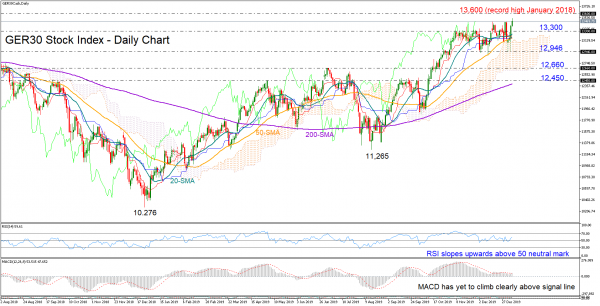

The German 30 stock index opened positive this week after hitting support at 12,946, which is where the price bottomed in December and peaked in October.

The bulls are currently pushing efforts to extend the uptrend off 10,276 towards the record high of 13,600 registered on January 2018 and while the upward slope in the RSI endorses the positive move, the MACD has yet to comfortably rise above its red signal line, suggesting that some caution remains in the market.

A decisive close above the 13,600 top would remove doubts of a downside reversal and shift the spotlight towards the 13,700 and 13,800 psychological levels.

Otherwise, a negative correction below 13,300 could retest the 12,946 restrictive area, where any violation would likely send the price to 12,660 and near the lower surface of the Ichimoku cloud. Beneath the latter, the index would resume its neutral profile in the medium-term picture, putting its upward pattern at risk, especially if it significantly breaches the area between the 12,450 resistance mark and the 200-day simple moving average (SMA). For now, the upward-sloping 50-day SMA that holds its bullish cross with the 200-day SMA intact signals that an outlook deterioration in a longer timeframe may come later than sooner.

In brief, the GER 30 index is holding a bullish but weak short-term bias, with traders eagerly waiting for a rally above 13,600 to increase buying interest. Such a move would also strengthen the current positive direction in the medium-term picture.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals