and remained virtually unchanged in industry (-0.2 to -9.3).

Amongst the largest euro-area economies, the ESI increased significantly in Italy (+1.7) and Spain (+1.3) and edged up in Germany (+0.4), while it remained broadly unchanged in France (-0.2). By contrast, the ESI declined somewhat in the Netherlands (-0.4).

Business Climate Indicator dropped -0.04 to -0.25. With the exception of production expectations, which improved markedly, all the components of the BCI worsened.

Germany factory orders dropped -1.3% mom in November, below expectation of 0.1% mom.

EU said without extension of Brexit transition, cannot agree on every aspect of new partnership with UK

European Commission President Ursula von der Leyen said at the London School of Economics that the relationship between EU and UK will be different after Brexit. She also warned that there is not enough time to complete negotiations by the end of this year. She said, “the European Union is ready to negotiate a truly ambitious and comprehensive new partnership with the United Kingdom”. However, “without an extension of the transition period beyond 2020, you cannot expect to agree on every single aspect of our new partnership.”

She explained, “we are ready to design a new partnership with zero tariffs, zero quotas, zero dumping. A partnership that goes well beyond trade and is unprecedented in scope. Everything from climate action to data protection, fisheries to energy, transport to space, financial services to security. And we are ready to work day and night to get as much of this done within the timeframe we have.” But “none of this means it will be easy, but we start this negotiation from a position of certainty, goodwill, shared interests and purpose. And we should be optimistic.”

UK Prime Minister Boris Johnson made himself clear that he would not seek transition period extension. His spokesperson said yesterday that ” having waited for over three years to get Brexit done, both British and EU citizens rightly expect negotiations on an ambitious free trade agreement (FTA) to conclude on time… “There will be no extension to the Implementation Period, which will end in December 2020 as set out in the Political Declaration,” the spokesperson added.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.29; (P) 108.46; (R1) 108.66; More..

USD/JPY’s rebound from 107.65 extends higher in early US session and focus is back on 108.86 resistance. Break should indicate that correction from 109.72 has completed at 107.65, after hitting 38.2% retracement of 104.45 to 109.72 at 107.70. Further rise should then be seen to retest 109.72 high. In case of another fall, we’d still expect strong support form 107.70 to contain downside.

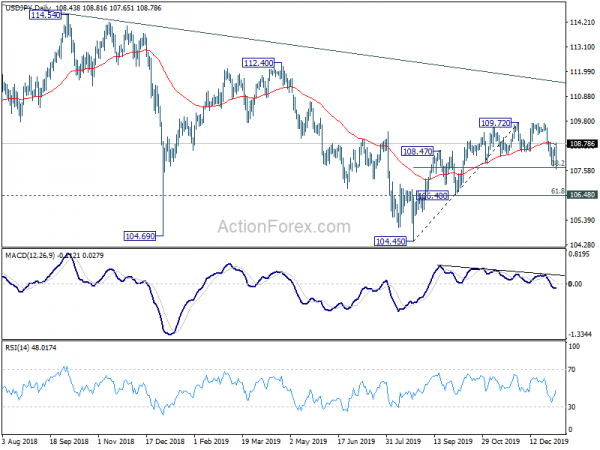

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). Recovery from 104.45 also failed to sustain above 55 week EMA (now at 109.02). Overall outlook remains bearish and fall from 118.65 is in favor to extend through 104.45 low. This will now stay as the favored case as long as 109.72 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | -0.20% | -0.20% | 0.00% | |

| 00:30 | AUD | Building Permits M/M Nov | 11.80% | 2.10% | -8.10% | -7.90% |

| 05:00 | JPY | Consumer Confidencex Dec | 39.1 | 39.6 | 38.7 | |

| 07:00 | EUR | Germany Factory Orders M/M Nov | -1.30% | 0.10% | -0.40% | 0.20% |

| 07:45 | EUR | France Trade Balance (EUR) Nov | -5.6B | -5.0B | -4.7B | -4.9B |

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Dec | 101.5 | 101.4 | 101.3 | 101.2 |

| 10:00 | EUR | Eurozone Industrial Confidence Dec | -9.3 | -9 | -9.2 | -9.1 |

| 10:00 | EUR | Eurozone Consumer Confidence Dec | -8.1 | -8.1 | -8.1 | -7.2 |

| 10:00 | EUR | Eurozone Services Sentiment Dec | 11.4 | 9.5 | 9.3 | 9.2 |

| 10:00 | EUR | Eurozone Business Climate Dec | -0.25 | -0.16 | -0.23 | -0.21 |

| 13:15 | USD | ADP Employment Change Dec | 202K | 150K | 67K | |

| 15:30 | USD | Crude Oil Inventories | -3.4M | -11.5M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals