Yen and Swiss Franc weakened notably as imminent US-Iran war receded. Canadian Dollar also turned slightly softer as oil prices reversed this week’s gains. Dollar is currently trying to ride on the development to extend recent rebound. But the real will probably lie in tomorrow’s non-farm payroll report. For the week so far, Sterling is the strongest one, followed by Dollar. Australian Dollar is the weakest, followed by Yen and then Euro.

Technically, WTI’s break of 50.46 support should confirm short term topping at 65.38, inside 63.04/66.49 resistance zone. Sustained break of 55 day EMA (now at 58.80) should also confirm completion of whole rise 50.86 and pave the way back to this key level to extend medium term range trading. Gold should also formed a short term top at 1611.37, ahead of 1625 projection level. Some consolidations should be seen with risk on the downside for the near term.

In Asia, Nikkei is currently up 2.32%. Hong Kong HSI is up 1.18%. China Shanghai SSE is up 0.66%. Singapore Strait Times is up 0.27%. Japan 10-year JGB yield is up 0.0085 at 0.001, turned positive. Overnight, DOW rose 0.56%. S&P 500 rose 0.49%. NASDAQ rose 0.67%. 10-year yield rose 0.047 to 1.874.

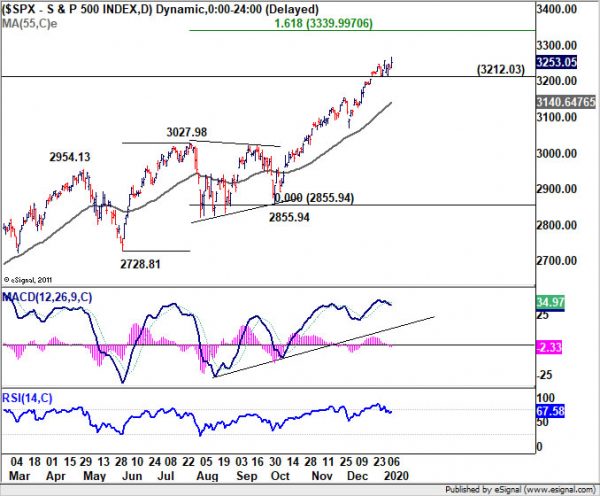

S&P 500 hit record high as risk of imminent US-Iran war receded

S&P 500 and NASDAQ jumped to new record highs overnight as risk of imminent US-Iran war receded after President Donald Trump indicated he’s not expectation further retaliations for now. He said in Washington that “no Americans were harmed in last night’s attack by the Iranian regime… All of our soldiers are safe and only minimal damage was sustained at our military bases”. “Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world,” Trump added.

S&P 500 is holding well above 3212.03 support with recent consolidations. Hence, near term bullishness is maintained. Current up trend could target 161.8% projection of 2728.81 to 3027.98 from 2855.94 at 3339.99 next. However, upside momentum is clearly diminishing as seen in daily MACD. Upside should be limited around 3339.99 to bring consolidations at least. Meanwhile, break of 3212.03 will suggest that a short term top is formed and bring pull back to 55 day EMA (now at 3140.64).

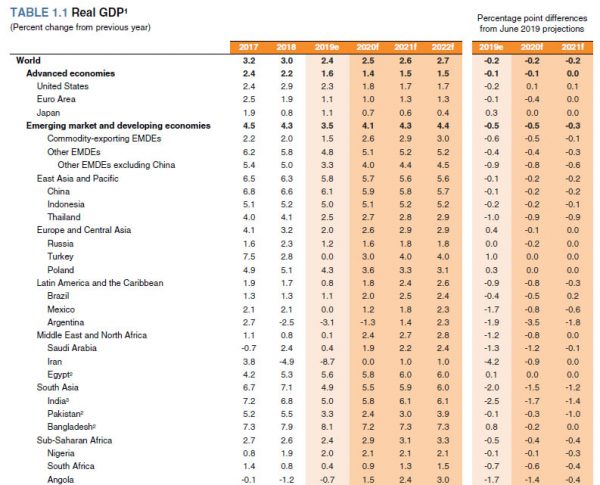

World Bank downgrades 2020 global growth forecast to 2.5% as downside risks predominate

In its January 2020 Global Economic Prospects report, World Bank forecasts global growth to pick up by 0.1% to 2.5% as “investment and trade gradually recover from last year’s significant weakness”. Even so, that was a -0.2% downgrade from June’s projection of 2.7%. Growth in US is expected slow from 2.3% to 1.8% (revised down by -0.2%). Eurozone growth is projected to slow from 1.1% to 1.0% (revised down by -0.1%). Japan’s growth is estimated to slow from 1.1% to 0.7% (revised up from 0.3%). China’s growth is projected to slow from 6.1% to 5.9% (revised down by -0.1%).

World Bank also warned: “Downside risks to the global outlook predominate, and their materialization could slow growth substantially. These risks include a re-escalation of trade tensions and trade policy uncertainty, a sharper-than expected downturn in major economies, and financial turmoil in emerging market and developing economies. Even if the recovery in emerging and developing economy growth takes place as expected, per capita growth would remain well below long-term averages and well below levels necessary to achieve poverty alleviation goals.”

On the data front

In seasonally adjusted term, Australia goods and services exports rose AUD 706M to AUD 40.89B in November. Goods and services imports dropped AUD 1020m to AUD 35.09B. Trade surplus widened by AUD 1.73B to AUD 5.80B. From China, CPI was unchanged at 4.5% yoy in December, PPI improved to -0.5% yoy.

Looking ahead, Germany industrial production and trade balance will be featured in European session. Eurozone will release unemployment while Swiss will release retail sales. Later in the day, US will release jobless claims. Canada will release housing starts and building permits.

USD/JPY Daily Outlook

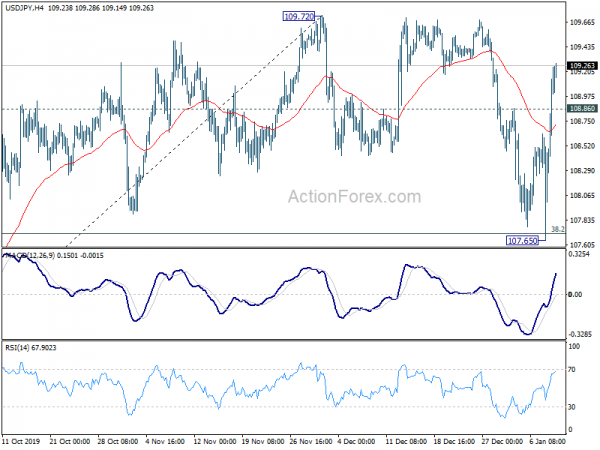

Daily Pivots: (S1) 108.11; (P) 108.68; (R1) 109.70; More..

USD/JPY rises to as high as 109.28 so far. Break of 108.86 resistance suggests that correction form 109.72 has completed at 107.65 after hitting 38.2% retracement of 104.45 to 109.72 at 107.70. Intraday bias stays on the upside for 109.72 resistance next. Firm break there will resume whole rise from 104.45 to channel resistance (now at 111.51). On the downside, in case of another fall, we’d expect strong support form 107.70 to contain downside.

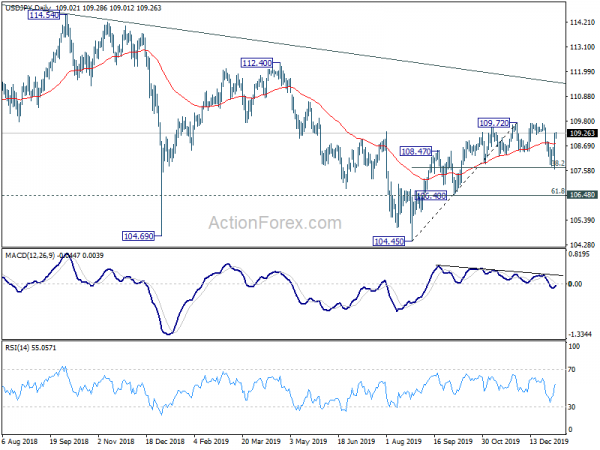

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). Recovery from 104.45 also failed to sustain above 55 week EMA (now at 109.02). Overall outlook remains bearish and fall from 118.65 is in favor to extend through 104.45 low. This will now stay as the favored case as long as 109.72 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Dec | 1.70% | -4.90% | ||

| 0:30 | AUD | Trade Balance (AUD) Nov | 5.80B | 4.10B | 4.50B | 4.08B |

| 1:30 | CNY | CPI Y/Y Dec | 4.50% | 4.70% | 4.50% | |

| 1:30 | CNY | PPI Y/Y Dec | -0.50% | -0.40% | -1.40% | |

| 7:00 | EUR | Germany Industrial Production M/M Nov | 0.70% | -1.70% | ||

| 7:00 | EUR | Germany Trade Balance (EUR) Nov | 20.9B | 20.6B | ||

| 7:30 | CHF | Real Retail Sales Y/Y Nov | 0.50% | 0.70% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Nov | 7.50% | 7.50% | ||

| 13:15 | CAD | Housing Starts Y/Y Dec | 215K | 201K | ||

| 13:30 | USD | Initial Jobless Claims (Jan 3) | 222K | 222K | ||

| 13:30 | CAD | Building Permits M/M Nov | 2.20% | -1.50% | ||

| 15:30 | USD | Natural Gas Storage | -58B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals